DeFiChain (DFI) Airdrop Guide 2025: How to Claim, Types & Benefits

Jul, 26 2025

DeFiChain Airdrop Calculator

Calculate Your Airdrop Potential

Determine which DeFiChain airdrop program offers the best value based on your situation.

If you’re looking for a DeFiChain airdrop guide that cuts through the hype, you’re in the right place. In the next few minutes we’ll break down every major airdrop DeFiChain has run, show you how to claim your DFI tokens, and help you decide which program fits your goals.

What is DeFiChain?

DeFiChain is a blockchain built specifically for decentralized finance applications, leveraging Bitcoin’s security while delivering fast, low‑cost transactions for lending, staking and decentralized exchanges. Its native cryptocurrency, the DFI token, used for governance, collateral and reward distribution, powers the whole ecosystem.

Why DeFiChain Uses Airdrops

DeFiChain’s airdrop strategy is all about quality over quantity. By rewarding existing Bitcoin holders, new platform users, and active community members, the project builds a loyal user base that actually uses its DeFi services.

Historical Bitcoin‑Holder Airdrop (Sept 2020)

When DeFiChain launched, it offered a massive snapshot‑based distribution aimed at Bitcoin enthusiasts. The key facts are:

- Snapshot taken at Bitcoin block #647,500 (Sept 9 2020, 22:00 UTC).

- Ratio: 500 DFI per 1 BTC held.

- Cap: 100 BTC per address → max 50,000 DFI.

- No minimum BTC balance required.

- Eligibility required a private Bitcoin wallet capable of message signing.

- Claims had to be submitted before Dec 31 2020.

The claim process involved signing a message with the Bitcoin private key, then submitting the signature via DeFiChain’s portal. This technical hurdle filtered out casual speculators and ensured only users who understood wallet security could receive DFI.

Current Cake DeFi Partnership Airdrop

The ongoing collaboration with Cake DeFi is a more hands‑on program that rewards users for actual platform activity.

- Reward: $30 worth of DFI for new accounts.

- Referral bonus: $10 worth of DFI per successful referral.

- Requirements:

- Create a Cake DeFi account and verify email.

- Complete KYC (Know Your Customer).

- Deposit a minimum of $50 in supported tokens.

- Lock the deposit for at least 28 days.

- All rewards are auto‑enrolled in the “Confectionery” program for 180 days, earning a 34.5 % APY.

This airdrop encourages users to experiment with staking, lending, or liquidity mining on Cake DeFi, turning a one‑off token drop into a longer‑term passive‑income experiment.

CoinMarketCap Social Airdrop

The third major program runs through CoinMarketCap, the leading crypto data aggregator.

- Total prize pool: 58,383 DFI across 1,590 winners.

- Maximum per user: 36.72 DFI.

- Tasks to qualify:

- Add DeFiChain to your CoinMarketCap watchlist.

- Follow DeFiChain’s official Twitter and Reddit accounts.

- Join the DeFiChain Telegram group.

- Follow the DeFiChain Community account on CoinMarketCap.

- Only an active CoinMarketCap account is required - no financial commitment.

This airdrop is the lowest‑barrier option, targeting community builders and social‑media‑savvy users.

Comparison of DeFiChain Airdrop Programs

| Program | Reward Size | Key Requirement | Technical Difficulty | Long‑Term Incentive |

|---|---|---|---|---|

| Bitcoin‑Holder (2020) | 500 DFI per BTC (max 50,000 DFI) | Own BTC in a sign‑capable wallet | High - message signing & snapshot verification | None - one‑time drop |

| Cake DeFi Partnership | $30 DFI + $10 per referral | Deposit ≥ $50 & lock 28 days + KYC | Medium - account setup & staking knowledge | 34.5 % APY for 180 days |

| CoinMarketCap Social | Up to 36.72 DFI | Complete 4 social tasks | Low - just platform navigation | None - one‑off reward |

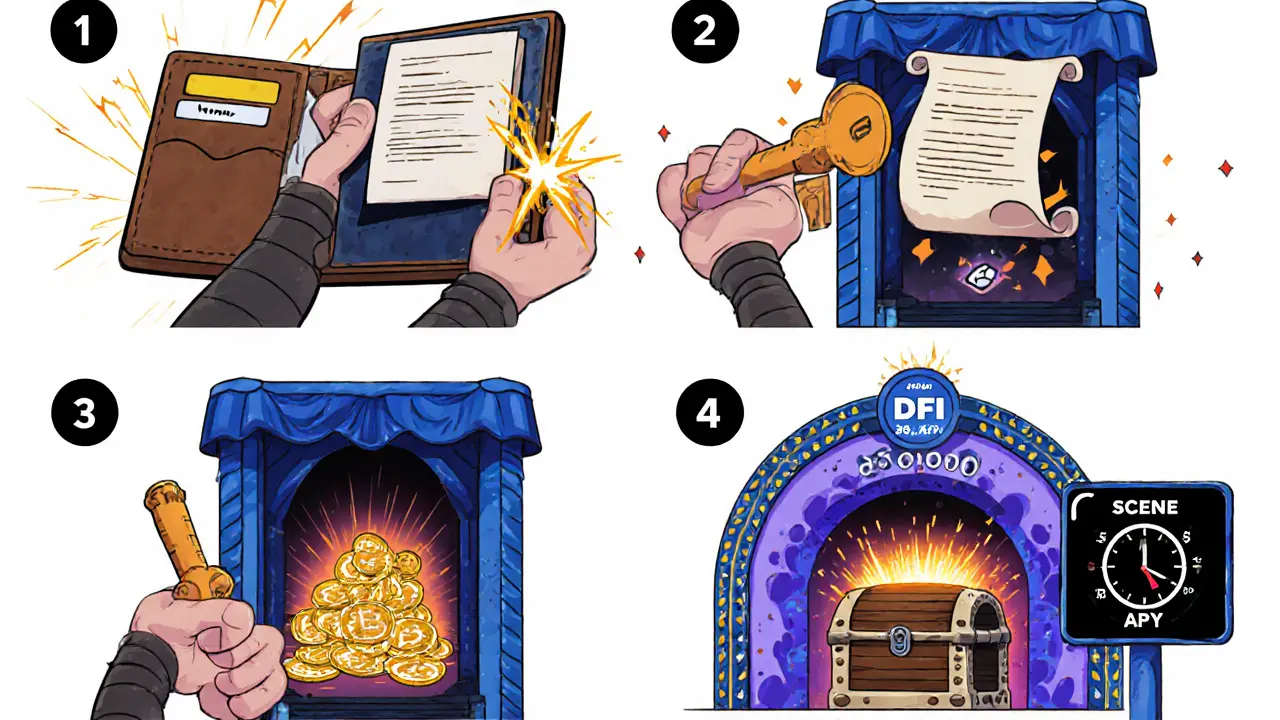

Step‑by‑Step: How to Claim DFI from Each Program

- Bitcoin‑Holder Airdrop (historical)

- Identify the Bitcoin address you used at the snapshot block.

- Open a wallet that supports message signing (e.g., Electrum, Wasabi).

- Sign the provided challenge message with your private key.

- Paste the signature into DeFiChain’s claim portal and submit.

- Wait for on‑chain verification; DFI will be sent to the address you specify.

- Cake DeFi Partnership

- Register on the Cake DeFi website and verify your email.

- Complete the KYC questionnaire (photo ID, proof of address).

- Deposit ≥ $50 of a supported token (BTC, ETH, USDT, etc.).

- Lock the deposit for a minimum of 28 days via the “Freezer” feature.

- Once the lock period is confirmed, the $30 DFI reward appears in your “Confectionery” balance and starts earning the 34.5 % APY.

- CoinMarketCap Social Airdrop

- Log in to your CoinMarketCap account (create one if needed).

- Navigate to the DeFiChain airdrop page and click “Join”.

- Finish each social task: watchlist addition, Twitter follow, Reddit join, Telegram join.

- Submit proof (e.g., screenshot of your watchlist) if required.

- After verification, the DFI tokens are transferred to the wallet address you entered on the form.

Pros & Cons of Each Program

Bitcoin‑Holder Airdrop

- Pros: Massive reward potential for large BTC holders, no monetary outlay.

- Cons: Requires technical knowledge, limited to a one‑time snapshot.

Cake DeFi Partnership

- Pros: Generates ongoing yield, referral bonuses, introduces users to DeFi services.

- Cons: Needs $50 deposit and KYC, funds are locked for 28 days.

CoinMarketCap Social

- Pros: No financial commitment, easy entry.

- Cons: Smaller rewards, no long‑term earnings.

Common Pitfalls & How to Avoid Them

- Missing the claim window. The 2020 snapshot closed on Dec 31 2020. For active programs, keep an eye on email alerts from Cake DeFi and CoinMarketCap.

- Using exchange wallets for signing. Exchanges do not expose private keys, so you cannot sign the Bitcoin‑holder challenge. Transfer BTC to a self‑custody wallet first.

- Skipping KYC verification. Incomplete KYC will pause your Cake DeFi reward. Double‑check photo clarity and address consistency.

- Forgetting the lock period. If you withdraw before 28 days, you forfeit the airdrop and any accrued APY.

Future Outlook for DeFiChain Airdrops

DeFiChain’s roadmap hints at more partnership drops, possibly with other DeFi aggregators or NFT platforms. The focus will likely remain on “quality engagement” - meaning future airdrops may require staking larger amounts or participating in governance votes.

Keeping an eye on official DeFiChain announcements (Telegram, Discord, and the blog) will ensure you don’t miss the next round.

Key Takeaways

- DeFiChain’s airdrops target three user groups: Bitcoin holders, active DeFi participants, and social‑media engag ers.

- The Bitcoin‑holder drop offers the biggest one‑off reward but needs wallet‑level tech skills.

- Cake DeFi’s program blends a modest token gift with a 34.5 % APY, rewarding genuine platform use.

- CoinMarketCap’s social airdrop is the easiest entry point, perfect for newcomers.

- Stay updated on deadlines, complete KYC, and protect your private keys to claim safely.

How do I know if I’m eligible for the Bitcoin‑holder airdrop?

Eligibility required holding any amount of BTC in a private wallet at block #647,500 (Sept 9 2020). You also needed to be able to sign a message with that wallet’s private key. If you owned BTC on an exchange, you were not eligible.

Is the $30 DFI from Cake DeFi taxable?

Tax treatment varies by jurisdiction. In many countries, airdropped tokens are considered ordinary income at the fair market value on the day you receive them. Check your local tax regulations or consult a tax professional.

Can I claim the CoinMarketCap airdrop if I already have a DeFiChain wallet?

Yes. The CoinMarketCap campaign only requires an active CM‑C account and the completion of social tasks. When you submit your wallet address, the DFI is sent directly to it, regardless of prior holdings.

What happens if I withdraw my $50 deposit before 28 days?

The airdrop reward and any accrued APY are forfeited. The deposited tokens are returned, but you lose the $30 DFI and the 34.5 % interest.

Will DeFiChain run more airdrops in 2026?

While the team has not announced specifics, their roadmap emphasizes community growth through partnerships, so additional airdrops are likely. Follow DeFiChain’s official channels for the latest info.