Équilibre Crypto Exchange Review: Is It a Real Trading Platform?

Dec, 2 2024

Crypto Slippage Calculator

Calculate Your Trade Impact

Enter your trade amount to see how much slippage you might experience on low-liquidity DeFi platforms like Équilibre. This calculator helps you understand the risks of trading on protocols with limited liquidity.

Trade Impact Estimate

Comparison: On high-liquidity exchanges, slippage is typically under 0.1% for this trade size.

When you search for Équilibre crypto exchange review, you probably expect a rundown of fees, mobile apps, and security features-just like any other exchange. But the reality is a bit twistier. Équilibre is a decentralized finance (DeFi) protocol that issues the VARA token, not a traditional centralized exchange like Binance or Coinbase. In the next few minutes we’ll peel back the layers, see what you actually get when you sign up, and compare it with real exchanges that traders rely on daily.

What Exactly Is Équilibre?

Équilibre (sometimes written as Equilibre) launched in 2022 and introduced its native token VARA. The protocol lives on the Ethereum blockchain and offers liquidity pools, token swaps, and yield‑farming options. Think of it as a small‑scale version of Uniswap that focuses on a handful of niche assets.

Because it runs on smart contracts, there’s no central order book, no KYC checkpoint, and no customer‑service desk you can call. All interactions happen through a web UI or directly via a wallet like MetaMask. That’s why many analysts lump it under the broader Decentralized Finance (DeFi) umbrella rather than treating it as a full‑service exchange.

Is Équilibre an Exchange at All?

Short answer: not in the conventional sense. A crypto exchange usually offers spot trading, futures, a deep order book, and regulatory compliance. Équilibre offers a DEX‑style swap interface and a few liquidity‑mining programs. There’s no order‑book depth data, no official volume reporting, and no fiat on‑ramps.

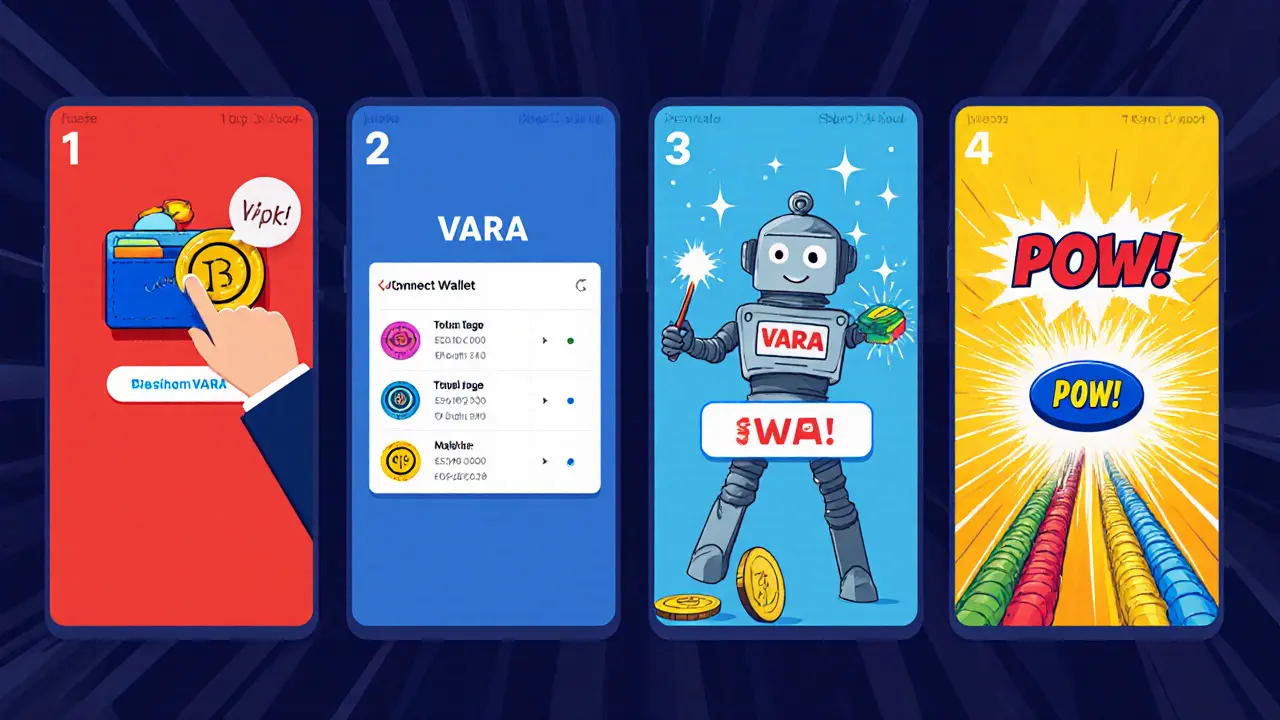

If you’ve never used a DEX, you might wonder how you actually trade. The process looks like this:

- Connect a non‑custodial wallet (MetaMask, Trust Wallet, etc.).

- Select the VARA token or any supported pair.

- Approve the smart contract to spend your assets.

- Confirm the swap; the transaction is executed on‑chain.

Everything is transparent on the blockchain, but the user experience feels more like interacting with a web3 app than a traditional exchange dashboard.

Feature Comparison: Équilibre vs. Established Exchanges

| Feature | Équilibre (VARA) | CoinEx | Uniswap (DEX) | Binance |

|---|---|---|---|---|

| Centralized Order Book | No | Yes | No | Yes |

| KYC / AML | None | Optional | None | Mandatory for high limits |

| Fiat On‑ramps | None | Supported (USD, EUR, etc.) | None | Wide range |

| Mobile App | No dedicated app (web UI only) | iOS / Android | MetaMask mobile, others | iOS / Android |

| Security Features | Smart‑contract audits (public) | 2FA, cold storage | Smart‑contract audits | 2FA, SAFU fund, cold storage |

| Liquidity / Volume (24h) | Very low, limited public data | ~$2.1 B | ~$1.8 B (all pools) | ~$30 B |

| Regulatory Compliance | None disclosed | Registered in Seychelles, limited licenses | None (protocol‑level) | Multiple jurisdictions, licenses |

The table makes it clear: Équilibre lacks most of the conveniences and safeguards you’d expect from a full‑service exchange. It’s more comparable to Uniswap’s model, but with far less liquidity.

Security and Regulatory Landscape

Because there’s no custodial service, the biggest security risk comes from the smart contracts themselves. The team published an audit by a third‑party firm in early 2023, but no follow‑up audits have been released since. In contrast, big players like Binance publish quarterly security reports and hold insurance funds.

Regulation is another gray area. No licensing information is publicly available for Équilibre, and the protocol does not claim to be registered in any jurisdiction. If you live in a tightly regulated market (US, EU, UK), using a platform with no compliance framework could expose you to legal scrutiny-especially if you’re swapping large amounts.

User Experience: What Does the Interface Look Like?

The web UI is minimalist: a single “Swap” tab, a “Liquidity” section, and a “Dashboard” showing your VARA balance. There’s no order‑history page, no charting tools, and no support ticket system. If you’re used to the polished dashboards of OKX or CoinEx, you’ll feel the absence of features immediately.

Language support is limited to English, and there’s no live chat or email support. The only help you can expect is a community Discord channel, where response times vary.

Trading Data and Liquidity: The Numbers That Matter

Accurate volume data for VARA is scarce. CoinGecko lists a 24‑hour trading volume of roughly $12,000 as of October 2025-tiny compared with the multi‑billion dollar streams on major exchanges. Low volume means higher slippage; a $1,000 trade could move the price noticeably.

Liquidity pools on Équilibre are shallow. The biggest pool holds about 15,000 VARA (~$0.00005 each), so any sizable swap will eat into the pool and cause a price impact that can exceed 10 %.

Alternatives Worth Considering

If you’re looking for a place to trade VARA or similar niche tokens, you have two practical paths:

- Use a reputable DEX aggregator like Uniswap or 1inch, which route your trade through multiple pools to get the best price.

- Find a centralized exchange that lists VARA-CoinEx occasionally adds low‑cap assets, and you’ll benefit from higher liquidity and proper KYC.

Both options give you clearer fee structures, proven security measures, and access to customer support if something goes wrong.

Red Flags and Due Diligence Checklist

Before you commit any funds to Équilibre, run through this quick checklist:

- Confirm the smart‑contract address on Etherscan. Verify the audit report is linked on the official site.

- Check community activity-Discord, Telegram, and GitHub commits. Stale communities often signal abandoned projects.

- Assess liquidity: query the pool size via a block explorer or a DeFi analytics tool like Dune.

- Look for any regulatory warnings from financial authorities in your country.

- Only allocate an amount you can afford to lose; low‑volume tokens are inherently risky.

Following these steps will help you avoid the common pitfalls that plague many new DeFi experiments.

Final Thoughts: Should You Use Équilibre?

If you enjoy experimenting with niche DeFi protocols and are comfortable managing private keys, Équilibre can be an interesting sandbox for learning about liquidity provision. But for serious trading, reliable price execution, and regulatory peace of mind, you’re better off sticking with established exchanges like Binance, CoinEx, or a reputable DEX aggregator.

Bottom line: Équilibre is not a full‑featured crypto exchange; it’s a modest DeFi protocol with limited liquidity and minimal infrastructure. Treat it accordingly, and always do your homework before moving any capital.

Is Équilibre a centralized exchange?

No. Équilibre operates as a decentralized finance protocol that enables token swaps and liquidity mining via smart contracts. It lacks order books, KYC, and fiat gateways typical of centralized exchanges.

Can I buy VARA on Équilibre?

You can swap other ERC‑20 tokens for VARA directly on the platform, provided you have a compatible wallet and enough liquidity in the pool. There’s no fiat‑on‑ramp.

How secure is the platform?

Security relies on the smart‑contract code. An audit was published in 2023, but no recent audits are available. Users should treat it as higher risk compared with exchanges that hold assets in cold wallets and offer 2FA.

What are the main fees?

Fees consist of the standard 0.3 % DEX swap fee plus any gas fees charged by the Ethereum network. There are no hidden withdrawal or deposit charges because the platform is non‑custodial.

Should I use Équilibre for large trades?

Probably not. Low liquidity means large trades suffer high slippage, and price impact can be significant. For sizable orders, a high‑volume exchange or a DEX aggregator with better depth is safer.