Flash Loans Explained: How They Work Without Collateral

Oct, 19 2025

Flash Loan Fee Calculator

Calculate the exact fee and total repayment for your flash loan transaction based on the protocol you choose. Enter an amount to borrow and select your preferred lending platform to see the cost breakdown.

Profit Potential

If you execute an arbitrage strategy that yields 0.15% profit after gas costs, your net gain would be: 0.00 ETH

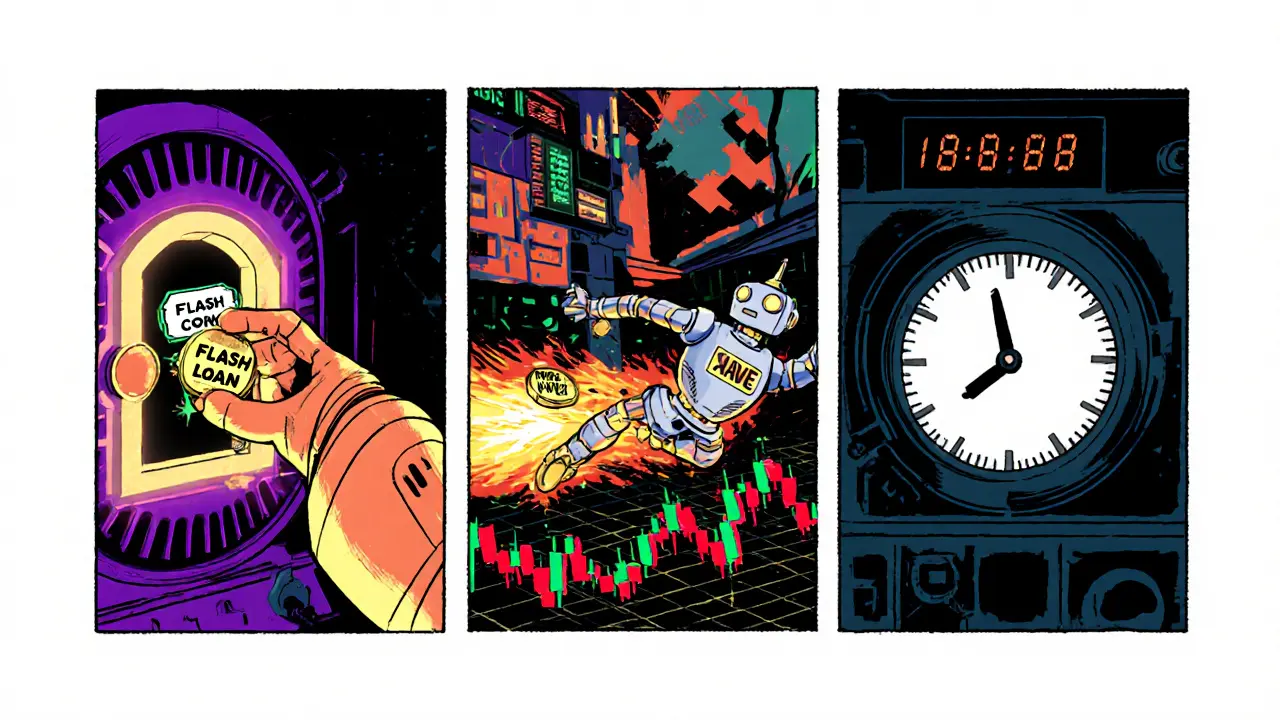

Imagine borrowing millions of dollars, using none of your own capital, and paying it back in the time it takes to click a mouse. That isn’t a fantasy for crypto traders - it’s the reality of flash loans. In the world of decentralized finance (DeFi), flash loans let you tap into huge liquidity pools, execute complex strategies, and settle everything in a single blockchain transaction. No collateral, no credit check, just pure code and timing.

What Are Flash Loans?

Flash loans are a DeFi primitive that allows users to borrow assets without any upfront collateral, provided the loan plus a small fee is repaid within the same blockchain transaction. They rely on the atomic nature of blockchain operations: either every step succeeds or the whole transaction rolls back.

First introduced by the Marble protocol in 2018 and popularized by Aave in early 2020, flash loans have become a core tool for traders who need instant, large‑scale liquidity.

Why No Collateral Is Possible

Traditional loans need collateral because the lender faces the risk of non‑repayment. Flash loans dodge that risk by using Ethereum’s transaction atomicity. When a borrower submits a transaction, the network treats the whole bundle of actions as one unit. If the contract fails to return the borrowed amount plus the fee before the block is finalized, the blockchain automatically reverts every operation-including the initial asset transfer. That means the protocol never loses money, eliminating the need for security deposits.

Step‑by‑Step: How a Flash Loan Works

- **Borrower calls the flash‑loan function** on a lending protocol (e.g., Aave).

- The protocol transfers the requested tokens to the borrower’s smart contract.

- The borrower’s contract executes its strategy-arbitrage, liquidation, or any other logic.

- Before the transaction ends, the contract repays the principal plus the protocol fee.

- If repayment succeeds, the transaction is committed; if not, everything reverts.

The entire flow happens inside a single block, typically 12-15 seconds on Ethereum. Gas limits usually cap the complexity at around 30 million gas, which translates to a few seconds of compute time.

Common Use Cases

- Arbitrage: Buy an asset cheap on one DEX and sell it higher on another, all within the same transaction.

- Liquidation: Repay an under‑collateralized loan on a lending platform and claim the collateral, using the flash loan to cover the repayment.

- Self‑repayment hacks: Some developers use flash loans to refinance a position, effectively moving debt between protocols.

- Collateral swapping: Swap one type of collateral for another without needing extra capital.

Because the loan must be settled instantly, strategies that need longer exposure-like yield farming-won’t work with flash loans.

Risks and Limitations

Flash loans are powerful, but they come with a steep learning curve. The biggest pitfalls include:

- **Front‑running (MEV)** - Others can see your pending transaction and try to beat you to profit.

- **Gas price spikes** - High fees can turn a profitable arbitrage into a loss.

- **Smart‑contract bugs** - A small coding mistake can cause the whole transaction to revert, wasting gas.

- **Limited time horizon** - All actions must finish within one block; complex multi‑step trades may exceed the gas limit.

According to a 2022 security report by OpenZeppelin, flash‑loan attacks accounted for 24 % of all DeFi incidents, underscoring the need for rigorous testing.

Top Protocols Offering Flash Loans

| Protocol | Fee | Primary Chains | Special Feature |

|---|---|---|---|

| Aave | 0.09 % (V3) | Ethereum, Polygon, Avalanche | Time‑locked fee + circuit breaker (V3) |

| Uniswap (Flash Swaps) | 0.30 % (tiered) | Ethereum, Optimism | Fee tier system for different pools |

| dYdX | 0.30 % | Ethereum, StarkEx L2 | Margin‑trading integration |

| Balancer | 0.25 % | Ethereum, Gnosis Chain | Weighted pool support |

As of Q3 2023, Aave handled roughly 62 % of global flash‑loan volume, with Uniswap trailing at 28 %.

Building a Basic Flash‑Loan Contract

If you’re a developer, the typical workflow looks like this:

- Import the protocol’s interface (e.g.,

IFlashLoanReceiverfor Aave). - Implement the

executeOperation()callback where you place your strategy logic. - Within the callback, interact with other contracts (DEXes, price oracles, liquidation bots).

- At the end of the function, approve the protocol to pull back the principal + fee.

- Deploy the contract and call the lending pool’s

flashLoan()method.

Key safety patterns include:

- Re‑entrancy guards (use

nonReentrantmodifier). - Slippage checks when swapping tokens.

- Using trusted price oracles like Chainlink instead of on‑chain AMM prices.

Finematics estimates that a beginner needs 40-60 hours of Solidity study to write a secure flash‑loan contract. Plenty of open‑source examples exist on GitHub, but remember that 63 % of public implementations still contain at least one vulnerability.

Recent Trends and Future Outlook

Flash‑loan usage is climbing. TokenTerminal reports $14.7 B in total flash‑loan volume for 2022, and Delphi Digital projects $25 B annual volume by 2025. Two big developments are shaping the next wave:

- Cross‑chain flash loans: Emerging bridges let you borrow on one chain and settle on another, opening arbitrage opportunities across ecosystems.

- Enhanced security modules: Protocols are adding circuit breakers, fee‑rate timelocks, and stricter oracle validation to curb attacks.

Regulators are watching. The SEC’s 2023 enforcement action flagged flash loans as a potential securities‑law issue if they’re used to manipulate markets. While the legal landscape is still fuzzy, most DeFi projects are adopting compliance‑friendly designs (e.g., KYC‑friendly lending pools) to stay ahead.

Quick Checklist Before You Launch

- ✔️ Understand the atomicity principle - every step must finish in one block.

- ✔️ Choose the right protocol - compare fees, chain support, and security features.

- ✔️ Write a sandbox contract - test on a testnet (Goerli, Sepolia) before mainnet deployment.

- ✔️ Use reputable oracles - avoid price manipulation.

- ✔️ Simulate gas costs - high gas spikes can erase profits.

- ✔️ Review MEV exposure - consider sandwich‑protection tools.

Can I use flash loans without writing code?

Most platforms require you to interact via a smart contract, but some UI‑based tools (e.g., DeFi Saver) let you configure common strategies without deep Solidity knowledge.

What is the typical fee for a flash loan?

Fees vary by protocol: Aave charges about 0.09 %, Uniswap’s flash swaps charge around 0.30 % (tiered), and dYdX also uses a 0.30 % fee.

Why do flash loans require a single‑block execution?

The blockchain’s atomic transaction model guarantees that if the loan isn’t repaid before the block finalizes, the entire operation reverts, protecting the lender from loss.

Are flash loans safe for beginners?

They’re powerful but risky. Without solid Solidity skills and a grasp of gas economics, you can lose the entire transaction fee. Start on testnets and study proven code before moving to mainnet.

What are the most common attack vectors against flash loans?

Front‑running (MEV), oracle manipulation, and re‑entrancy bugs are the top three. Protocols now add circuit breakers and stricter oracle validation to mitigate these risks.