CryptoMines: What They Are, How They Work, and Where to Find Real Opportunities

When people talk about CryptoMines, digital operations that validate blockchain transactions and earn rewards through computational work. Also known as cryptocurrency mining, it's the engine behind Bitcoin, Ethereum (before 2022), and dozens of other networks that still rely on proof-of-work. It’s not magic—it’s math, electricity, and hardware working together to secure decentralized ledgers. You don’t need a fancy lab or a PhD to get started, but you do need to know what’s real and what’s just noise.

Most crypto mining, the process of using computer power to solve cryptographic puzzles and add new blocks to a blockchain. Also known as blockchain mining, it’s how new coins enter circulation and how networks stay secure today happens on specialized machines called ASICs, especially for Bitcoin. But not every coin needs that kind of power. Some, like Monero or Ravencoin, still let regular users mine with GPUs—or even CPUs—making it more accessible. Then there are the projects that claim to be "mining" but are really just gamified staking or fake apps. You’ll see plenty of those in the wild. The real ones? They leave a digital footprint: open-source code, transparent reward schedules, and active communities tracking hashrate and difficulty changes.

What’s often missed is how mining rewards, the cryptocurrency given to miners for successfully validating blocks and securing the network. Also known as block rewards, they’re the incentive that keeps miners running 24/7 change over time. Bitcoin’s reward halves every four years. Other coins have fixed schedules or even dynamic adjustments based on network health. If you’re looking at a project that promises "high mining yields" without explaining how the reward structure works, that’s a red flag. Real mining doesn’t promise returns—it offers probabilities. And those probabilities depend on your hardware, electricity cost, and the coin’s difficulty curve.

You’ll find posts here about exchanges that list mining-related tokens, airdrops tied to mining activity, and even guides on how to spot fake mining platforms. Some cover how blockchain energy use connects to microgrids. Others break down why certain coins still use proof-of-work while others moved on. There’s no sugarcoating: mining isn’t the easy money it was in 2017. But for those who understand the mechanics, the risks, and the real-world constraints, it’s still a valid way to participate in decentralized networks.

What follows isn’t a list of get-rich-quick schemes. It’s a collection of real analysis—on exchanges that support mining coins, on tokens tied to mining infrastructure, and on the hidden costs behind the hype. Whether you’re looking to mine yourself, invest in mining-related projects, or just avoid scams, you’ll find something here that cuts through the noise.

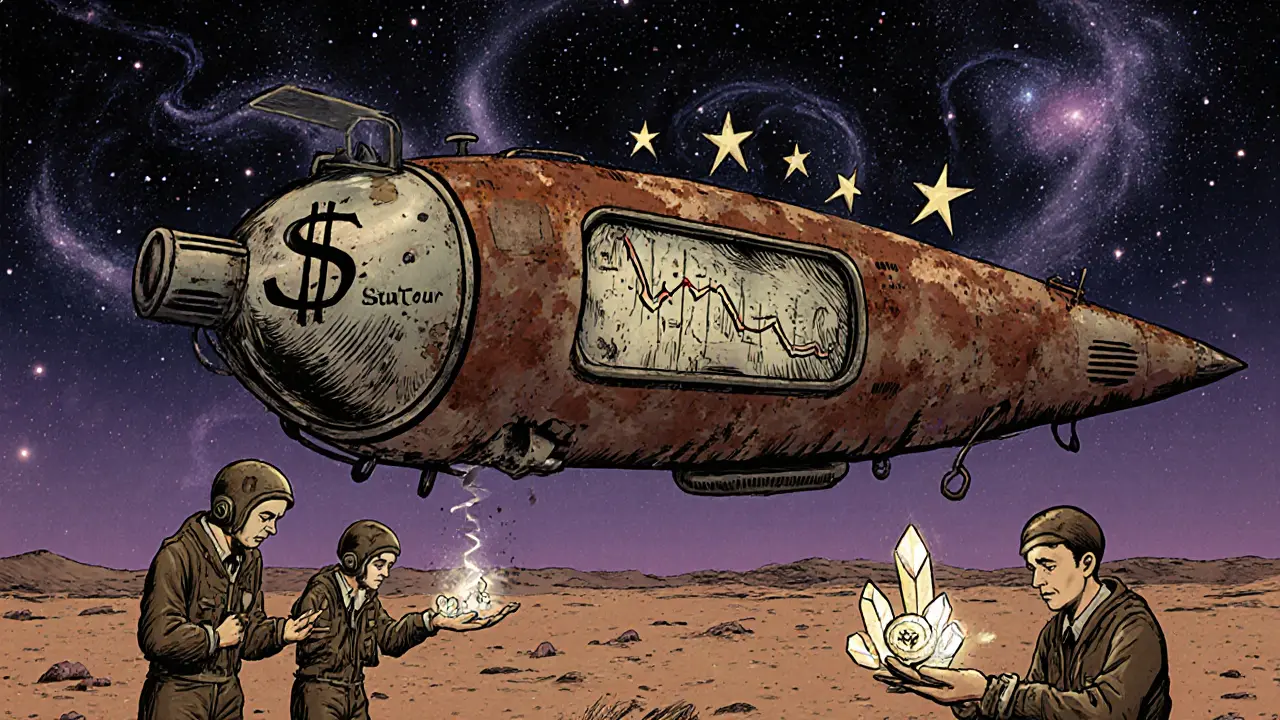

What is CryptoMines (ETERNAL) Crypto Coin? A Real-World Look at the Play-to-Earn Token

Caius Merrow Nov, 7 2025 0CryptoMines (ETERNAL) was a play-to-earn crypto game that promised big earnings-but its token crashed over 95%. Learn why it failed, who still plays, and whether it’s worth your time today.

More Detail