Unregulated Crypto Exchange: Risks, Real Examples, and How to Stay Safe

When you hear unregulated crypto exchange, a cryptocurrency trading platform that operates without oversight from financial authorities. Also known as offshore exchange, it doesn’t follow rules like KYC, AML, or insurance requirements that protect users on platforms like Coinbase or Binance. That sounds appealing—no paperwork, no delays, no limits. But here’s the truth: every major crypto scam in the last five years started with an unregulated exchange.

These platforms don’t answer to anyone. They don’t have to prove they hold your coins, report suspicious activity, or even exist legally. Look at Coinrate, a fake exchange exposed as a complete scam with no security, no users, and no real infrastructure. Or Bitaroo, a real exchange focused on Australia but still operating without international regulatory licenses. One is a fraud. The other is a gray-area player. Both are risky if you don’t know the difference.

Unregulated exchanges often lure you with low fees or exotic tokens you can’t find elsewhere. But what happens when they vanish overnight? Your coins disappear with them. There’s no customer support, no refund policy, no legal recourse. India’s crypto traders face this daily—trading on unregulated platforms while paying 30% taxes with zero legal protection. That’s not freedom. That’s gambling with your life savings.

And it’s not just about the exchange itself. Many unregulated platforms host fake airdrops—like the ones pretending to be from Swaperry, a project that never launched an official token distribution, or BULL Finance, a DeFi project with zero official airdrop but dozens of phishing sites claiming otherwise. These scams use the chaos of unregulated markets to trick you into connecting your wallet and handing over your private keys.

Even if you’re not trading, you’re still at risk. If you hold crypto on an unregulated exchange, you’re not owning it—you’re trusting someone else’s database. Blockchain means control. Unregulated exchanges mean surrender. The same people who warn you about DeFi risks won’t tell you that holding coins on an unregulated exchange is the riskiest move of all.

So what’s the alternative? Stick to exchanges that publish their legal status, have clear terms of service, and allow you to withdraw to your own wallet. Look for real user reviews—not fake testimonials on Telegram. Check if they’re registered anywhere, even if it’s just a local business license. If they’re hiding behind a .io domain and a Discord channel, walk away.

Below you’ll find real cases of unregulated crypto exchanges that failed, scams disguised as exchanges, and honest reviews of platforms that walk the line. No fluff. No hype. Just what happened, who got burned, and how to avoid the same fate.

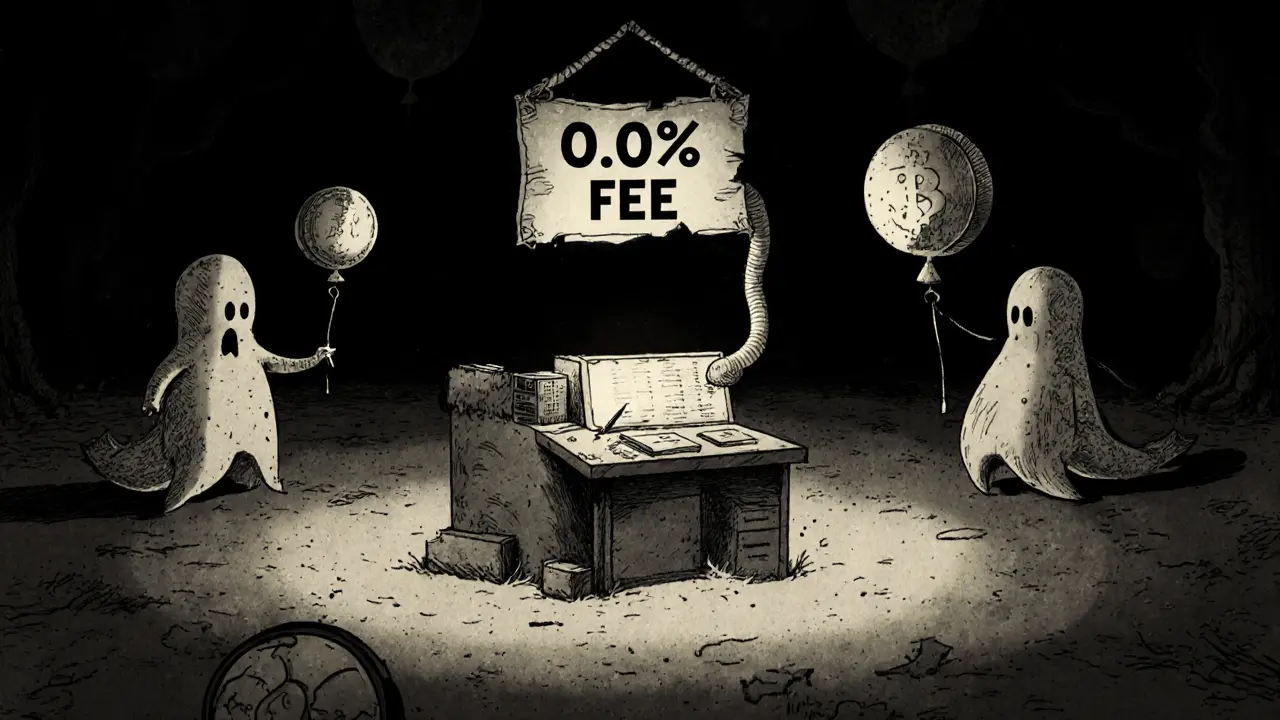

Zeddex Exchange (Zedxion) Crypto Exchange Review: Is It Safe or Just a Ghost Platform?

Caius Merrow Mar, 20 2025 0Zeddex Exchange claims zero fees but has zero users, no security, and no regulation. This review reveals why it's not a real crypto platform - and where to trade safely instead.

More Detail