ZG.TOP Crypto Exchange Review: Why This Platform Vanished Without a Trace

Feb, 15 2026

Back in 2015, a cryptocurrency exchange called ZG.TOP launched in Mongolia with a bold promise: zero trading fees for buyers. It sounded too good to be true - and it was. By March 2020, the website stopped loading entirely. No warning. No announcement. Just silence. Today, in 2026, trying to visit zgtop.com returns nothing. Not even an error page. Just an empty domain. If you’re wondering whether ZG.TOP is still around, the answer is simple: it’s gone. And here’s why it disappeared - and what you can learn from its failure.

What ZG.TOP Actually Was

ZG.TOP wasn’t a household name like Binance or Coinbase. It was a small, regional exchange with barely 5,000 active users at its peak. It only allowed trades between cryptocurrencies - no USD, EUR, or any fiat currency. That meant you couldn’t buy Bitcoin with your bank account. You had to already own crypto from another exchange, transfer it over, and then trade. For most new users, that was a dealbreaker. By 2019, its 24-hour trading volume had dropped from $1.6 million to $1.24 million. Compare that to Binance, which traded over $1.5 billion that same month. ZG.TOP wasn’t just small - it was irrelevant in the bigger market.

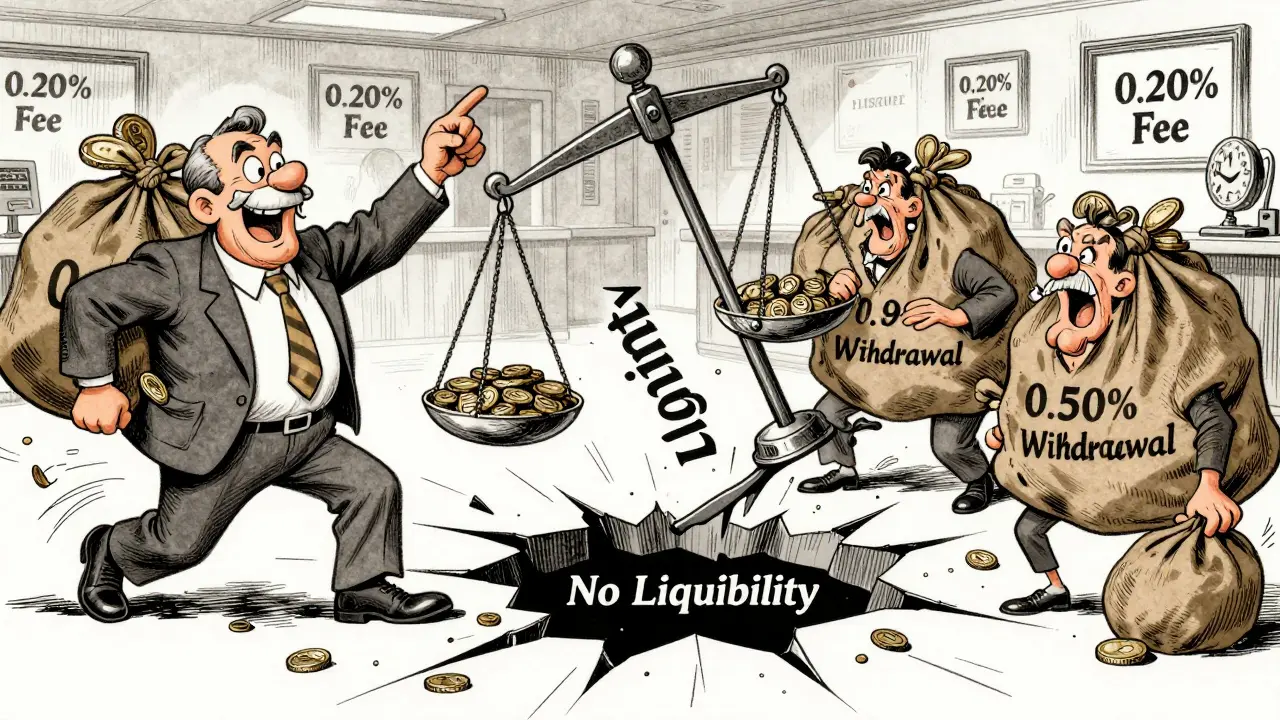

The Fee Structure That Backfired

ZG.TOP’s entire identity revolved around one gimmick: buyers paid 0% fees, while sellers paid 0.20%. On paper, it looked like a win for traders who bought more than they sold. But in practice, it created chaos. Market makers - the traders who keep prices stable by constantly offering to buy and sell - avoid platforms where one side pays and the other doesn’t. Why? Because it skews the market. Sellers had to absorb all the cost, so they either pulled their orders or moved elsewhere. That meant fewer orders, wider spreads, and slippage on every trade. Even if you wanted to buy a small amount of Ethereum, you’d end up paying more in price movement than you saved in fees. It’s like a grocery store that charges customers $1 for every item they buy but gives sellers a discount. No one stays in business long with that model.

Withdrawal Fees That Made No Sense

When you tried to pull your crypto out of ZG.TOP, you weren’t just hit with the normal blockchain network fee. You also paid a 0.50% fee on the total amount you withdrew. That’s not how exchanges work. Most charge a flat fee - say $5 or 0.0005 BTC - no matter how much you take out. ZG.TOP’s percentage-based model punished small withdrawals. If you pulled out $100 worth of Bitcoin, you paid 50 cents. If you pulled out $1,000, you paid $5. And if you withdrew $10,000? That’s $50 in fees alone - on top of the network cost. Users reported withdrawal delays of up to five days. Some waited over a week. Customer support? Unresponsive. Trustpilot showed a 1.8/5 rating based on 17 reviews. Comments like “my BTC withdrawal took 5 days” and “customer service never replied” were common. This wasn’t a glitch - it was a pattern.

Lack of Security and Transparency

There was never any public proof that ZG.TOP used cold storage, two-factor authentication, or regular security audits. No third-party reports. No transparency dashboard. No mention of insurance for user funds. CipherTrace, a blockchain analytics firm, never included ZG.TOP in any of its exchange audits. That’s a red flag. Even smaller exchanges like Kraken and Bitstamp published security details. ZG.TOP didn’t even try. Its website had a 12-article FAQ, mostly about how to deposit. Nothing on encryption, how funds were stored, or what happened if the site got hacked. When an exchange doesn’t talk about security, it’s usually because it doesn’t have any.

Why It Couldn’t Survive

ZG.TOP was built on a tiny local market - Mongolia had less than 1% of adults holding crypto in 2019. That’s not enough to sustain a trading platform. It had no international presence. No mobile app. No API for developers. No advanced trading tools like stop-loss orders or margin trading. It was stuck in 2015 while the rest of the industry moved forward. Meanwhile, exchanges in Japan, Singapore, and the U.S. were getting licensed, adding fiat on-ramps, and building user trust. ZG.TOP didn’t adapt. It didn’t grow. It didn’t even try. When the 2020 crypto market crashed, exchanges with weak liquidity got wiped out. ZG.TOP was one of 45 that vanished in just three months. It wasn’t a coincidence - it was inevitable.

What Happened to Your Money?

If you had funds on ZG.TOP when it shut down, you lost them. No one is recovering those assets. No legal recourse. No insurance fund. No official announcement. The domain zgtop.com is now unregistered. The company behind it? Gone. The servers? Offline. The team? Disappeared. There’s no successor. No new entity claiming to take over. It’s as if ZG.TOP never existed. That’s the harsh reality of unregulated, underfunded crypto exchanges. They can vanish overnight - and with them, your coins.

Is ZG.COM the Same Thing?

You might have heard of ZG.COM. It’s active today, based in Singapore and Taiwan, and listed on CoinMarketCap. But it has zero connection to ZG.TOP. Same name. Different company. Different team. Different tech. ZG.COM launched in 2018 - three years after ZG.TOP died. It has millions in daily volume, fiat support, and a solid reputation. Confusing the two is like thinking Tesla and Toyota are the same because they both make cars. Don’t let the name fool you.

What You Should Learn

ZG.TOP isn’t just a footnote - it’s a warning. Never use an exchange that:

- Doesn’t support fiat on-ramps (you can’t buy crypto with your bank)

- Charges uneven fees (buyers pay 0%, sellers pay 10x)

- Has withdrawal fees based on percentage

- Has no public security info

- Has less than $10 million in daily volume

- Is based in a country with no crypto regulations

If any of these apply, walk away. Stick to exchanges with clear licensing, high liquidity, and transparent operations. Binance, Kraken, Coinbase - they may not have zero fees, but they have trust. And trust is what keeps your money safe.

Is ZG.TOP still operating in 2026?

No, ZG.TOP has been completely offline since March 2020. Its website no longer loads, the domain is unregistered, and there is no evidence of any attempt to relaunch. It is officially classified as a "dead" exchange by industry databases like Cryptowisser.

Can I recover my funds from ZG.TOP?

No, there is no way to recover funds held on ZG.TOP. The exchange vanished without notice, and no entity has taken responsibility for user assets. There is no legal pathway, insurance claim, or recovery service available. This is why using regulated, well-established exchanges is critical.

Was ZG.TOP a scam?

There’s no proof it was intentionally fraudulent, but it operated with zero transparency, poor security, and unsustainable business practices. It didn’t have the liquidity, regulatory backing, or operational stability to survive. In crypto, that’s functionally the same as a scam - users lost access to their funds with no recourse.

Why did ZG.TOP charge sellers but not buyers?

It was a flawed attempt to attract buyers by offering zero fees. But this created an imbalance: sellers bore all the cost, so market makers avoided the platform. This led to low liquidity, wider spreads, and poor trading conditions. The model worked in theory but collapsed in practice.

How was ZG.TOP different from ZG.COM?

ZG.COM is a completely separate exchange launched in 2018, based in Asia, with high liquidity, fiat support, and active operations. It has no corporate, technical, or ownership ties to ZG.TOP. The similar names are coincidental and misleading.

What should I look for in a safe crypto exchange?

Look for exchanges with: fiat on-ramps, transparent fee structures, high trading volume ($10M+ daily), public security audits, two-factor authentication, cold storage, and regulatory compliance. Avoid any platform with uneven fees, low volume, or no clear jurisdiction.