ACX Crypto Exchange Review: Fees, Security, and What You Need to Know in 2026

Jan, 18 2026

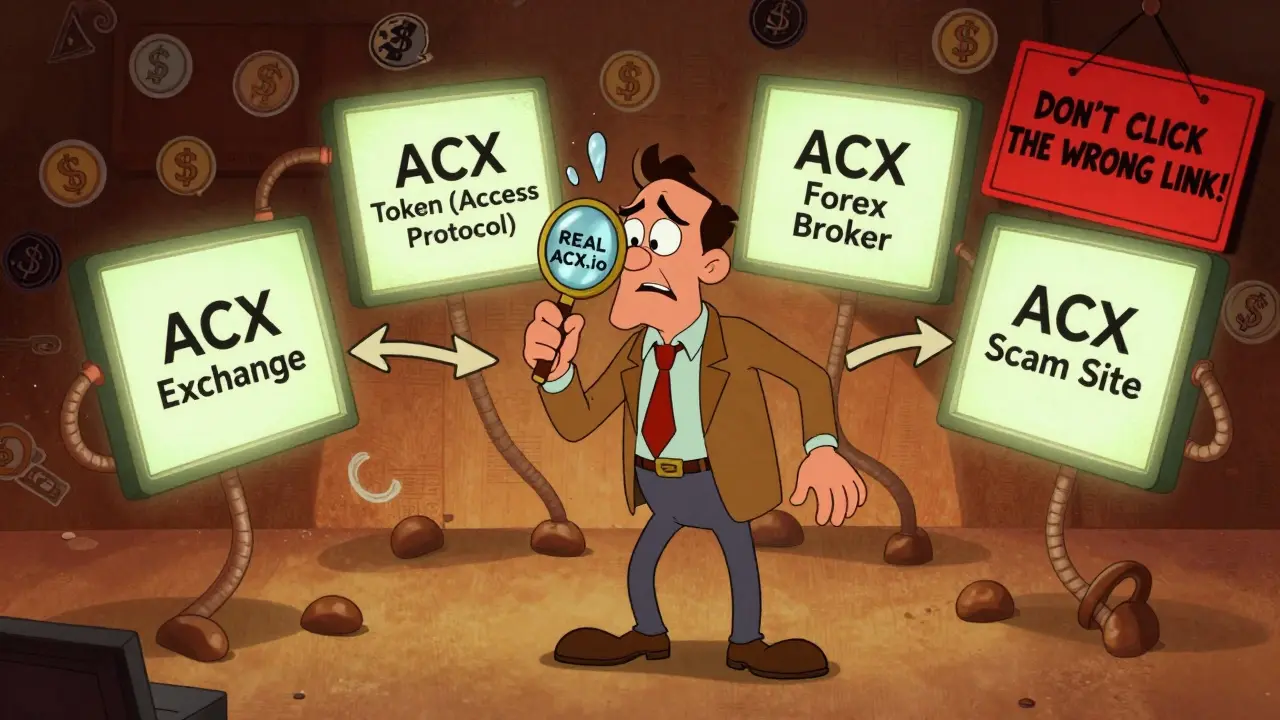

When you search for ACX crypto exchange, you’re not just looking at one platform-you’re stepping into a mess of similar names, confusing tokens, and unclear info. There’s an Australian exchange called ACX. There’s also an Access Protocol token named ACX. And a forex broker using the same acronym. If you’re trying to trade crypto and end up on the wrong site, you could lose money before you even click "Deposit". This review cuts through the noise and tells you exactly what the real ACX exchange does, how it works, and whether it’s worth your time in 2026.

What Is the Real ACX Crypto Exchange?

The actual ACX exchange is a cryptocurrency trading platform based in Australia. It’s not a giant like Binance or Coinbase. You won’t find it on most "Top 10 Exchanges" lists. But if you live in Australia and want to trade crypto with AUD, it’s one of the few platforms that still supports direct bank transfers without charging you to withdraw your money.

It launched years ago and hasn’t changed much since. No flashy mobile app. No derivatives trading. No staking. No NFT marketplace. Just spot trading-buy and sell Bitcoin, Ethereum, and a few other major coins. If you’re looking for advanced tools, you’ll be disappointed. But if you want a simple, no-frills exchange that doesn’t nickel-and-dime you on AUD withdrawals, it’s worth a closer look.

Fees: One of the Best Parts

ACX charges 0.20% for every trade, whether you’re making a market order or taking one. That’s lower than the industry average of 0.25%. For someone trading $1,000 a week, that saves you $5 a week-or $260 a year. That adds up.

Withdrawal fees? Here’s where ACX stands out. For Bitcoin, you pay 0.0006 BTC per withdrawal. That’s standard. But for Australian Dollars? Zero. No fee. Ever. That’s rare. Most exchanges charge $5-$15 to pull AUD out to your bank account. ACX doesn’t. That’s a big deal for Aussie traders who move money in and out regularly.

But here’s the catch: you can’t deposit with a credit card. Only bank wire transfers. That means if you want to buy crypto fast, you’re stuck waiting 1-3 business days for funds to clear. No instant buys. No PayPal. No POLi. If you’re used to funding your account in minutes, ACX will feel slow.

Security: Solid, But Quiet

ACX claims over 95% of user funds are stored offline in cold storage. That’s a good number. Top exchanges like Kraken and Coinbase use similar levels. It’s not perfect, but it’s above average.

They also require two-factor authentication (2FA). You can’t skip it. That’s a plus. Many smaller exchanges let you turn 2FA off-ACX doesn’t. Your password and phone code are the only way in.

They say they run regular security audits and financial reviews. But they never name the auditors. No public reports. No SOC 2 certification. No third-party proof. That’s a red flag for some. If you’re serious about security, you want to see who checked their systems. Not just a statement on their website.

There’s no history of major hacks. That’s good. But there’s also no public track record. No news articles. No user reports of stolen funds. That’s not proof of safety-it’s just silence. And in crypto, silence can mean either "no problems" or "no one’s paying attention."

What Coins Can You Trade?

ACX supports Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and a handful of others-maybe 15-20 total. That’s not much compared to Binance’s 1,000+ coins. But it’s enough for most people who stick to the big names.

They don’t list new memecoins or obscure tokens. That’s actually a good thing if you’re trying to avoid scams. Most new altcoins that explode in price are pump-and-dumps. ACX keeps it simple. No Shiba Inu. No Dogecoin variants. Just the coins with real market caps and liquidity.

If you’re into DeFi tokens or Solana-based projects, you’ll need another exchange. ACX doesn’t support them. If you want to trade ACX tokens from Access Protocol or Across Protocol? Forget it. Those are different projects. Don’t get confused. The ACX exchange doesn’t list the ACX token.

Who Is This Exchange For?

ACX isn’t for everyone. It’s not for day traders. Not for crypto investors chasing the next 10x. Not for people who want to trade on their phone while commuting.

It’s for one type of user: Australians who want to buy and hold Bitcoin and Ethereum, use AUD to deposit and withdraw, and don’t want to pay extra fees to move money in and out.

If you’re an Aussie with a bank account and you’re tired of paying withdrawal fees on other exchanges, ACX could save you hundreds a year. If you’re outside Australia? It’s not worth it. You can’t deposit in USD, EUR, or GBP. No fiat support outside AUD. And wire transfers from overseas are expensive and slow.

The Big Problem: Confusion Everywhere

Here’s the real danger. When you Google "ACX crypto", you’ll see:

- Access Protocol’s ACX token (price spiked 100% in 24 hours in late 2024)

- Across Protocol’s ACX token (predicted to hit $0.94 in 2025)

- An FX broker called ACX that trades forex and commodities

- And the actual Australian crypto exchange

People have lost money because they clicked the wrong link. They thought they were signing up for the exchange, but ended up on a token site. Or worse-they bought ACX tokens thinking it was the exchange’s native coin. It’s not. The exchange doesn’t have its own token.

Always check the URL: www.acx.io is the real one. Any other site using "ACX" in the name is a different company. Bookmark it. Double-check before you log in.

Final Verdict: A Niche Player with Real Advantages

ACX crypto exchange isn’t flashy. It’s not growing fast. It doesn’t have a big marketing budget. But it does one thing well: it lets Australians trade crypto without paying to withdraw AUD.

If you’re in Australia, want to avoid credit card fees, and don’t need 500 coins or margin trading, ACX is one of the most cost-effective options left. The fees are low. The security is decent. The platform is simple.

If you’re outside Australia? Skip it. You’ll pay more in wire fees than you save on trading fees. If you want advanced features? Go to Kraken or Binance. If you’re chasing new tokens? ACX won’t help you.

Bottom line: ACX is a quiet, reliable exchange for a specific group of users. Not the best overall. But the best for Aussie spot traders who want to keep their fees low and their withdrawals free.

What You Should Do Next

Before you sign up:

- Confirm you’re on www.acx.io-not a lookalike site.

- Check if your bank allows international wire transfers to Australia (some block them).

- Make sure you’re okay with a 2-3 day wait to deposit funds.

- Only deposit what you’re comfortable losing-this isn’t regulated like a bank.

- Enable 2FA immediately after signing up.

If you’re an Aussie trader tired of withdrawal fees, ACX is still one of the few places that makes sense. Just don’t get tricked by the name.

Is ACX crypto exchange regulated?

ACX doesn’t publicly list its regulatory status. While it’s based in Australia and likely follows AUSTRAC guidelines, there’s no official confirmation of registration or licensing. Always assume unregulated platforms carry higher risk, even if they claim to be secure.

Can I deposit USD or EUR on ACX?

No. ACX only accepts Australian Dollar (AUD) deposits via bank wire transfer. If you’re outside Australia, you can’t fund your account directly. You’d need to buy AUD first through another service, which adds cost and complexity.

Does ACX have a mobile app?

No. ACX only offers a web-based platform. There’s no official iOS or Android app. If you see an "ACX app" in the App Store or Google Play, it’s not affiliated with the exchange. Stick to the website to avoid scams.

Is ACX the same as the ACX token?

No. ACX crypto exchange is a trading platform. ACX is also the ticker symbol for tokens from Access Protocol and Across Protocol-two unrelated blockchain projects. The exchange does not issue or list the ACX token. Confusing them could lead to accidental purchases or phishing attempts.

Why doesn’t ACX accept credit cards?

ACX avoids credit cards to reduce chargeback risks and payment processing fees. Credit card deposits are common targets for fraud in crypto. By limiting deposits to bank wires, ACX lowers operational risk-though it sacrifices convenience for users who want instant funding.

Are there hidden fees on ACX?

The only fees are the 0.20% trading fee and the 0.0006 BTC withdrawal fee for Bitcoin. AUD withdrawals are free. There are no deposit fees, inactivity fees, or account maintenance fees. All fees are clearly listed on their website.