Baby World Liberty Financial (BABYWLFI) Explained - Full Crypto Coin Overview

Apr, 24 2025

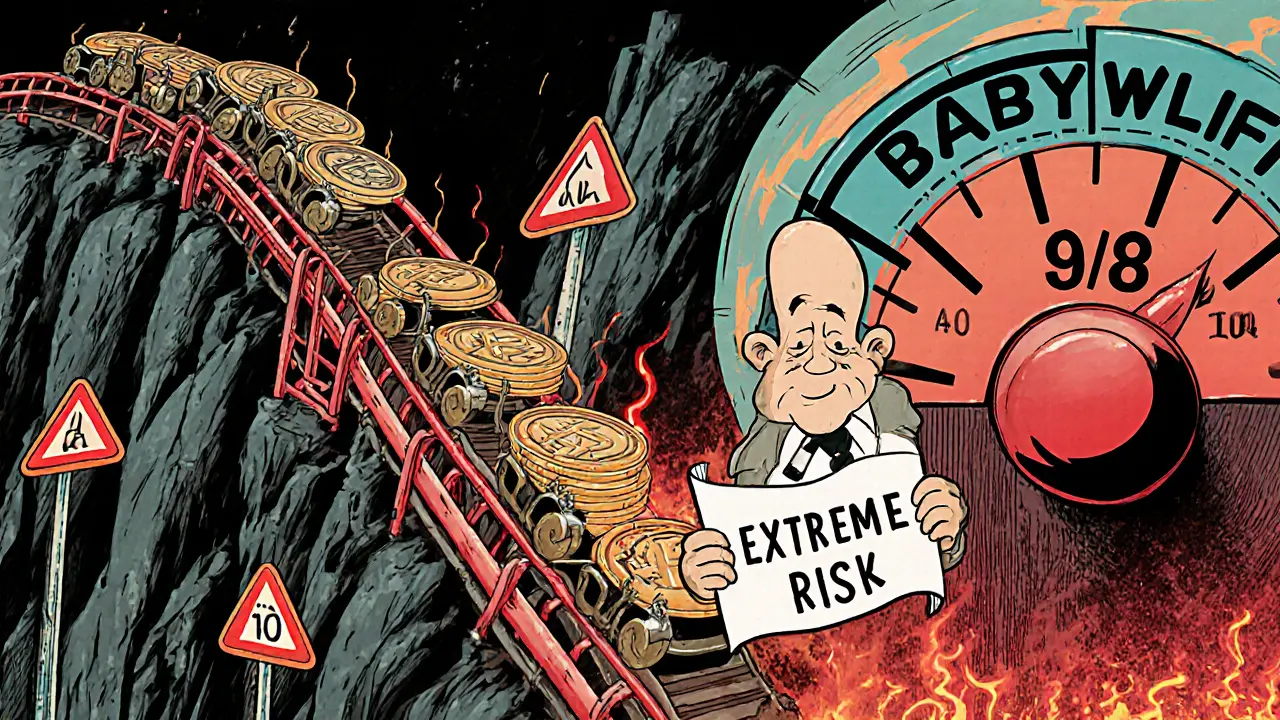

BABYWLFI Risk Calculator

BABYWLFI Risk Assessment

This calculator estimates potential outcomes based on the article's data showing BABYWLFI as an extremely high-risk token with a 98/100 risk score.

Key Risk Factors

- Anonymous developers (no verifiable team)

- 45% token concentration in top 10 wallets

- Inconsistent circulating supply data (0 vs 90B)

- High slippage (>30%) on trades

- Only available on DEXs (no major exchanges)

Potential Outcomes

Total loss of investment due to pump-and-dump or rug pull event.

80%+ loss of value (from ATH), with low liquidity making exit difficult.

Potential for massive upside (1,000x), but extremely unlikely given current market metrics.

Ever stumbled upon a token that costs a fraction of a cent and wondered if it’s a hidden gem or a trap? BABYWLFI is one of those ultra‑low‑priced coins that pops up on social feeds with promises of 1000x returns. This article breaks down exactly what Baby World Liberty Financial (BABYWLFI) is, how it works, who’s behind it, and why you should approach it with serious caution.

What is Baby World Liberty Financial (BABYWLFI)?

Baby World Liberty Financial (BABYWLFI) is a cryptocurrency token launched in 2024. It claims to be a deflationary meme‑coin aimed at retail traders seeking massive percentage gains. The token’s max supply is 100 billion, and it lives on the Ethereum blockchain.

Key Technical Specs

- Contract address:

0xf929e6cdaf(verified on Etherscan) - Total supply: 100,000,000,000 BABYWLFI

- Circulating supply: reports differ - CoinMarketCap lists 90 billion, while Bitget reports zero circulating tokens.

- Current price (Oct 2025): roughly $0.00000108 USD

- Market cap: about $100,000 USD, ranking near #4750 on major trackers

These numbers already signal red flags: a huge supply, a tiny market cap, and inconsistent data across sources.

Where Does BABYWLFI Trade?

The token is only available on a handful of decentralized exchanges such as Uniswap. Uniswap is an Ethereum‑based DEX that lets users swap tokens directly from their wallets. No major centralized exchange (Binance, Coinbase, Kraken) lists BABYWLFI, which means liquidity is extremely thin and slippage can exceed 30 % on modest trades.

Team and Community - Who’s Running the Show?

Bab yWorld’s website (babywlfi.vip) and Twitter handle @BabyW_ETH are the only public faces. The team remains anonymous; no LinkedIn profiles, GitHub repos, or whitepapers are available. Community channels (Telegram, Discord) have dwindled from over 1,200 members in September 2023 to under 400 today, and many accounts appear to be bots.

Price History and Market Performance

The token’s all‑time high hit $0.00000566 on August 31 2023, then fell more than 80 % to its current level. Daily trading volume hovers around $23,000 USD, giving a volume‑to‑market‑cap ratio of roughly 23 %, a metric often linked to price manipulation in low‑cap assets.

Risk Profile - What the Experts Say

Chainalysis flagged BABYWLFI as a high‑risk micro‑cap token: circulating supply mismatches, lack of verifiable team, and sub‑$200 k market cap are common traits of rug pulls. Dr. Elena Rodriguez of Chainalysis noted that 92.7 % of confirmed rug pulls in 2023 fell into the same category. BitBoy Crypto’s Ben Armstrong warned that such tokens often create false scarcity while keeping liquidity under the control of a few wallets.

Ownership Concentration

Analysis of the Ethereum ledger shows the top 10 wallets hold about 45 % of total BABYWLFI supply. With only 630 verified holders, the token’s distribution is highly centralized, making it vulnerable to dump events.

How to Buy (and Why It’s Hard)

Purchasing BABYWLFI requires a wallet like MetaMask configured for Ethereum, enough ETH for gas fees, and a visit to a DEX such as Uniswap. MetaMask is a browser extension wallet that many crypto users rely on.

- Install MetaMask and fund it with ETH.

- Navigate to Uniswap and paste the BABYWLFI contract address.

- Enter the amount of ETH you want to swap, set a slippage tolerance (often >30 % for this token), and confirm the transaction.

The average first‑time buyer spends about 22 minutes completing the trade, and roughly two‑thirds fail on the first attempt due to slippage or out‑of‑gas errors.

Comparative Snapshot - BABYWLFI vs Typical Micro‑Cap Tokens

| Metric | BABYWLFI | Average Micro‑Cap |

|---|---|---|

| Market cap | $100k | $300k‑$500k |

| 24‑h volume | $23k | $15k‑$30k |

| Circulating supply accuracy | Inconsistent (0 vs 90 B) | Generally consistent |

| Exchange listings | Only DEXs (Uniswap) | Few DEXs, occasional CEX trial |

| Team transparency | Anonymous | Usually disclosed |

| Risk score (IntoTheBlock) | 98/100 (extreme) | 80‑90/100 |

Even within the risky micro‑cap arena, BABYWLFI scores poorly on every key dimension.

Bottom Line - Should You Consider BABYWLFI?

If you’re looking for a long‑term store of value, a utility token, or an asset with real‑world partnerships, BABYWLFI does not qualify. Its appeal is purely speculative; the combination of low liquidity, anonymous developers, and a concentration of tokens in a few wallets makes it a classic high‑risk play. Most seasoned traders treat it as a “pump‑and‑dump” candidate rather than a legitimate investment.

In short, only allocate money you’re prepared to lose, and be ready for a potential total loss of capital.

Frequently Asked Questions

What blockchain does BABYWLFI run on?

BABYWLFI is an ERC‑20 token on the Ethereum blockchain, confirmed by the contract address 0xf929e6cdaf on Etherscan.

Is BABYWLFI listed on any major exchange?

No. It only trades on decentralized platforms like Uniswap. There are no listings on Binance, Coinbase, or Kraken.

How risky is investing in BABYWLFI?

Extremely risky. Risk models assign it a 98/100 score, and the token meets multiple red‑flag criteria for rug pulls.

Can I buy BABYWLFI with a credit card?

Not directly. You need Ethereum (ETH) in a wallet, then swap it for BABYWLFI on a DEX.

What is the team behind BABYWLFI?

The developers remain anonymous. No verifiable identities, GitHub repos, or audited code have been published.