How Iran Uses Bitcoin Mining to Bypass International Sanctions

Nov, 20 2025

Sanctions Bypass Profitability Calculator

This calculator demonstrates how Iran's low electricity costs enable profitable Bitcoin mining as a sanctions bypass strategy. Enter your own parameters to see how they impact profitability.

This calculator uses simplified mining models. Real-world profitability is affected by factors like network difficulty changes, hardware efficiency, and market volatility.

Iran Example: At $0.01/kWh, a 3000W miner at current difficulty and $60,000 BTC price generates 0.00000000 BTC/day with a daily profit of -$0.00. This explains why Iran can scale mining operations despite equipment costs.

By 2025, Iran is mining Bitcoin at a scale that shocks even seasoned crypto analysts. It’s not just a side hustle-it’s a state-backed financial lifeline. With Western banks locked down by sanctions, Iran turned to something no government can easily shut down: the Bitcoin network. And it’s working.

Why Bitcoin? Because It Can’t Be Blocked

When the U.S. pulled out of the Iran nuclear deal in 2018, the financial noose tightened. Banks stopped processing payments. Oil sales dried up. Dollars vanished. Iran couldn’t buy medicine, spare parts for power plants, or even basic electronics without jumping through a dozen international hoops. Then came Bitcoin. Unlike bank transfers, Bitcoin doesn’t need SWIFT. It doesn’t need a U.S. correspondent bank. It doesn’t care if you’re on a sanctions list. All you need is an internet connection and electricity. Iran had both-plenty of it. The country’s electricity is among the cheapest in the world. Thanks to massive natural gas reserves and state subsidies, miners pay next to nothing per kilowatt-hour. In the U.S., electricity costs $0.05 on average. In Iran? Often less than $0.01. That’s not just an advantage-it’s a game-changer.The Mining Machine: Factories on Military Land

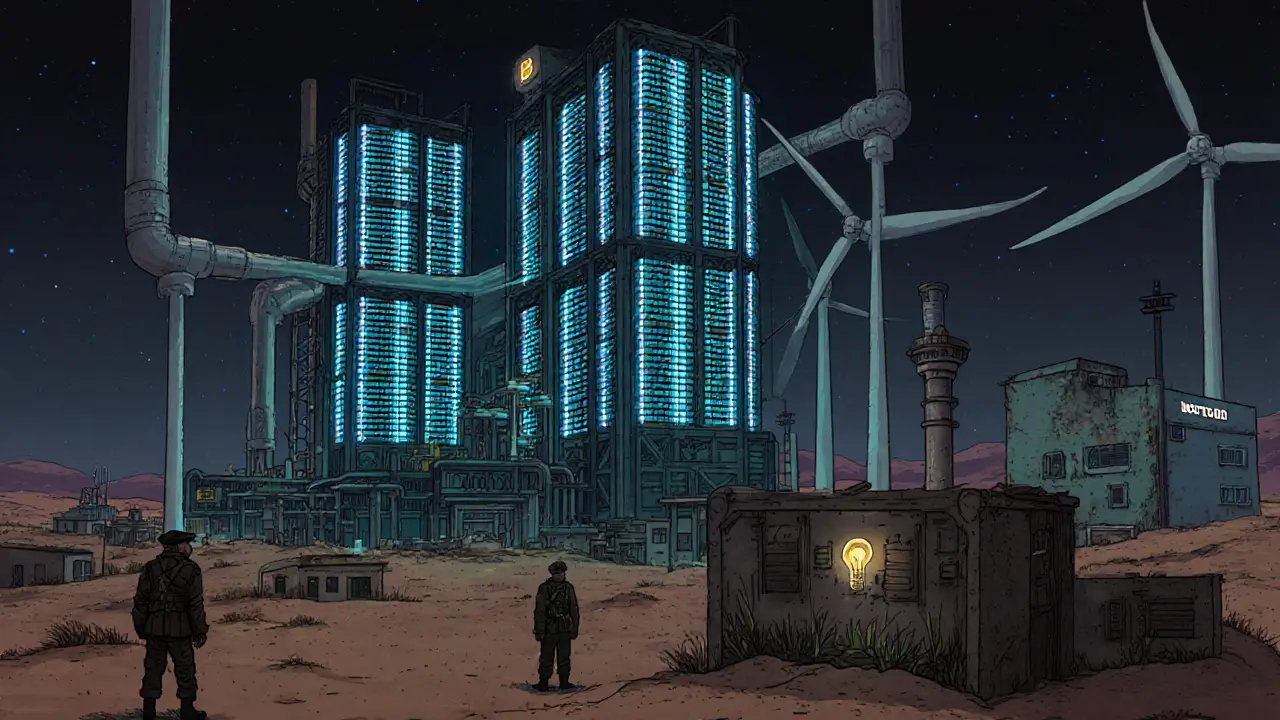

Iran didn’t start with a few home rigs. It built industrial-scale farms. One of the biggest? A 175-megawatt facility in Rafsanjan, Kerman province. It’s not run by a tech startup. It’s a joint venture between the Islamic Revolutionary Guard Corps (IRGC) and Chinese investors. The power? Directly tapped from military-grade grids. The bills? Paid by the state-or ignored entirely. By 2022, Iran had licensed over 10,000 mining operations. Many sit inside religious foundations like Astan Quds Razavi, which controls vast land and energy resources. Others are hidden inside industrial zones where regulators rarely check. These aren’t hobbyists. These are state-sanctioned operations with political protection. The hardware? Mostly Chinese ASIC miners-Bitmain, MicroBT, and others smuggled in through Turkey, the UAE, and Pakistan. Sanctions make direct imports impossible, but gray markets thrive. Miners trade equipment through encrypted Telegram channels, paying in crypto or barter.How the Money Flows Out

Mining Bitcoin is only half the battle. Turning it into usable cash is the real trick. Iran doesn’t cash out on Coinbase or Binance directly. Too risky. Instead, it uses a layered system:- Bitcoin is sent to offshore exchanges with weak KYC-like TRON-based platforms or shell companies in the UAE.

- From there, it’s swapped into stablecoins (USDT, USDC) or other cryptos that move faster and harder to trace.

- Then, it’s funneled into international trade-buying goods from Russia, Turkey, or India, often paid for directly in crypto.

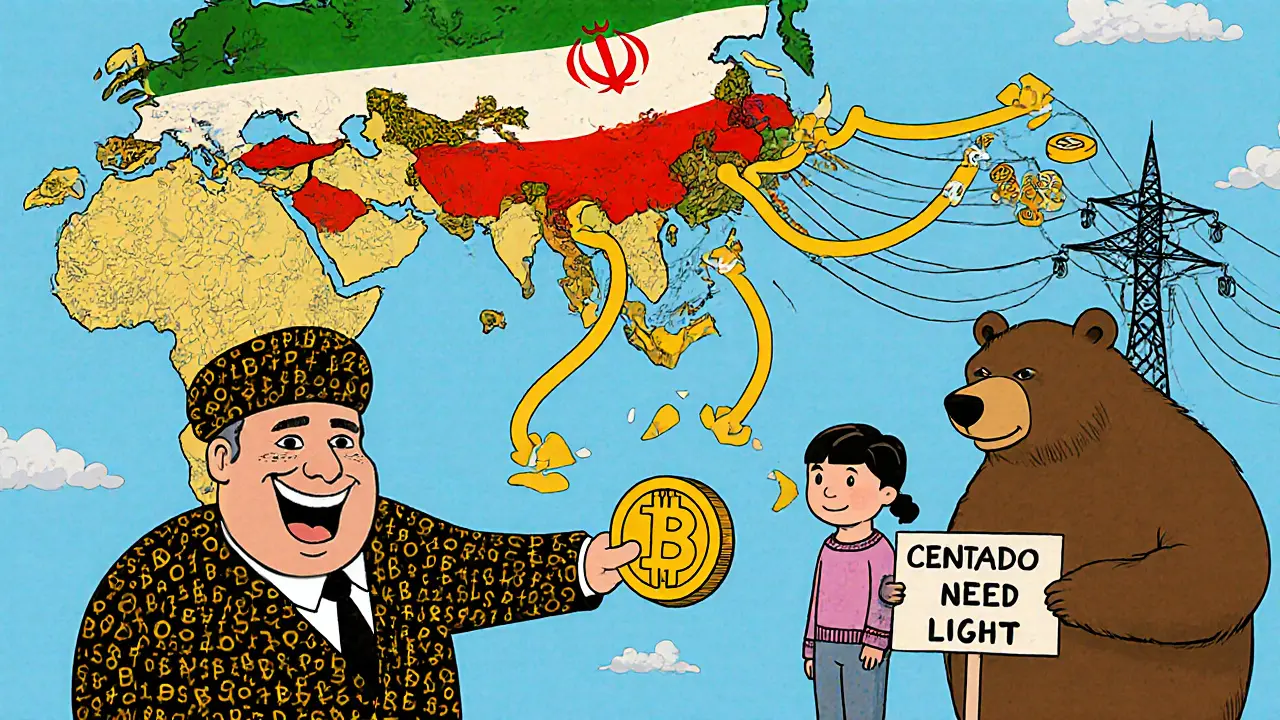

It’s Not Just Bitcoin-It’s a Parallel Financial System

Iran didn’t stop at mining. It built a whole crypto ecosystem. The Central Bank of Iran now oversees 90 domestic cryptocurrency exchanges. They’re not just for trading. They’re for paying for imports, settling debts, and even paying salaries to state contractors. The government even issued licenses for crypto payments to foreign suppliers. It’s like creating a shadow banking system-with Bitcoin as the reserve currency. Iran signed crypto cooperation deals with Russia in 2018. Since then, it’s been negotiating similar agreements with Austria, Switzerland, and even South Africa. The goal? To create a network of countries that accept crypto as payment-bypassing the dollar entirely. This isn’t theory. It’s happening. A Russian company sells grain to Iran. Iran pays in Bitcoin. Russia converts it to rubles via a local exchange. No U.S. bank touches the money. No SWIFT. No sanctions violation-at least not on paper.Who Benefits? And Who Pays the Price?

The benefits are clear: Iran keeps its economy running. It buys weapons, fuel, and tech. It funds proxy groups like Hezbollah and the Houthis. The IRGC and religious foundations get richer. But ordinary Iranians? They’re left with rolling blackouts. Bitcoin mining now uses as much electricity as 10 million barrels of oil per year. That’s 4% of Iran’s total oil export value-diverted to power servers, not homes or hospitals. In cities like Tehran and Mashhad, families endure 12-hour daily power cuts. Schools shut down. Refrigerators fail. Hospitals run on generators. Critics say the government could fix the grid. But why? Mining is profitable. Powering homes isn’t. The regime prioritizes revenue over resilience.Why Other Sanctioned Nations Failed-And Iran Didn’t

Venezuela tried with the Petro-a state-backed digital currency. It never gained traction. North Korea hacked exchanges and stole crypto. Both were clumsy. Iran did something smarter. It didn’t invent a new coin. It used Bitcoin-the most trusted, decentralized, and liquid asset in crypto. It didn’t rely on theft. It used legal mining. It didn’t isolate itself. It built bridges with other countries. Russia’s post-2022 crypto surge looks similar-but Iran had a seven-year head start. Iran’s infrastructure is deeper. Its licensing system is more organized. Its political will is more consistent.

The Risks Are Real

This strategy isn’t foolproof. International regulators are watching. FinCEN issued a warning in June 2025 about Iranian-linked crypto flows using "teapot" refineries and Hong Kong shell companies. Exchanges are starting to block Iranian IPs. Some mining pools now exclude IPs from Iran. Hardware is getting harder to get. Newer, more efficient ASICs are blocked by export controls. Miners are stuck with older models that use more power and break down faster. And if Iran ever re-enters a nuclear deal? Sanctions could lift. The whole crypto strategy might become unnecessary. But for now, it’s the best tool they have.What’s Next?

Iran plans to increase mining capacity by 50% over the next two years. New facilities are being built in Bushehr and Khuzestan, using surplus gas power. They’re even experimenting with solar and wind to reduce reliance on the grid. They’re also exploring blockchain for customs, land titles, and supply chain tracking. If successful, Iran could become the first sanctioned nation to fully integrate decentralized tech into its core economy. But the world isn’t standing still. The U.S. and EU are pushing for global crypto sanctions frameworks. The IMF is studying how to track state-backed mining. And Bitcoin miners everywhere are starting to ask: Should we filter out Iranian hashes? Would that break Bitcoin’s core promise of openness? There’s no easy answer.Can Sanctions Still Work in the Crypto Age?

Iran’s Bitcoin mining shows something profound: financial sanctions are losing their teeth. You can freeze bank accounts. You can ban SWIFT. But you can’t shut down a global, decentralized network that runs on millions of computers across 190 countries. Bitcoin doesn’t need permission. It doesn’t need a license. It doesn’t care who you are. Iran didn’t break the rules. It found a loophole no one thought existed-and built an empire inside it. The real question isn’t whether Iran can keep mining. It’s whether the rest of the world can afford to ignore it.Is Bitcoin mining legal in Iran?

Yes, Bitcoin mining is fully legal in Iran and actively encouraged by the government. Since 2020, Iran has issued licenses to over 10,000 mining operations and permits cryptocurrency exchanges to operate domestically. Miners must register with the Central Bank of Iran and obtain electricity permits from the Ministry of Energy, but state-backed entities-especially those tied to the IRGC-receive preferential treatment and subsidized power.

How much Bitcoin does Iran mine?

Iran accounts for approximately 4.5% of global Bitcoin mining hash rate as of mid-2025, making it the fourth-largest mining nation after the U.S., Kazakhstan, and Russia. This translates to hundreds of millions of dollars in Bitcoin output annually, with over $4.18 billion worth of cryptocurrency exported from Iran in 2024 alone.

Does Iran use Bitcoin to buy oil or sell it?

Iran uses Bitcoin primarily to buy imports-not to sell oil. While oil is still exported through its "dark fleet" of tankers, Bitcoin helps pay for the goods Iran needs: medicine, industrial equipment, semiconductors, and spare parts. In some cases, Iranian companies pay foreign suppliers directly in Bitcoin, bypassing Western banking systems entirely. This avoids the need for dollar intermediaries and sanctions-triggering transactions.

Why hasn’t the U.S. shut down Iran’s Bitcoin mining?

Bitcoin mining is decentralized and distributed. Unlike a bank or exchange, you can’t shut down a network of thousands of servers spread across cities, industrial zones, and military bases. Even if you block IPs or sanction exchanges, miners simply switch to new platforms or use proxy services. The energy used is domestically generated, so sanctions on electricity exports don’t apply. Enforcement is technically and politically complex.

Is Iran’s Bitcoin mining hurting its citizens?

Yes. Bitcoin mining consumes electricity equivalent to 10 million barrels of oil per year-roughly 4% of Iran’s total oil export value. This diverts power away from homes, hospitals, and factories, contributing to nationwide blackouts. While the state profits from mining, ordinary Iranians face rising energy costs, unreliable service, and inflation. Critics argue the regime prioritizes sanctions evasion over basic public welfare.

Could other sanctioned countries copy Iran’s model?

Absolutely. Russia has already adopted similar tactics since 2022, though not as systematically. Venezuela, North Korea, and Syria have tried-but failed due to poor infrastructure, lack of energy access, or reliance on stolen crypto. Iran’s success comes from its combination of cheap energy, state coordination, and integration with existing sanctions-evasion networks like its dark fleet of tankers. Any country with abundant power and political will could replicate it.