Blockchain Technology Guide 2025: Full Explained

Jul, 24 2025

Imagine a ledger that lives on thousands of computers at once, never erases a line, and lets strangers trade without a bank. That’s the promise of blockchain technology, and in 2025 it’s finally moving from hype to real‑world impact. This guide walks you through every building block - from the math that secures the chain to the industries that are already reaping the benefits - so you can decide if, where, and how to adopt it.

What Exactly Is a Blockchain?

At its core, a Blockchain is a distributed ledger that records transactions in immutable, cryptographically linked blocks. Each block stores a batch of transactions, a timestamp, and the hash of the previous block, forming a chain that can’t be altered without changing every subsequent block - an effort that would require more computing power than exists on the planet.

Key Characteristics That Set Blockchain Apart

- Decentralization: No single entity controls the ledger; every node holds a copy.

- Transparency: Participants can view all recorded transactions, though data can be permissioned.

- Immutability: Once a block is added, changing it breaks the cryptographic hash chain.

- Consensus: Network members agree on the state of the ledger using mechanisms like Proof-of-Work or Proof-of-Stake.

How a Transaction Gets Recorded

- A user initiates a transaction, which is broadcast to the network.

- Nodes validate the transaction against protocol rules (e.g., signature verification, balance checks).

- Validated transactions are grouped into a block.

- Consensus algorithm selects the next block and appends it, linking its hash to the previous block.

- The updated ledger is instantly distributed to all participants.

This four‑step flow is the same whether you’re moving a Bitcoin, an ERC‑20 token, or a supply‑chain record.

Types of Blockchains: Public, Private, and Consortium

| Attribute | Public | Private | Consortium |

|---|---|---|---|

| Access | Open to anyone | Restricted to approved participants | Multiple vetted organizations |

| Governance | Decentralized, protocol‑driven | Central authority | Shared governance model |

| Typical Use Cases | Cryptocurrencies, public dApps | Internal audit, asset tracking | Supply‑chain provenance, inter‑bank settlement |

| Transaction Throughput (TPS) | 4-30 (Bitcoin/Ethereum) | 100-500+ | 500-3,500 (e.g., Hyperledger Fabric) |

Choosing the right type depends on who needs to see the data, how fast you need to move, and how much trust you can place in a central authority.

Consensus Mechanisms: Proof‑of‑Work vs Proof‑of‑Stake

Proof-of-Work (PoW) requires miners to solve cryptographic puzzles, consuming large amounts of electricity but offering strong security guarantees. Bitcoin’s network, for example, processes 4‑7 TPS and averages 10‑minute block times.

Proof-of-Stake (PoS) selects validators based on the amount of stake they lock up, slashing those who act maliciously. Ethereum’s recent “Dencun” upgrade cut transaction fees by 90% and now averages 15‑30 TPS with 12‑second block intervals.

Hybrid models like Byzantine Fault Tolerance (BFT) are common in private networks such as Hyperledger Fabric, where up to 3,500 TPS is achievable.

Smart Contracts: Automation on the Chain

A Smart contract is self‑executing code stored on a blockchain that triggers when predefined conditions are met. They enable decentralized finance (DeFi), automated supply‑chain escrow, and tokenized assets without a middle‑man.

Ethereum remains the dominant platform for smart contracts, with over 28,000 monthly Stack Overflow questions and a developer community of 4,500+ GitHub contributors. Languages like Solidity dominate, though newer languages (e.g., Move for Diem) are gaining traction.

Real‑World Use Cases That Matter

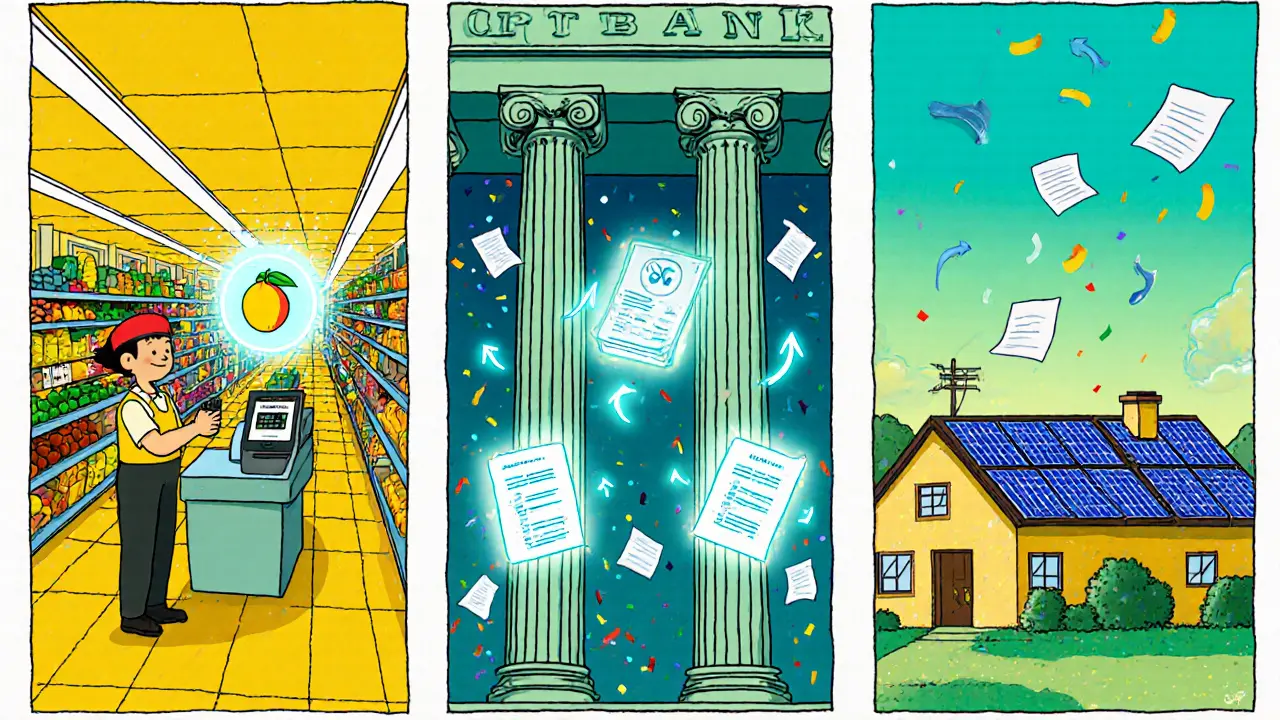

- Supply‑chain provenance: Walmart’s mango traceability dropped verification time from 7 days to 2.2 seconds using a public‑private hybrid.

- Financial settlement: JPMorgan’s Interbank Information Network (IIN) processes cross‑border payments with 30‑50% lower audit costs.

- Digital identity: Nations like Estonia pilot blockchain‑backed e‑residency, allowing citizens to sign documents securely online.

- Energy trading: Power Ledger enables peer‑to‑peer electricity trades, cutting intermediaries.

These examples show where the trust and immutability of blockchain outweigh its lower throughput compared to traditional databases.

Performance, Scalability, and the Road Ahead

Scalability remains the biggest hurdle. Public chains struggle with single‑digit TPS, while private solutions can hit thousands but sacrifice openness. Layer‑2 solutions (e.g., rollups on Ethereum) and sharding are promising, yet they add complexity.

Quantum‑computing risk is also on the horizon; NIST warns that current SHA‑256 and KECCAK‑256 hashes could become vulnerable by 2030, prompting research into post‑quantum cryptography.

Despite challenges, the market is booming: a 56.3% CAGR from 2023‑2030 pushes global blockchain spend to an estimated $33.5 billion by 2027, with enterprise adoption topping 55% of supply‑chain projects by 2028.

Practical Checklist for a First‑Time Blockchain Project

- Define the business problem - avoid blockchain for “just because it’s cool.”

- Select the appropriate network type (public, private, consortium).

- Choose a consensus mechanism that matches security and performance needs.

- Plan for integration: allocate 40‑60% of the timeline to re‑engineer existing processes.

- Establish key management policies - 83% of enterprises rely on third‑party solutions.

- Validate regulatory compliance early - 67% of projects need legal review.

- Prototype with a testnet before committing to production.

Common Pitfalls and How to Avoid Them

Over‑engineering: Trying to put every data point on‑chain leads to bloat. Use off‑chain storage for bulk data and store only hashes on the ledger.

Key loss: Private keys are the crown jewels. Implement multi‑sig wallets and hardware security modules.

Under‑estimating governance: Without clear rules, consortiums stall. Draft a governance charter before code is written.

Future Outlook: What to Watch in 2025‑2028

• Ethereum continues its rollup migration, targeting sub‑second finality.

• Central banks, like the European Central Bank’s Digital Euro pilot, will test large‑scale retail CBDCs.

• Interoperability frameworks (e.g., Polkadot, Cosmos) aim to lift the current 22% cross‑chain capability.

• Gartner places blockchain on the “Slope of Enlightenment,” signaling mainstream adoption between 2026‑2028.

Is blockchain the same as cryptocurrency?

No. Blockchain is the underlying distributed ledger technology, while cryptocurrencies are digital assets that use a blockchain to record ownership and transfers.

Which consensus mechanism is best for a supply‑chain network?

Most supply‑chain pilots choose a BFT‑style algorithm (e.g., Tendermint) or a permissioned Proof‑of‑Stake because they provide fast finality and low energy use while still preventing tampering.

Can I store large files directly on a blockchain?

Storing big files on‑chain is impractical due to high costs and limited throughput. The common pattern is to keep the file in IPFS or a cloud bucket and store its hash on the blockchain for verification.

What are the main security concerns for blockchain projects?

Key‑management failures, smart‑contract bugs, and future quantum attacks are the top risks. Use hardware wallets, rigorous code audits, and stay updated on post‑quantum cryptography research.

How do I choose between a public and a private blockchain?

Pick a public chain if transparency and open participation are critical (e.g., token issuance). Choose a private chain for internal processes where data confidentiality, higher throughput, and controlled access matter.