How Iranian Energy Subsidies Fuel Crypto Mining - And Why It’s Breaking the Grid

Jan, 7 2026

Iran’s power grid is failing. Millions of households face 10 to 12 hours of blackouts every day in summer. Meanwhile, thousands of industrial-scale Bitcoin mining rigs run nonstop - powered by electricity that costs less than a penny per kilowatt-hour. This isn’t a glitch. It’s policy.

The Math Behind the Madness

Mining one Bitcoin in Iran takes about 300 megawatt-hours of electricity. That’s enough to power 35,000 Iranian homes for a full day. Yet, miners pay just $0.01 to $0.05 per kWh. Compare that to Italy, where the same Bitcoin costs $306,000 to mine. In Iran? Around $1,300. That’s a 235-fold difference. No wonder Iran now hosts between 3.5 and 4.2 million ASIC mining machines, operated by 450,000 to 600,000 people. The government doesn’t just tolerate this - it bankrolls it. Cryptocurrency mining generates $1.5 billion a year in foreign exchange, mostly through state-approved exports. The Central Bank of Iran lets licensed miners sell their Bitcoin to pay for sanctioned imports like medicine and food. It’s a workaround for sanctions, and it works - for some.Who’s Really Running the Rigs?

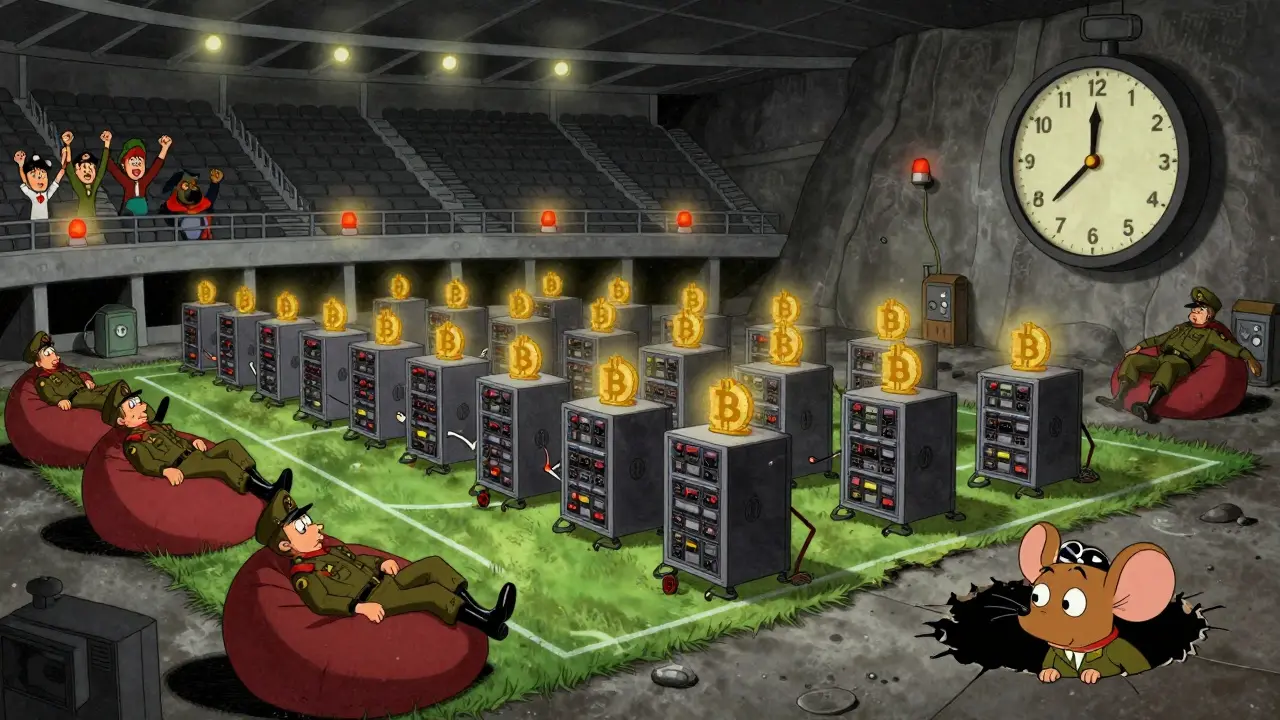

Here’s the dirty secret: nearly two-thirds of all mining operations in Iran are controlled by the Islamic Revolutionary Guard Corps (IRGC). They don’t pay market rates. They don’t even pay the subsidized rates. Many use stolen household electricity, rerouted through illegal connections. In April 2025, authorities found a mining farm hidden inside the tunnels beneath Ahvaz Stadium. It ran 24/7, siphoning power from the city’s grid while residents sat in darkness. This isn’t just corruption. It’s institutionalized theft. Energy analysts at Sharif University of Technology say the IRGC’s control over mining means the state is literally stealing electricity from its own citizens to fund its foreign operations. And the numbers back it up: mining consumes 2,000 megawatts of power daily - 5% of Iran’s total electricity use, but 15-20% of its grid imbalance. That’s like running Tehran’s entire population on one power plant, and then asking the rest of the country to make do with what’s left.How the System Works (And Why It’s Broken)

To mine legally in Iran, you need four licenses: one from the Ministry of Industry for importing hardware, one from the power company for electricity quotas, one from the Central Bank for exporting Bitcoin, and a final approval from the Iran Blockchain Council. The process takes 3 to 6 months. Approval rates? Below 40%. Meanwhile, illegal miners skip all that. They buy used ASICs from China through smuggling networks. They plug into residential lines. They use unregistered inverters to mask usage. And they pay nothing. The government estimates up to 2 gigawatts of power - equal to Tehran’s entire daily consumption - is stolen this way. That’s why during the mid-2025 internet blackout, power demand dropped by 2,400 MW. Overnight, over 900,000 illegal mining rigs shut down. The grid stabilized. The people noticed.

The Human Cost

In Tehran, families wait hours for water pumps to restart after a blackout. Hospitals run on generators. Students study by candlelight. On Twitter, Iranians post videos of their children crying in the heat, while hashtags like #IranElectricityCrisis trend with 50,000+ posts a day. One Reddit thread from June 2025 collected 1,450 comments. 92% blamed crypto mining for the blackouts. Telegram channels like "Iran Electricity Crisis" share real-time maps showing outage patterns aligning with known mining locations. When Bitcoin’s price jumps, blackouts spike 30-40% within two days. That’s not coincidence. It’s cause and effect. "They only mine cryptocurrency, but we are deprived of electricity," said a Tehran resident quoted by Iran Focus. That sentiment is shared by millions.Why the Government Won’t Stop It

Iran’s energy minister, Ali Akbar Mehrabian, defends the system. "Regulated mining brings in $800 million annually in foreign currency," he said in June 2025. And he’s not wrong. The state uses crypto exports to buy essentials the U.S. sanctions block. It’s a lifeline. But here’s the catch: the government doesn’t just profit from legal mining. It profits from the chaos. By keeping illegal operations alive, it creates a black market it can control. It can shut them down at will - during elections, during protests, during heatwaves - and blame "criminals" for the blackouts. Meanwhile, the legal miners, mostly tied to the IRGC, keep running. The government even pays citizens to snitch. In early 2025, it launched a reward program: 10% of recovered electricity costs for reporting illegal mines. In six months, 8,432 tips led to 2,157 shutdowns. But the rigs always come back. Because the system is designed to fail - just not for the people in charge.