US Sanctions and Crypto: How Global Powers Shape Digital Asset Markets

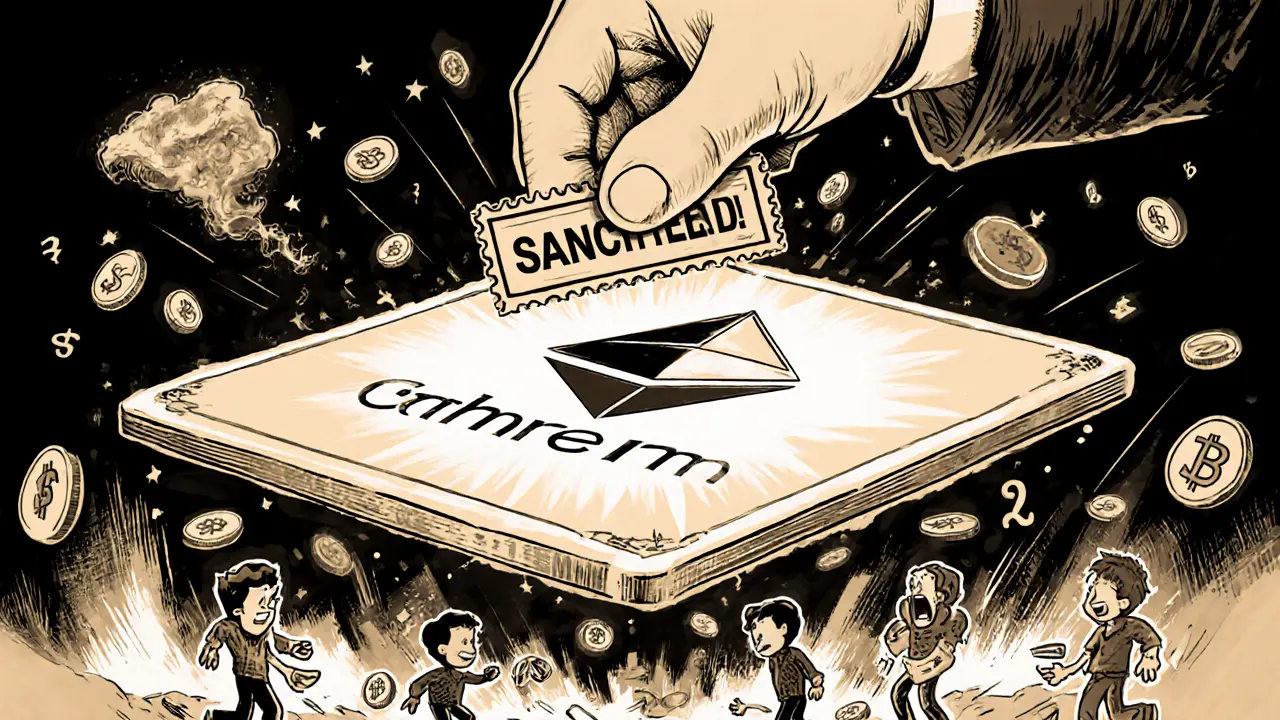

When the US sanctions, official restrictions imposed by the U.S. government on individuals, companies, or countries to enforce foreign policy and national security goals. Also known as financial embargoes, they are one of the most powerful tools the U.S. has to control global finance—even in decentralized spaces like cryptocurrency. These aren’t just political statements. They directly freeze wallets, delist tokens from exchanges, and shut down entire DeFi protocols. If a project is tied to a sanctioned country, person, or entity, it doesn’t matter if it’s built on Ethereum or Solana—it’s effectively dead in the U.S. market and often globally.

US sanctions don’t just target rogue states. They’ve hit crypto exchanges, mixing services, and even individual developers. In 2022, Tornado Cash was sanctioned for allegedly laundering $7 billion in crypto, and suddenly, any wallet that interacted with it became a risk. Banks froze accounts. Exchanges like Coinbase and Kraken blocked transactions. Users couldn’t withdraw. This isn’t theoretical—it’s happened. And it’s not just about North Korea or Iran. Even projects with no clear ties to bad actors get caught in the net because their founders used pseudonyms, hosted servers overseas, or accepted funding from wallets with murky histories. The Office of Foreign Assets Control (OFAC) doesn’t need proof of intent—just association. That’s why so many crypto projects now avoid U.S. users entirely, or build compliance checks into their smart contracts.

Related entities like crypto compliance, the process of ensuring digital asset activities follow legal rules, especially around anti-money laundering and sanctions screening have become critical for any platform wanting to operate legally. Tools like Chainalysis and Elliptic are now standard for exchanges to screen transactions. But compliance isn’t foolproof. Many smaller DeFi protocols still run without KYC, making them easy targets for sanctions. Meanwhile, blockchain sanctions, the application of government restrictions directly on public ledgers through wallet blacklisting and transaction monitoring are evolving fast. Some countries are experimenting with CBDCs that can be programmed to block payments automatically—something the U.S. hasn’t adopted yet, but is watching closely.

What you’ll find in this collection isn’t theory. These are real cases: exchanges that vanished after sanctions, tokens that dropped to zero because their team was flagged, and projects that survived by going fully anonymous—or by cutting off U.S. traffic entirely. You’ll see how Binance, Bitaroo, and COREDAX handle compliance differently. You’ll learn why fake airdrops like Swaperry and BULL Finance keep popping up—they’re often designed to slip under the radar of sanctions filters. And you’ll understand why a coin like JUSD or OX can disappear overnight, not because of market conditions, but because its issuer got caught in a sanctions sweep. This isn’t about speculation. It’s about survival in a world where governments can turn your digital assets into digital ghosts with a single press release.

US Sanctions on Crypto Mixers: What the Tornado Cash Case Really Means

Caius Merrow Nov, 9 2025 0The U.S. sanctions on Tornado Cash marked a turning point in crypto regulation-targeting open-source software for the first time. Learn how it worked, why it was banned, and what it means for privacy, developers, and the future of crypto.

More Detail