Crypterum Crypto Exchange Review: Fees, Inactivity, and What It Means for Traders

Oct, 14 2025

Crypterum Fee Calculator

Crypterum Fees

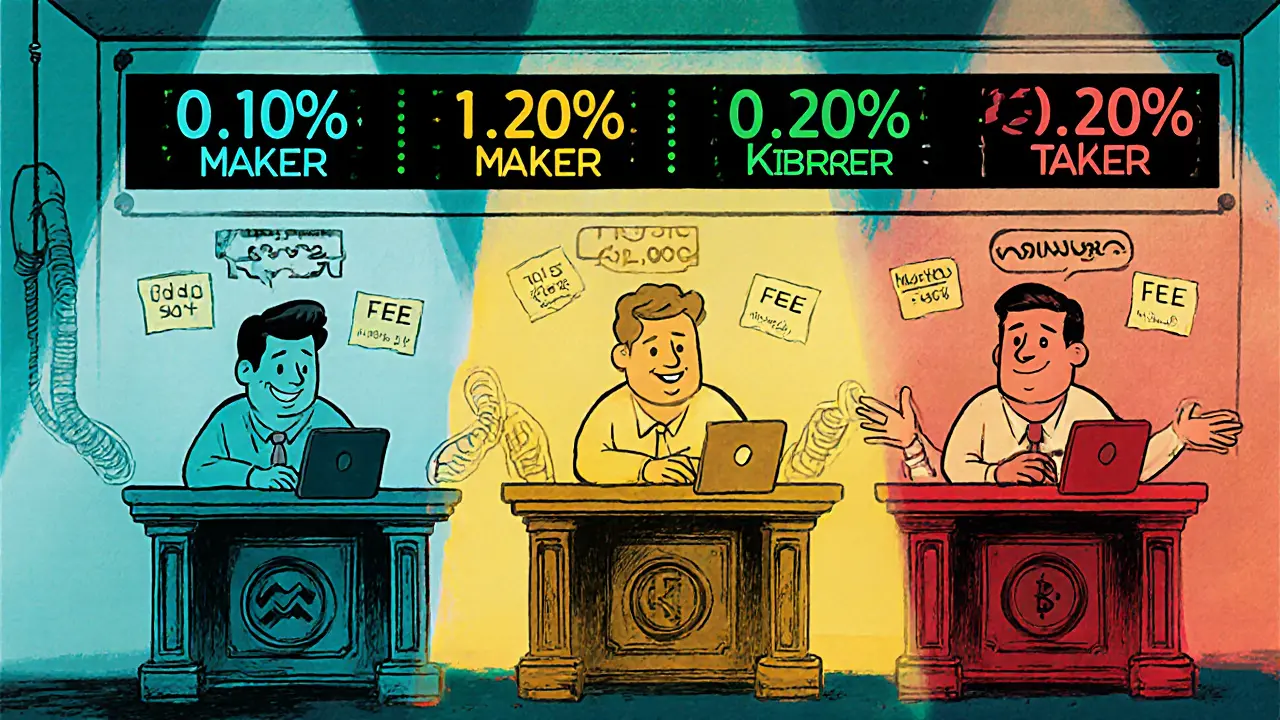

Maker: 0.10% of trade value

Taker: 0.20% of trade value

Bitcoin Withdrawal: 0.0003 BTC

Industry Comparison

| Exchange | Maker Fee | Taker Fee | BTC Withdrawal |

|---|---|---|---|

| Crypterum | 0.10% | 0.20% | 0.0003 BTC |

| Binance | 0% - 0.1% | 0% - 0.1% | 0.0004 BTC |

| Kraken | 0% - 0.16% | 0% - 0.26% | 0.0004 BTC |

| Coinbase | 0% - 0.5% | 0% - 0.5% | 0.0005 BTC |

Crypterum crypto exchange review uncovers a once‑low‑fee trading platform that’s now officially inactive. If you’re hunting for a cheap spot‑trading venue, the numbers look tempting, but the exchange’s shutdown in 2025 makes it a dead end. Below we break down the fee structure, compare it with major players, explain why the platform folded, and point you toward safer alternatives.

Quick Takeaways

- Crypterum charged 0.10% maker and 0.20% taker fees - lower than most 2025 exchanges.

- Bitcoin withdrawal cost was 0.0003 BTC, roughly half the industry average.

- The platform is flagged as inactive by Cryptowisser and no longer processes trades or withdrawals.

- Operated from Cyprus under Agreados LTD, offering standard KYC but limited regulatory transparency.

- For active trading, steer clear of Crypterum and consider established exchanges like Binance, Coinbase, or Kraken.

What Was Crypterum?

Crypterum was a cryptocurrency exchange based in Cyprus, run by the company Agreados LTD. It entered a crowded market offering a simple maker‑taker fee model that appealed to cost‑conscious traders. The platform supported standard KYC verification, a handful of major crypto pairs, and a web‑based trading interface. Despite its low fees, Crypterum never achieved the liquidity or user base of the industry leaders.

Fee Structure - Numbers That Look Good on Paper

The exchange used a classic maker‑taker model:

- Maker fee: 0.10% of the order value.

- Taker fee: 0.20% of the order value.

These rates sit below the 2025 global averages-0.164% for makers and 0.217% for takers-making Crypterum one of the cheaper spots for active traders.

Withdrawal fees were equally competitive. Bitcoin withdrawals cost a flat 0.0003 BTC, which is roughly 53% of the average 0.000643 BTC charged by most exchanges at the time.

How Crypterum Stacked Up Against the Big Guys

| Exchange | Maker Fee | Taker Fee | BTC Withdrawal |

|---|---|---|---|

| Crypterum | 0.10% | 0.20% | 0.0003 BTC |

| Coinbase | 0%‑0.5% | 0%‑0.5% | 0.0005 BTC |

| Kraken | 0%‑0.16% | 0%‑0.26% | 0.0004 BTC |

| Binance US | 0%‑0.1% | 0%‑0.1% | 0.0004 BTC |

| Gemini | 0.25% | 0.35% | 0.0005 BTC |

On fee‑only metrics, Crypterum would have been an attractive alternative for high‑volume traders. However, the platform’s limited coin list and lack of advanced features (margin, futures, staking) left it trailing the big exchanges.

Why Inactivity Matters - The Red Flag

Cryptowisser, a respected exchange review site, marked Crypterum as inactive in its 2025 assessment. An “inactive” label means the exchange no longer processes deposits, withdrawals, or new account registrations. For traders, that translates to frozen assets, no customer support, and the risk of total loss if any funds remain on the platform.

The Cyprus jurisdiction offers a modest regulatory framework, but the lack of a licensing body overseeing Agreados LTD suggests that the shutdown likely stemmed from financial strain, insufficient liquidity, or inability to meet evolving compliance standards.

User Experience - What We Know (and What We Don’t)

Because Crypterum never built a sizable community, feedback on user experience is scarce. No Reddit threads, Trustpilot reviews, or detailed forum discussions surfaced during the research period. The absence of user‑generated content hints at low adoption and possibly a short operational lifespan.

During its active window, the platform would have required standard KYC verification-ID upload, proof of address, and a selfie check-mirroring most regulated exchanges. Trading pairs were limited to major cryptocurrencies like Bitcoin, Ethereum, and a few altcoins, but the exact list was never publicly disclosed.

Lessons From Crypterum’s Downfall

The crypto exchange market in 2025 is dominated by a handful of giants that can afford extensive security audits, insurance funds, and marketing budgets. Smaller players like Crypterum face three main challenges:

- Liquidity pressure: Without deep order books, traders experience slippage and higher price impact.

- Regulatory headwinds: Jurisdictions like Cyprus are tightening AML/KYC rules, making compliance costly for tiny firms.

- Feature deficit: Users now expect futures, staking, fiat on‑ramps, and native token incentives-features Crypterum never rolled out.

When any of these pressures mount, the platform’s sustainability collapses, as seen with Crypterum.

Where to Trade Instead

If low fees are a priority, consider these active alternatives that also provide robust security and a wide asset range:

- Binance: Maker 0%, taker 0.1% (further reduced with BNB holdings).

- Kraken: Tiered fees starting at 0% maker, 0.16% taker; strong regulatory compliance.

- Coinbase Pro: Competitive tiered fees, deep liquidity, and strong insurance coverage.

All three maintain active support channels, regular security audits, and extensive community resources-critical factors you didn’t get from Crypterum.

Final Verdict

On paper, Crypterum offered enticingly low fees and cheap Bitcoin withdrawals. In reality, its inactive status renders the platform unusable and potentially risky for anyone still holding assets there. The exchange serves as a cautionary tale: fee‑only decisions can backfire if the underlying service lacks longevity, regulatory backing, and a vibrant user base.

For anyone looking to trade crypto today, stick with exchanges that are openly regulated, actively supported, and have a proven track record. Crypterum belongs in the “historical footnote” section of your crypto toolbox, not in your active trading arsenal.

Is Crypterum still accepting new users?

No. Cryptowisser listed the exchange as inactive in 2025, meaning registrations, deposits, and withdrawals are no longer possible.

How did Crypterum’s fees compare to major exchanges?

Crypterum charged 0.10% maker and 0.20% taker fees, which were lower than the average 0.164%/0.217% seen across the industry. Withdrawal of Bitcoin cost 0.0003 BTC, about half the usual rate.

Can I withdraw funds that I left on Crypterum?

If the platform is truly offline, withdrawals are impossible. Users should contact the former operator (Agreados LTD) or seek legal advice, but chances of recovery are slim.

What regulatory body oversaw Crypterum?

Crypterum was registered in Cyprus under Agreados LTD. The Cypriot Financial Services Authority provides basic oversight, but the exchange lacked a specific crypto‑license.

Which active exchanges should I use instead?

Consider Binance, Kraken, or Coinbase Pro. They offer low fees, extensive coin selections, strong security, and active customer support.