Crypto Tax Policy Review in Portugal: Future Changes and What You Need to Know

Jan, 6 2026

Portugal used to be the go-to place for crypto investors who wanted to avoid taxes. If you held Bitcoin or Ethereum for more than a year, you paid zero in capital gains tax. That was the rule - simple, clear, and powerful. But that changed in 2023. The government didn’t shut the door. It just added a few more locks.

What Changed in Portugal’s Crypto Tax Rules?

The 2023 State Budget introduced a new system that divides crypto activity into three buckets, each with its own tax treatment. This wasn’t a crackdown - it was a refinement. Portugal still wants crypto businesses and digital nomads. But now, it also wants a fair share from those who trade frequently or make money professionally.The three categories are:

- Category B: Professional crypto activities - like running a mining operation or trading as a business.

- Category E: Passive income - staking, lending, or earning interest in crypto.

- Category G: Capital gains - selling or exchanging crypto for profit.

Before 2023, everything was tax-free if held over a year. Now, only long-term capital gains are still tax-free. Everything else has rules.

Capital Gains: The 365-Day Rule Still Holds

This is the part most people care about. If you buy Bitcoin in January 2025 and sell it in March 2026 - that’s more than 365 days. You pay nothing in capital gains tax.But if you sell before the year is up? You owe 28%. That’s it. No extra fees, no social contributions. Just 28% on the profit.

How do they calculate your profit? First In, First Out (FIFO). If you bought 1 BTC in 2021 for €20,000 and another in 2023 for €40,000, and you sell 1 BTC in 2025 for €50,000, the system assumes you sold the first one. Your gain is €30,000. If you held it over 365 days? No tax. If not? You owe €8,400.

Important: This only applies if you’re selling to fiat (euros) or exchanging for something that’s not crypto. Crypto-to-crypto trades? Still tax-free - as long as you don’t cash out.

Staking and Lending: Taxed When You Cash Out

If you stake Ethereum or lend your crypto for interest, you’re earning passive income. Under Category E, that’s taxed at 28% - but not when you get the reward. You pay tax only when you convert it to euros.That’s a big win. Say you earn 0.5 ETH in staking rewards in June 2025. You don’t pay tax then. You hold it. In November 2026, you sell it for €2,000. Only then does the 28% tax trigger. And if you held the original asset for over a year? The gain on the ETH reward might be tax-free too - if it qualifies as long-term capital gain.

Some people choose to include staking income with their other earnings and get taxed at progressive rates instead of the flat 28%. That can help if your total income is low. But for most, the flat rate is simpler and cheaper.

Professional Crypto: Mining and Active Trading

If you’re mining Bitcoin, running a validator node, or trading crypto full-time as a business - you’re in Category B. This is where things get complex.Portugal gives you a break: you only pay tax on 15% of your gross income from professional crypto activities. So if you make €100,000 in trading profits, only €15,000 is taxable. That amount then gets added to your other income and taxed at Portugal’s progressive rates - from 14.5% up to 53%.

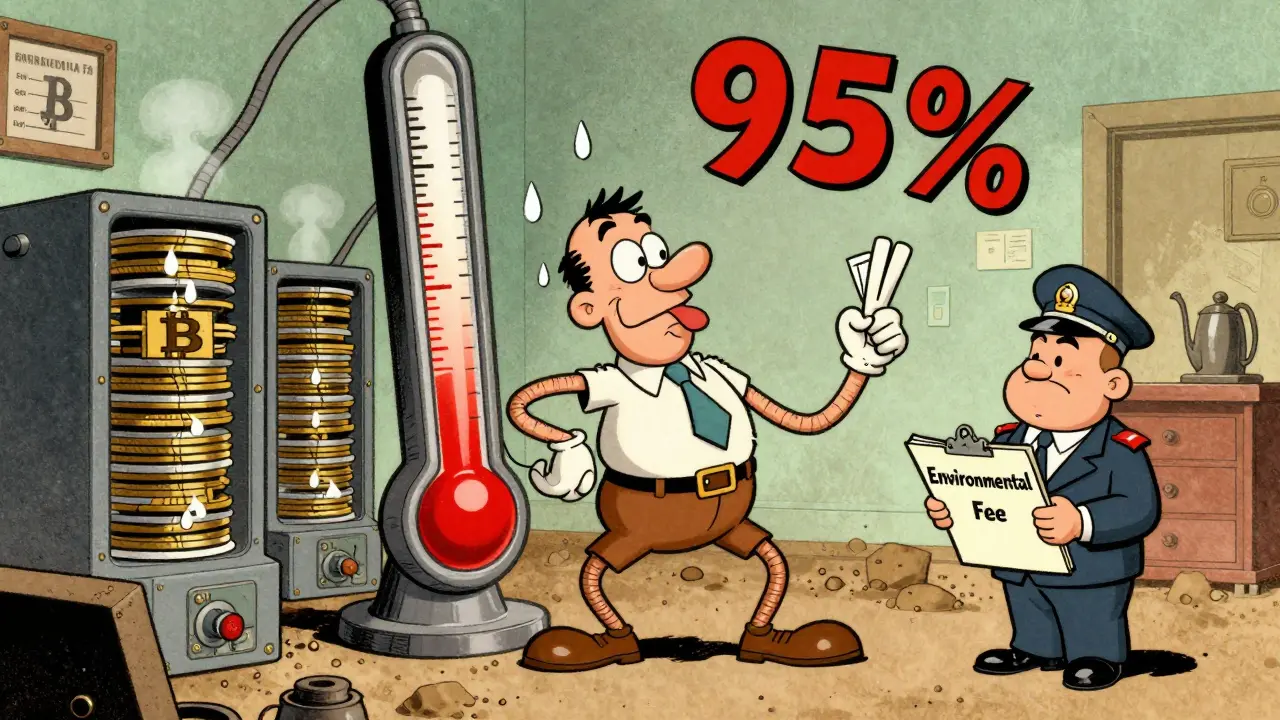

Miners? Different rule. Because of environmental concerns, the government taxes 95% of your gross mining income. So if you mine €50,000 worth of Bitcoin, €47,500 is taxable. That’s harsh, but it’s the price of doing business.

How do you know if you’re a professional? If you trade daily, use advanced tools, treat it like a job, or earn more than €200,000 a year - you’re likely in Category B. The tax authority doesn’t care if you call yourself an “investor.” They look at your behavior.

How Portugal Compares to the Rest of Europe

Portugal isn’t the cheapest anymore - but it’s still one of the best.Germany also has a 1-year tax exemption. But if you sell within a year, you pay up to 45% in income tax - higher than Portugal’s flat 28%. France taxes all crypto gains at 30%, no matter how long you hold. The UK taxes you every time you sell, with rates up to 20% and only a £3,000 annual allowance.

Portugal’s 28% short-term rate is competitive. The real advantage? The complete tax exemption after 365 days. No other major EU country offers that for long-term holders.

What’s Coming Next? The Future of Crypto Tax in Portugal

The EU’s MiCAR regulation is coming into full effect in 2026. It will standardize licensing, reporting, and AML rules across member states. Portugal won’t lose its tax autonomy - but it will need to align with EU reporting standards.Expect the tax authority to get better at tracking crypto. Right now, they don’t have the tools to catch every undeclared wallet. But that’s changing. Banks and exchanges are required to report customer data. The Bank of Portugal is building systems to detect suspicious activity.

Don’t expect the 365-day rule to disappear. It’s too central to Portugal’s identity as a crypto hub. But the thresholds for professional activity might get adjusted. Maybe the €200,000 income cap for simplified Category B will drop. Or staking rewards might get taxed at receipt, not conversion.

For now, the system is stable. The incentives are clear. If you’re a long-term holder, you’re still golden. If you’re active, you pay a fair rate. And if you’re a pro? You’ve got a simplified path - if you keep good records.

What You Should Do Right Now

If you’re holding crypto in Portugal, here’s what matters:- Track your purchase dates. Use tools like CoinTracking, Koinly, or even a simple spreadsheet. Know exactly when you bought each coin.

- Don’t assume everything is tax-free. Only long-term capital gains are exempt. Staking, mining, and short-term trades aren’t.

- Keep receipts for every transaction. Even crypto-to-crypto swaps. You might need them to prove your cost basis later.

- Know your category. Are you an investor? A trader? A miner? Your tax treatment changes with each.

- Don’t wait until December. Start organizing your records now. Tax season comes fast.

Portugal didn’t turn its back on crypto. It just made the rules smarter. The country still welcomes people who want to build, hold, and invest. But it no longer lets people hide behind silence.

If you’re planning to move to Portugal or already live there, this system gives you control. You choose how much risk to take. You choose how active to be. And if you play by the rules, you’ll keep your tax bill low - and your freedom high.

Frequently Asked Questions

Is crypto still tax-free in Portugal if held for over a year?

Yes. If you hold cryptocurrency for more than 365 days and sell it for euros or another fiat currency, you pay zero capital gains tax - as long as you’re a resident and the transaction is between EU/EEA countries or jurisdictions with a tax treaty with Portugal. This rule applies only to capital gains, not to staking, mining, or trading income.

Do I pay tax on crypto-to-crypto trades in Portugal?

No. Exchanging one cryptocurrency for another - like swapping Bitcoin for Ethereum - is not a taxable event in Portugal. Tax is only triggered when you convert crypto into euros or another fiat currency. However, you must still track these trades to calculate your cost basis for future sales.

How is staking income taxed in Portugal?

Staking rewards are classified as passive income (Category E) and are taxed at a flat 28% rate - but only when you convert the rewards into euros. If you receive 0.1 ETH as a reward and hold it for over a year before selling, you may owe no tax at all if it qualifies as a long-term capital gain. You don’t pay tax when you receive the reward, only when you cash out.

What counts as professional crypto activity in Portugal?

Professional activity includes frequent trading, running a mining operation, or earning income from crypto as your main source of livelihood. If you earn over €200,000 annually from crypto, you’re automatically considered a professional. Otherwise, the tax authority looks at your behavior: how often you trade, whether you use professional tools, and if you treat it like a business. Professional income is taxed on 15% of gross earnings (95% for miners) under progressive rates up to 53%.

Do I need to declare my crypto holdings to the Portuguese tax authority?

You’re not required to declare holdings unless you’ve made a taxable event - like selling crypto for euros, earning staking income, or receiving mining rewards. However, if you’re audited, you must be able to prove your purchase dates, transaction history, and cost basis. Keeping detailed records is essential, even if you haven’t sold anything yet.

Will Portugal’s crypto tax rules change again in 2026?

Major changes are unlikely. The 365-day exemption is too valuable to Portugal’s reputation as a crypto-friendly hub. However, enforcement will tighten as the EU’s MiCAR regulation rolls out. Expect better reporting from exchanges and more scrutiny of professional traders. Thresholds for professional status or staking rules could be adjusted, but the core structure is expected to remain stable.