Different Hash Algorithms Used in Cryptocurrencies: SHA-256, Keccak, BLAKE2, and More

Jan, 28 2026

When you send Bitcoin or deploy a smart contract on Ethereum, you’re not just clicking a button-you’re relying on a hidden layer of math that makes the whole system secure. At the heart of every blockchain is a hash algorithm. These aren’t just fancy math tricks. They’re the digital fingerprints that lock transactions, prevent tampering, and keep networks running without central control. But not all hash algorithms are the same. Some are fast, some are memory-heavy, and some were built to fight off powerful mining machines. Understanding which one a cryptocurrency uses tells you a lot about its goals, its security, and even its future.

SHA-256: The Original Workhorse

SHA-256 is the algorithm that started it all. Satoshi Nakamoto picked it for Bitcoin in 2009, and it’s still the most widely used hash function in crypto today. It takes any amount of data-whether it’s a single transaction or a whole block-and turns it into a 256-bit string, usually shown as a 64-character hexadecimal code. It’s deterministic: same input, always same output. It’s also one-way: you can’t reverse it to find the original data. And it’s collision-resistant: finding two different inputs that produce the same hash is practically impossible with today’s tech.

Bitcoin uses SHA-256 for proof-of-work. Miners race to find a hash that starts with a certain number of zeros. This process secures the network but comes with a cost: it’s incredibly energy-intensive. ASIC miners-specialized hardware built just for SHA-256-now dominate mining. The latest Antminer S19 XP Hydro can do over 300 terahashes per second. That’s 300 trillion guesses per second. Because of this, regular GPUs and CPUs can’t compete. Bitcoin mining is now dominated by big companies with factories full of these machines.

SHA-256 also plays a role in Bitcoin addresses. First, your public key is hashed with SHA-256, then again with RIPEMD-160. This double-hash creates the shorter, more efficient address you share with others. It’s a clever design that balances security and usability.

Despite its age, SHA-256 is still considered secure. NIST, the U.S. standards body, has never broken it. But critics point out its vulnerability to centralization. If one company controls most of the mining power, the network’s decentralization is at risk. And while it’s not quantum-resistant, experts estimate a real quantum threat is still 10-15 years away.

Keccak-256: Ethereum’s Unique Choice

Ethereum doesn’t use SHA-256. Instead, it uses Keccak-256, a variant of SHA-3. The difference might sound technical, but it matters. Keccak was chosen in 2012 after a five-year global competition run by NIST. It uses a different structure called a “sponge construction,” which handles data differently than SHA-2’s Merkle-Damgård design. This makes it more resistant to certain types of attacks, like length extension attacks.

Here’s the twist: Ethereum uses a slightly modified version of Keccak, not the final NIST-standardized SHA3-256. The padding rules are different. Why? Because Ethereum’s developers wanted to avoid accidental collisions between Ethereum and future SHA-3 systems. It’s a deliberate design choice to keep Ethereum’s ecosystem isolated and secure.

After Ethereum’s Merge in 2022, which switched from proof-of-work to proof-of-stake, Keccak-256 still plays a key role. It’s used to hash transaction data, smart contract code, and block headers. It’s faster than SHA-256 on regular CPUs, which helps with the high volume of transactions Ethereum handles. On modern hardware, it processes about 1,000 nanoseconds per hash-faster than SHA-256’s 600-800 nanoseconds on ASICs, but slower on general-purpose machines.

And here’s something interesting: the Ethereum Foundation plans to switch from Keccak-256 to the official SHA3-256 by 2025. Why? To align with NIST standards and improve compatibility with other systems. But this transition isn’t simple. It requires careful planning to avoid breaking existing smart contracts or wallets.

BLAKE2b: Speed for High-Throughput Networks

If you want speed, BLAKE2b is one of the fastest hash algorithms available. Designed in 2012 by cryptographers including Jean-Philippe Aumasson, it’s optimized for modern CPUs. Benchmarks show it can process over 1,200 megabytes per second on high-end processors-faster than SHA-256 and Keccak-256. That’s why Nano, a cryptocurrency focused on fast, feeless transactions, uses BLAKE2b.

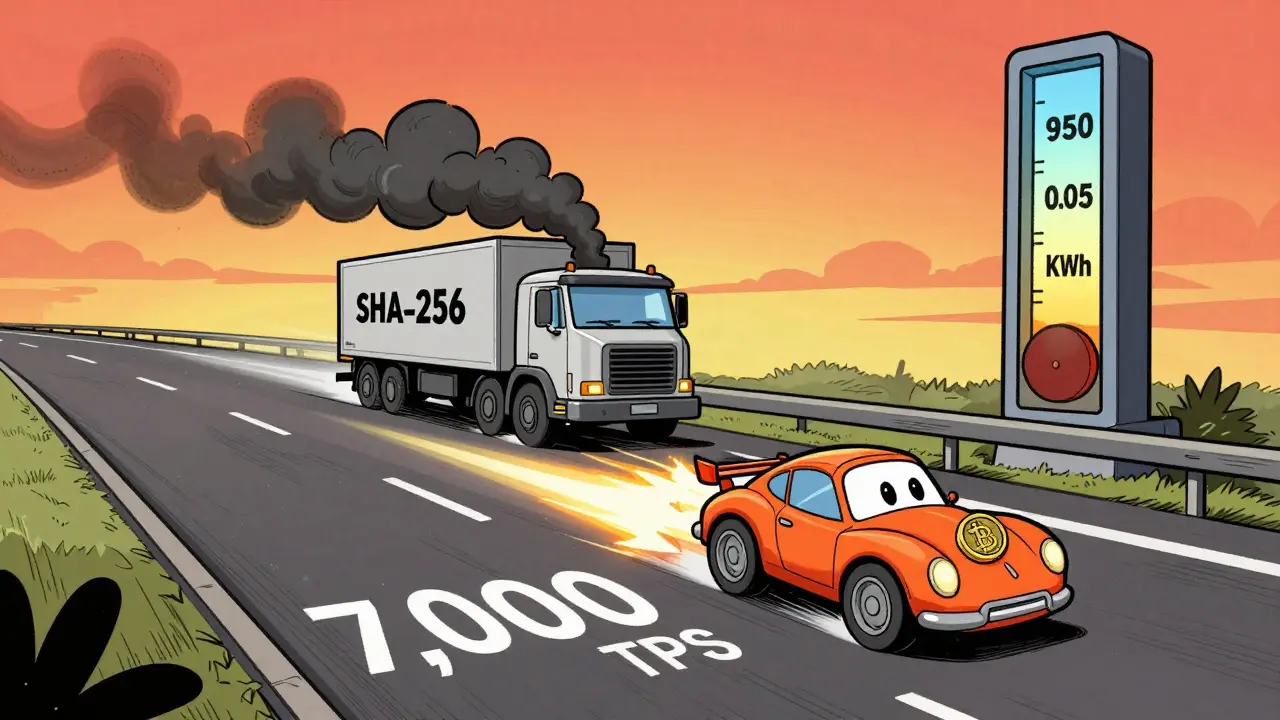

Nano’s architecture is built around speed. Each user has their own blockchain (a block-lattice structure), and transactions are confirmed quickly. BLAKE2b makes this possible. It handles about 7,000 transactions per second with confirmations under one second. Compare that to Bitcoin’s 4-7 transactions per second. The difference isn’t just about block size-it’s about the underlying hash function.

BLAKE2b is also energy-efficient. According to the Cambridge Bitcoin Electricity Consumption Index, BLAKE2-based networks use only 0.05 kWh per 1,000 transactions. Bitcoin’s SHA-256 network uses over 950 kWh for the same number. That’s a 20,000x difference. For applications focused on scalability and sustainability, BLAKE2b is a strong contender.

It’s not just Nano. Other newer blockchains like Algorand and some private enterprise chains are starting to adopt BLAKE2b for its efficiency. It’s also used in password hashing and file integrity tools outside crypto, proving its reliability in real-world use.

Equihash and Scrypt: Fighting ASIC Dominance

One of the biggest complaints about Bitcoin mining is that it’s no longer fair. Regular people can’t mine with their home computers anymore. That’s where memory-hard algorithms come in. They’re designed to make ASICs useless by requiring a lot of memory.

Equihash, created in 2016 by Alex Biryukov and Dmitry Khovratovich, is used by Zcash. It requires 140MB of RAM per hash calculation. The idea was simple: GPUs have lots of memory, ASICs don’t. So miners would use consumer-grade hardware, keeping mining decentralized. But that plan didn’t hold up. By late 2022, companies like Innosilicon released the Z15 ASIC miner, capable of 1,500 sol/s. GPU mining for Zcash became unprofitable.

Scrypt, used by Litecoin since 2011, was the first major attempt at ASIC resistance. It requires 32 times more memory than SHA-256. It worked for a while-miners used GPUs and even high-end CPUs. But by 2015, ASICs for Scrypt appeared. Litecoin’s network became dominated by specialized hardware too.

Both algorithms failed to fully prevent centralization. But they did something important: they proved that ASIC resistance is incredibly hard to achieve. Any algorithm that’s efficient for CPUs or GPUs will eventually be optimized for ASICs. The real lesson isn’t that these algorithms failed-it’s that decentralization isn’t just about the hash function. It’s about economics, hardware access, and community governance.

RIPEMD-160: The Quiet Partner

You won’t hear much about RIPEMD-160, but it’s quietly essential. It’s not used for mining or consensus. Instead, it’s used in Bitcoin to shorten public keys into addresses. After SHA-256 hashes the public key, RIPEMD-160 takes the result and shrinks it from 256 bits to 160 bits. This makes addresses shorter and easier to handle.

It’s slower than SHA-256-about 1,200 nanoseconds per hash on the same hardware. That’s why some wallet developers have added hardware acceleration to compensate. It’s also less documented than SHA-256. Developers report it’s harder to find good libraries and examples, especially in non-C++ environments.

Despite its age (it was created in 1996), RIPEMD-160 remains secure. No practical collision attacks exist. But its role is narrow. It’s not a standalone algorithm in crypto-it’s a supporting player. Think of it like the final step in a recipe: you can’t make the dish without it, but you don’t cook with it directly.

Which Algorithm Should You Care About?

Most users don’t need to pick a hash algorithm. But if you’re evaluating a cryptocurrency, here’s what to look for:

- Bitcoin (SHA-256): Best for security and store-of-value. Worst for decentralization and energy use.

- Ethereum (Keccak-256): Best for smart contracts and flexibility. Moving toward NIST standards for long-term compatibility.

- Nano (BLAKE2b): Best for speed and low fees. Ideal for micropayments and high-throughput use cases.

- Zcash (Equihash): Tried to fight ASICs. Failed. Now just another algorithm with ASIC dominance.

- Litecoin (Scrypt): First attempt at ASIC resistance. Also failed. Still used for historical reasons.

Future-proofing matters. If you’re building a new blockchain, don’t just copy Bitcoin. Use SHA-3 or BLAKE2b. They’re faster, more efficient, and better prepared for quantum computing. Even if you’re not worried about quantum threats today, the crypto world is moving toward algorithm agility-meaning systems should be able to swap out hash functions if needed.

What’s Next for Hash Algorithms?

Quantum computing is the big shadow looming over all of this. A powerful enough quantum computer could break SHA-256 using Shor’s algorithm. That’s not happening tomorrow, but it’s not science fiction either. Google’s 70-qubit processor in 2023 was a step toward that future. The National Institute of Standards and Technology (NIST) has already selected quantum-resistant algorithms like CRYSTALS-Kyber for digital signatures. But hash functions? They’re still using SHA-2 and SHA-3.

Experts like Dr. Ari Juels and Bruce Schneier argue we should start transitioning now. The problem isn’t just breaking hashes-it’s harvesting. Attackers could be storing encrypted data today, waiting for quantum computers to decrypt it later. That means any blockchain storing long-term sensitive data needs to plan ahead.

Meanwhile, the industry is watching. Gartner predicts that by 2027, 30% of new blockchains will use SHA-3 variants. That’s up from just 12% in 2023. BLAKE2b will keep growing in high-speed networks. And SHA-256? It won’t disappear. Bitcoin’s ecosystem is too big to change overnight. But new projects? They’re already choosing better options.

The takeaway? Hash algorithms aren’t just technical details. They’re political choices. They reflect whether a network values security, speed, decentralization, or sustainability. And as crypto evolves, so will the math behind it.