Japan's Crypto Consumer Protection: Rules, Safeguards, and What It Means for Users

Jun, 15 2025

Cold Wallet Safety Calculator

How Much of Your Crypto is Secure?

Japan requires exchanges to keep at least 95% of user assets in offline cold wallets. Enter your holdings to see what portion is protected.

When you hear about crypto scandals overseas, Japan’s response often feels like a breath of fresh air. The country has built a detailed safety net around digital assets, aiming to keep your money safe while still encouraging innovation. This guide walks you through the core rules, the recent 2025 upgrades, and the practical steps you should take before trusting an exchange.

Key Takeaways

- All crypto‑asset exchanges in Japan must register with the Financial Services Agency (Japan’s top financial regulator) and follow strict capital, AML, and KYC standards.

- Customer funds have to stay separate from the exchange’s own money, with at least 95% kept in offline cold wallets.

- The 2025 amendment to the Payment Services Act now lets banks and trust companies refund users directly, cutting the typical 170‑day wait.

- Non‑registered operators face up to three years’ imprisonment (soon to become confinement punishment) and hefty fines.

- Tokens with investment or governance features are being moved under the Financial Instruments and Exchange Act, adding securities‑style disclosures and market‑conduct rules.

Regulatory Framework Overview

The backbone of cryptocurrency consumer protection Japan is the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA). The PSA focuses on payment‑related activities, while the FIEA targets securities‑like tokens. Both laws are enforced by the Financial Services Agency, which issues registrations, conducts inspections, and can order asset freezes.

Since the first PSA revision in 2017, the framework has been sharpened in 2020, 2023, and dramatically in 2025. Today more than 12 million Japanese users hold crypto accounts, with deposits topping 5 trillion yen (≈ $33.7 billion). That sheer scale makes robust consumer safeguards essential for market confidence.

Registration & Operational Requirements for Exchanges

Any platform that lets users buy, sell, or store crypto‑assets is classified as a crypto‑asset exchange service provider (CAESP). To operate legally, a CAESP must:

- Register with the Financial Services Agency and obtain a PSA license.

- Maintain a physical office in Japan - offshore‑only operators are barred.

- Implement rigorous Anti‑Money‑Laundering (AML) and Know‑Your‑Customer (KYC) program.

- Hold enough capital reserves to cover operational risks; the exact figure varies with the exchange’s size but must meet the FSA’s minimum equity requirement.

Failure to register triggers criminal penalties: up to three years in prison (transitioning to confinement punishment in 2025) and fines up to ¥3 million.

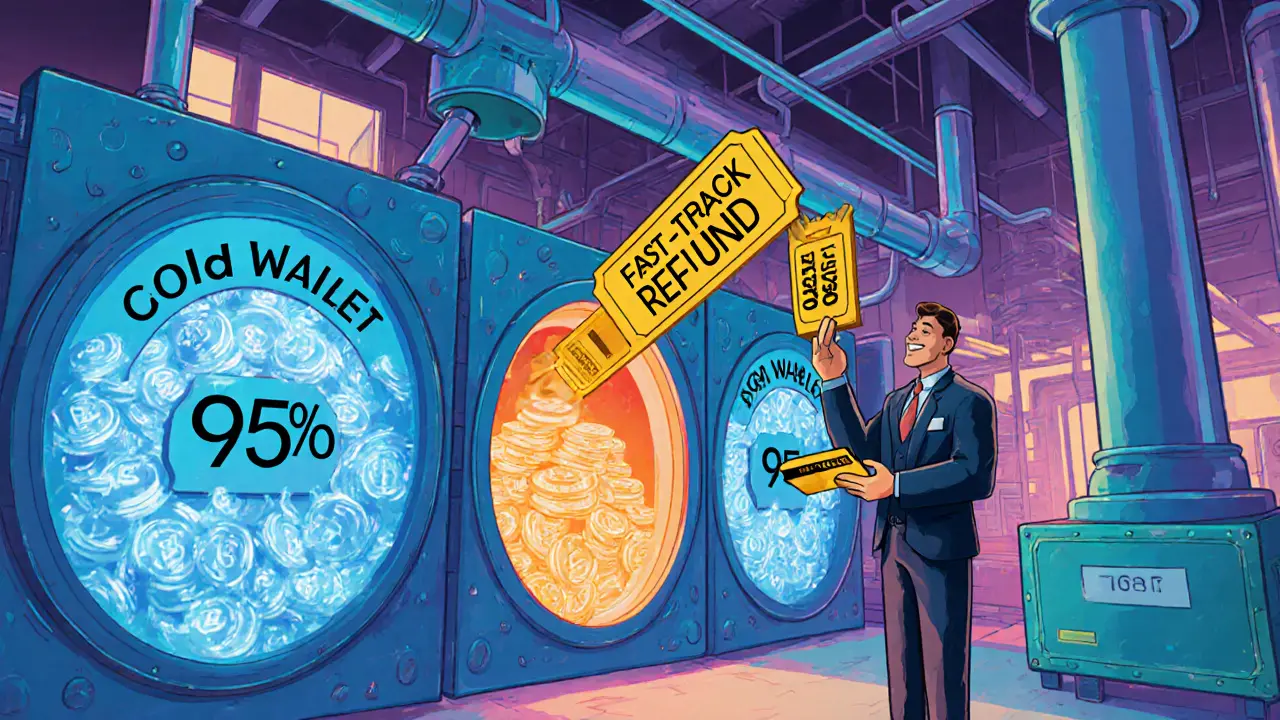

Fund Segregation & Cold‑Wallet Mandate

One of the most visible consumer‑protection levers is the segregation rule. Exchanges must keep user assets separate from their own balance, preventing a company’s insolvency from swallowing customer funds. Moreover, the 2025 amendment codified a 95 % cold‑wallet requirement:

- Cold wallets are offline storage devices, immune to online hacks.

- Only a small, audited portion (max 5 %) can sit in hot wallets for daily trading liquidity.

Regular audits are submitted to the FSA, and any deviation triggers an immediate enforcement order.

Fast‑Track Refund Process Introduced in 2025

Before 2025, if a crypto‑asset business collapsed, users waited an average of 170 days for a government‑run refund. The new PSA amendment empowers banks and trust companies to return funds directly, slashing the timeline to days rather than months. The process works like this:

- The exchange files a liquidation notice with the FSA.

- Designated banks verify the user’s claim against the segregated asset ledger.

- Verified users receive a direct transfer to their linked bank accounts.

This shift not only speeds up access to money but also reduces administrative overhead for regulators.

Enforcement Tools & Penalties

The PSA Amendment Act 2025 gave the FSA new levers:

- It can issue asset‑retention orders compelling CAESPs and electronic payment‑instrument service providers (EPISPs) to keep user funds within Japan.

- Non‑compliance can lead to immediate suspension of the exchange’s license.

- Criminal sanctions include up to three years’ imprisonment (or confinement punishment) and fines up to ¥3 million.

These strong deterrents keep operators on a tight compliance leash, which translates into higher trust for everyday investors.

Asset Classification & the FIEA Reclassification

In June 2025 the FSA announced that tokens with investment‑like or governance rights would be re‑classified under the Financial Instruments and Exchange Act. This re‑classification means:

- Issuers must publish comprehensive prospectuses, similar to traditional securities.

- Insider‑trading rules and market‑conduct standards apply, protecting retail investors from manipulation.

- Regulated crypto‑ETF products, including spot Bitcoin funds, gain a clearer legal pathway.

The shift narrows a historic protection gap where many token sales operated in a gray area, leaving investors vulnerable.

Special Consumer Protections for Crypto‑Credit Cards

When an exchange partners with a bank to issue a crypto‑linked credit card, the product falls under the Installment Sales Act. The act forces the card issuer to register as a credit‑purchase intermediary, imposing:

- Mandatory disclosure of fees, interest rates, and repayment terms.

- Obligation to provide clear statements in Japanese.

- Consumer‑right to cancel within a cooling‑off period.

These rules bring crypto‑payment cards into the same protective regime as traditional installment purchases.

Future Outlook: DeFi, Cross‑Border Services, and Ongoing Consultation

The FSA has set up a DeFi Study Group that meets every two to three months, gathering industry, academia, and regulator voices. Their charter includes:

- Exploring how smart‑contract based services can meet AML/KYC standards.

- Drafting a sandbox framework for decentralized exchanges.

- Assessing cross‑border collection services to avoid regulatory arbitrage.

By late 2025, the group expects to publish a set of draft guidelines that could become enforceable in 2026. Meanwhile, the pending FIEA integration bill aims to cement the world’s most comprehensive crypto‑investor protection regime.

Practical Checklist for Crypto Users in Japan

- Verify the exchange is registered with the Financial Services Agency. The FSA maintains a public list.

- Confirm that at least 95 % of your assets are stored in cold wallets. Most exchanges publish a “cold‑wallet ratio” in their transparency reports.

- Check the exchange’s capital adequacy. Smaller firms may have tighter buffers, increasing risk.

- Review the refund process outlined in the PSA amendment. Know which bank or trust company will handle a potential payout.

- If you’re using a crypto‑credit card, read the Installment Sales Act disclosures carefully-look for hidden fees and repayment schedules.

- Stay updated on token re‑classifications under the FIEA; newly‑listed tokens may require additional prospectus reading.

Following this list helps you stay on the safe side while still enjoying the benefits of crypto.

Frequently Asked Questions

Do I need a Japanese bank account to use a registered crypto exchange?

Yes. Registered exchanges must link user accounts to a Japanese bank for fiat deposits and withdrawals, which also simplifies the direct‑refund mechanism introduced in 2025.

What happens if an exchange loses my funds due to a hack?

Because of the segregation rule, the exchange cannot dip into its own money to cover the loss. The FSA may order the exchange to use its capital reserves to reimburse users, but the process can take longer than the direct‑refund route used for insolvency.

Are stablecoins treated the same as other crypto‑assets?

The 2025 amendment eased some burdens for stablecoin issuers but still classifies them as crypto‑assets under the PSA, meaning they must follow segregation and registration requirements.

Can I trade tokenized securities on a Japanese platform?

After the upcoming FIEA integration, tokenized securities will be subject to the same disclosure and market‑conduct rules as traditional securities, and only exchanges with a securities‑dealer license can list them.

What is “confinement punishment” replacing imprisonment?

Effective June 1 2025, certain financial crimes trigger a form of house arrest called koukin‑kei instead of prison time, aiming to reduce overcrowding while still imposing a serious sanction.