PSA Registration Requirements for Crypto Exchanges in Japan

Feb, 8 2026

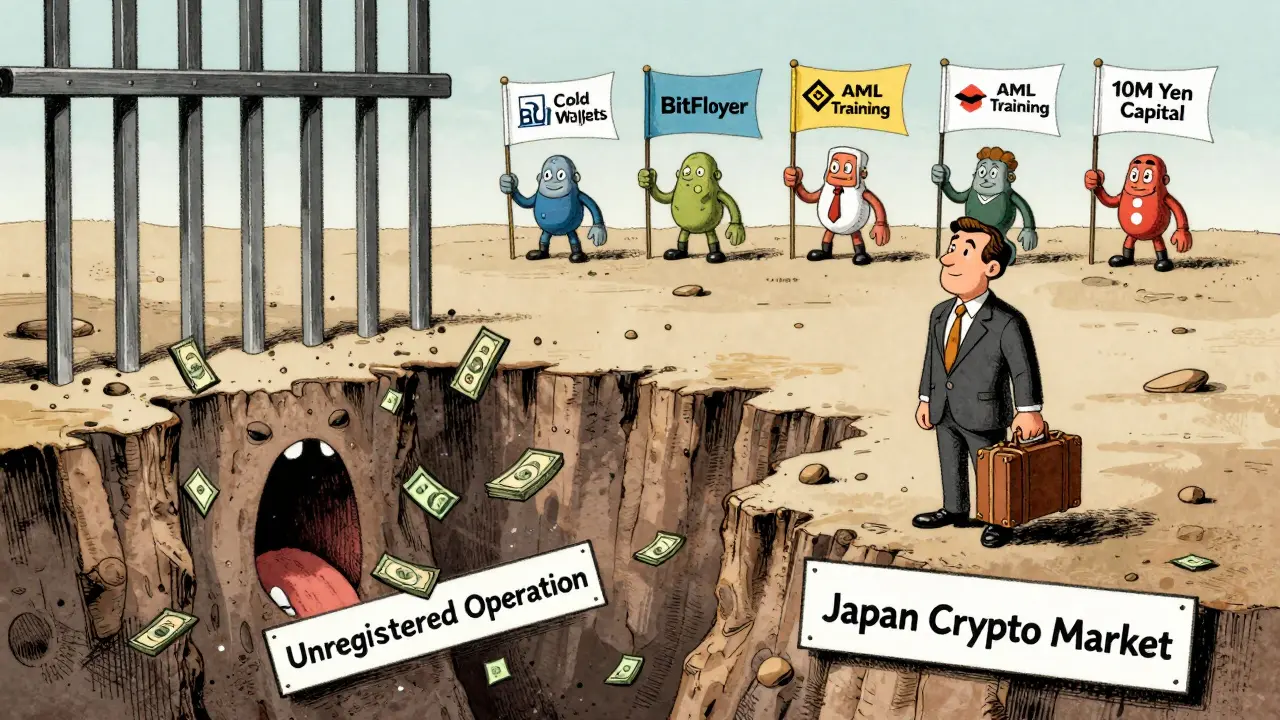

Japan doesn’t just allow cryptocurrency - it regulates it. If you want to run a crypto exchange in Japan, you can’t just set up a website and start trading. You need to pass one of the toughest regulatory hurdles in the world: registration under the Payment Services Act (PSA). This isn’t a form you fill out in a week. It’s a full-scale compliance project that takes months, costs millions, and demands total transparency.

What Exactly Is the PSA?

The Payment Services Act (PSA) is Japan’s main law governing digital currency businesses. Passed in 2017 and updated since, it defines crypto-assets as legal property - not money, not securities, but something else entirely. That means Bitcoin, Ethereum, Solana, and others can be bought, sold, and held legally. But if you’re running a business that trades them, you’re now a Crypto Asset Exchange Service Provider (CAESP), and you must register with Japan’s Financial Services Agency (FSA).Unregistered operation? That’s a crime. Before June 2025, violators faced up to three years in prison. Now, under Japan’s updated penal code, the punishment is confinement punishment (koukin-kei) - a form of detention without a criminal record, but still serious. Fines can hit JPY 3 million ($20,000 USD). The FSA doesn’t play around.

Who Can Apply?

Not just anyone. The PSA only accepts two types of applicants:- Japanese stock companies (kabushiki-kaisha)

- Foreign companies that set up a subsidiary in Japan

Foreign firms can’t just open a branch and apply. The FSA has never approved a branch application. Every foreign exchange - from Binance to Kraken - had to create a Japanese subsidiary. That means hiring local staff, opening a Japanese bank account, registering with the Legal Affairs Bureau, and complying with Japanese corporate law. It’s not a loophole. It’s a wall.

Minimum Capital and Financial Health

You need real money. Not just enough to cover rent and salaries. The PSA requires:- Minimum capital of JPY 10 million (about $67,000 USD)

- Positive net assets - meaning your total assets must exceed your liabilities

These aren’t suggestions. The FSA checks your balance sheet. If you’re barely breaking even, you’re rejected. This rule exists because exchanges handle billions in customer funds. If you go bankrupt without proper reserves, users lose everything. Japan won’t let that happen.

Operational Requirements: More Than Just a Website

The FSA doesn’t care how fancy your logo is. They care about your systems. Your application must prove you have:- A clear organizational structure with qualified directors and compliance officers

- Internal systems that prevent money laundering and fraud

- Secure, audited procedures for handling user assets

- Written policies for cybersecurity, data privacy, and incident response

One company lost its application because their password policy didn’t meet FSA standards. Another was rejected because their customer support team couldn’t prove they had training on AML procedures. This isn’t bureaucracy - it’s precision.

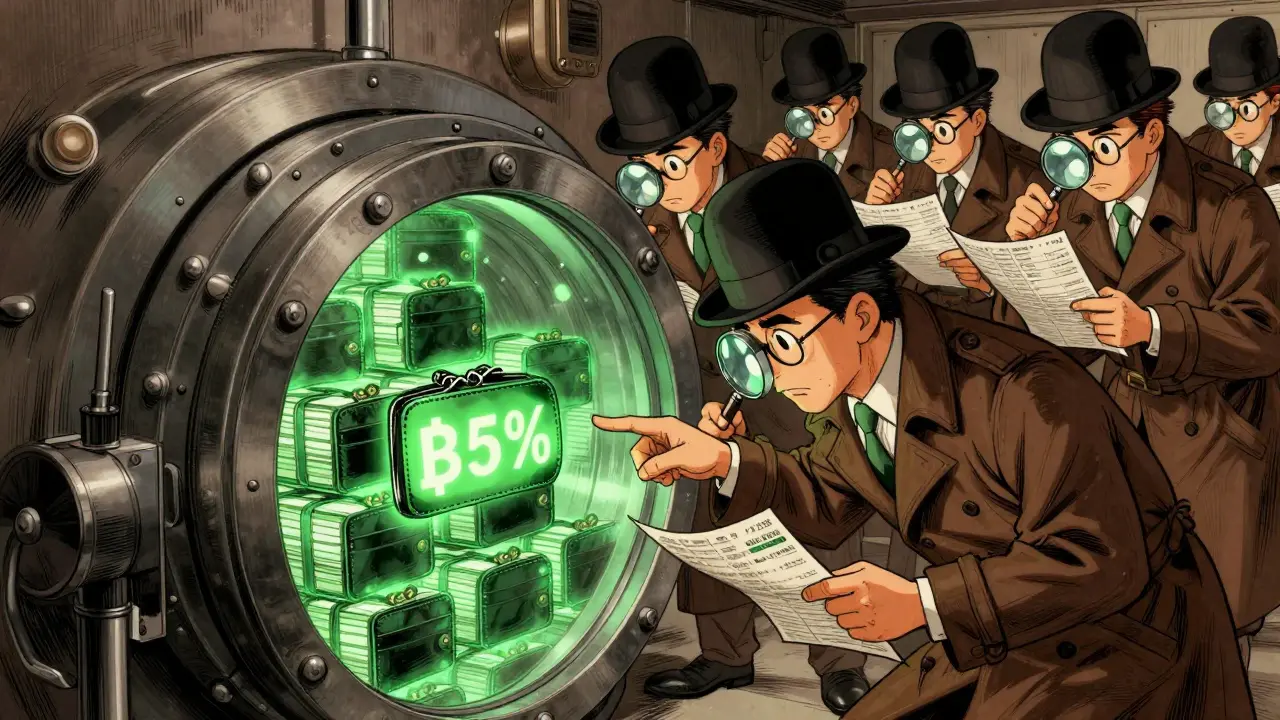

Crypto Asset Segregation: Cold Wallets Are Mandatory

Here’s the rule that separates Japan from every other country: At least 95% of user crypto assets must be stored offline in cold wallets.That means no hot wallets for customer funds. No online access. No risk of hacks from the internet. The remaining 5% can be kept in hot wallets for daily trading, but even that’s monitored. The FSA requires real-time reporting of wallet balances and transaction logs.

And here’s the kicker: customer crypto assets must be completely segregated from company assets. You can’t use user Bitcoin to cover your payroll. You can’t loan them out. You can’t use them as collateral. They belong to the users - and the law treats them like bank deposits.

Transparency and Advertising Rules

You can’t say “Get rich quick with Bitcoin!” on your website. You can’t promise returns. You can’t use testimonials like “I made 10x in a week!” The FSA bans all misleading marketing.Ads must clearly state:

- The risks of crypto trading

- That prices can drop to zero

- That users are responsible for their own security

One exchange got fined JPY 500,000 for using the word “guaranteed” in a banner ad. Another had to redesign their entire homepage after the FSA flagged their “low-fee” claim as misleading. The rules are strict - and enforced.

The Application Process: 6 Months Minimum

The clock starts when you submit your documents. The FSA takes up to six months to review. But don’t think that’s the full timeline. Most companies spend 9-12 months preparing:- Setting up a Japanese subsidiary (2-4 months)

- Hiring compliance officers and legal counsel (1-2 months)

- Building secure custody systems and cold wallet infrastructure (3-5 months)

- Preparing 50+ pages of documentation: org charts, financial statements, AML procedures, cybersecurity protocols

- Submitting the application and waiting for FSA feedback

There’s no fast track. No shortcut. No “consultant” who can get you approved in 30 days. If someone says that, they’re lying.

What About Security Tokens?

Not all crypto is the same under Japanese law. The PSA covers spot trading of digital currencies like Bitcoin and Ethereum. But if your token acts like a stock - promising dividends, profit-sharing, or investment returns - it falls under the Financial Instruments and Exchange Act (FIEA). That’s a whole other level of regulation.FIEA requires full securities licensing. Higher capital. More audits. Broader reporting. Most DeFi projects and tokenized asset platforms end up here. It’s not a backup plan - it’s a separate, stricter path.

Who’s Already Registered?

As of early 2026, only 26 companies are registered under the PSA. That’s down from 32 in 2023. Why? Because the FSA has been revoking licenses. Companies that failed audits, had poor security, or didn’t update their systems lost their status. The list includes:- Binance Japan (subsidiary of Binance Holdings)

- BitFlyer

- Coincheck

- GMO Coin

- SDAX

Every one of them had to build their own compliance team, invest in cold storage, and hire Japanese legal experts. No exceptions.

Why Does Japan Do This?

Japan’s approach isn’t about stopping crypto. It’s about making it safe. After the 2018 Coincheck hack - where $530 million in NEM was stolen - Japan realized that without strict rules, users lose trust. The PSA was designed to prevent that.The result? Japan has one of the highest rates of crypto adoption in the world. Why? Because people trust the exchanges. They know their coins are locked in offline vaults. They know the company can’t disappear with their money. That trust is worth more than any marketing campaign.

What Happens After Registration?

Getting registered isn’t the end. It’s the beginning. The FSA conducts annual inspections. They check:- Whether cold wallet balances match reports

- If user funds are still segregated

- If cybersecurity protocols are updated

- If staff are trained on new regulations

One exchange lost its license in 2025 because they used an outdated encryption standard. Another was fined for failing to report a minor system glitch within 72 hours. Compliance isn’t a checkbox. It’s a 24/7 obligation.

Final Reality Check

If you’re thinking about launching a crypto exchange in Japan, ask yourself: Do you have:- Over JPY 10 million in capital?

- A Japanese legal entity?

- A team that understands AML and KYC?

- Access to enterprise-grade cold storage?

- At least 9 months to wait?

If the answer is no - don’t try. The cost of failure isn’t just money. It’s your reputation, your future access to global markets, and possibly your freedom.

Japan didn’t build this system to make it easy. It built it to make it right. And for users, that’s the only thing that matters.

Can a foreign company register as a branch instead of a subsidiary?

No. The Financial Services Agency (FSA) has never approved a foreign crypto exchange operating under a branch structure. All registered entities must be Japanese stock companies (kabushiki-kaisha). Foreign firms must establish a wholly-owned subsidiary in Japan, hire local directors, open a Japanese bank account, and comply with corporate law. Branches are not an option.

What happens if I operate without PSA registration?

Operating without PSA registration is a criminal offense. Before June 2025, violators faced up to three years in prison. Under the 2022 Penal Code amendments, the punishment is now confinement punishment (koukin-kei), a form of detention without a criminal record, plus fines up to JPY 3 million. The FSA actively monitors unlicensed platforms and shuts them down. Users are also warned not to trade on unregistered exchanges.

Do I need to store 95% of user assets in cold wallets?

Yes. The PSA mandates that at least 95% of all user-held crypto assets must be stored in offline cold wallets. This is non-negotiable. The remaining 5% may be kept in hot wallets for trading liquidity, but must be fully audited and reported daily. The FSA conducts surprise inspections to verify wallet balances and security protocols.

Can I use the same compliance system I have in another country?

No. Japan requires its own domestic compliance infrastructure. Systems from the U.S., EU, or Singapore are not automatically accepted. You must build systems that meet Japanese legal standards - including Japanese-language documentation, local data storage, and compliance officers licensed under Japanese law. Outsourcing compliance to foreign firms is not permitted.

Are stablecoins covered under the PSA?

It depends. Stablecoins pegged to fiat currencies like the U.S. dollar or Japanese yen are generally excluded from the PSA if they’re issued by banks or licensed payment providers. But if a stablecoin is issued by a private company and traded as a crypto-asset (like USDT or USDC on exchanges), it falls under the PSA as a crypto-asset. Exchanges trading these must register and follow all PSA rules, including asset segregation and cold storage.