Cryptocurrency Sanctions: What They Are, Who Gets Hit, and How It Changes Crypto

When the U.S. government slapped sanctions on Tornado Cash, a decentralized crypto mixer that helped users obscure transaction trails. Also known as privacy protocol, it was the first time regulators targeted open-source software—not a company or person—because it could be used to hide illegal funds. This move didn’t just ban a tool; it rewrote the rules of what’s allowed in crypto. Cryptocurrency sanctions are no longer about freezing bank accounts. They’re about blocking code, punishing developers, and making it harder to use blockchain for privacy—even if you’re not breaking the law.

These sanctions don’t just hit mixers. They ripple through exchanges, wallets, and even wallets holding clean coins that once passed through a blacklisted address. The OFAC, the U.S. Treasury’s Office of Foreign Assets Control, which enforces sanctions and maintains the Specially Designated Nationals list. Also known as financial watchdog, it now includes crypto addresses on its blacklist. That means if your wallet ever received a dime from a sanctioned mixer—even unknowingly—you might get blocked by exchanges like Coinbase or Kraken. It’s not about guilt. It’s about risk. And that’s changed how people move money.

What’s worse? The line between privacy and crime is being blurred. Tools like Tornado Cash were used by hackers, yes—but also by activists in repressive regimes, journalists, and everyday users who didn’t want their spending tracked. Now, developers fear building anything that could be seen as enabling anonymity. Even simple smart contracts could get flagged. This isn’t just about stopping money laundering. It’s about controlling who can use crypto, and why.

And it’s not just the U.S. Other countries are watching. The EU, UK, and Canada are all tightening rules around crypto privacy tools. Meanwhile, decentralized exchanges and non-custodial wallets are becoming more popular—not because they’re cooler, but because they’re harder to sanction. If you can’t freeze a wallet you don’t control, you can’t stop the flow.

What you’ll find below are real stories about what happens when sanctions hit crypto. From the collapse of once-popular mixers to the rise of ghost tokens and fake airdrops pretending to be "sanction-free" alternatives. You’ll see how scams exploit fear, how exchanges quietly block users without warning, and why some projects that looked like legitimate crypto projects turned out to be digital ghosts. This isn’t theory. It’s happening right now—and if you hold crypto, it affects you.

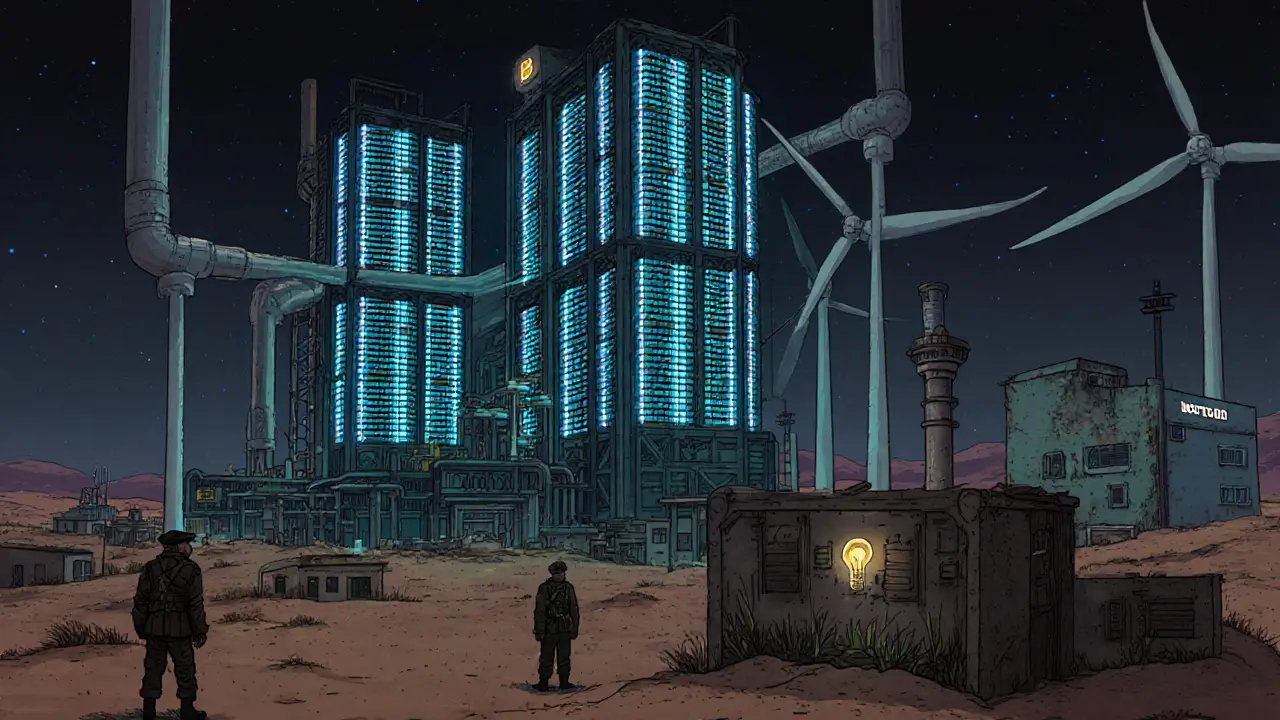

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Caius Merrow Nov, 20 2025 0Iran has turned Bitcoin mining into a state-led sanctions evasion strategy, using cheap electricity and state-backed mining farms to generate billions in crypto revenue. It's bypassing Western banks, funding imports, and reshaping how sanctions work in the digital age.

More Detail