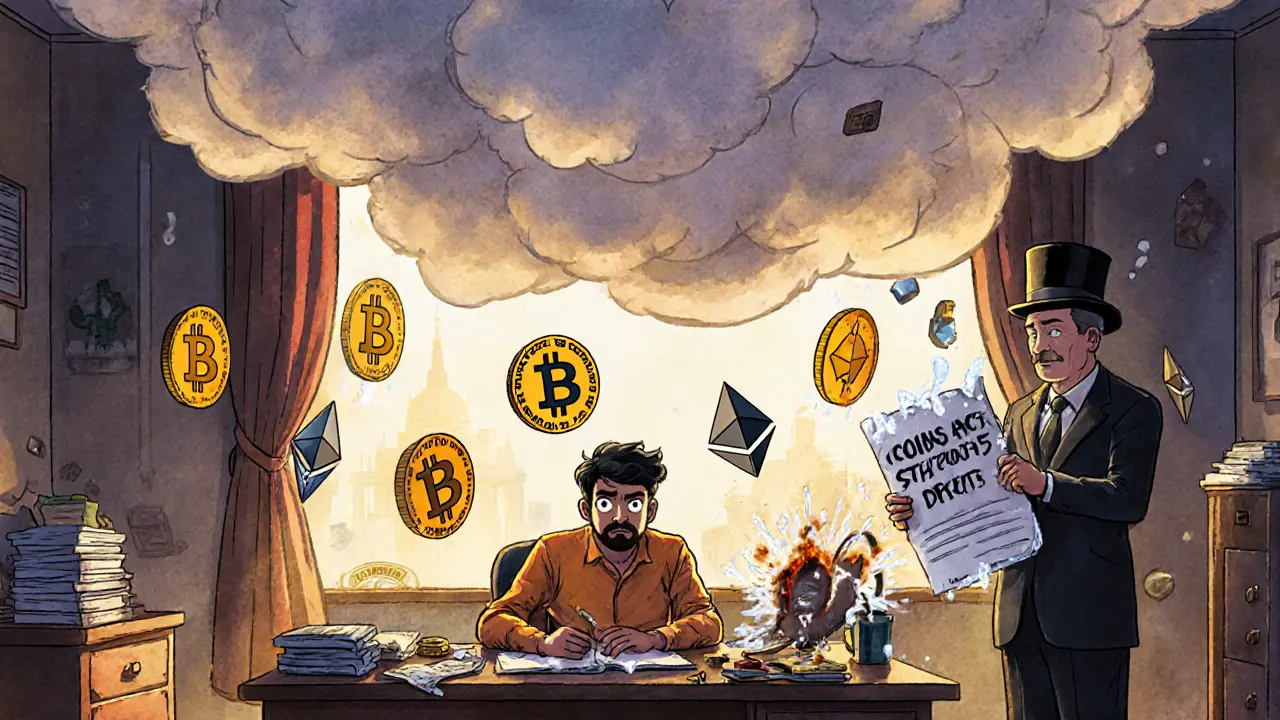

Unregulated Crypto: Risks, Realities, and How to Stay Safe

When you trade unregulated crypto, crypto transactions or platforms that operate without oversight from financial authorities. Also known as decentralized crypto, it often means you’re on your own—if something goes wrong, there’s no bank, no regulator, no lawyer to call. This isn’t just a technical term. It’s a warning label. You’re not just avoiding bureaucracy—you’re stepping into a world where exchanges can vanish overnight, airdrops can be fake, and your seed phrase is the only thing standing between you and total loss.

Unregulated crypto isn’t always illegal, but it’s almost always risky. Think of P2P crypto, peer-to-peer crypto trades done outside formal exchanges, often with cash or gift cards. Also known as cash-for-Bitcoin, it’s how people in Ecuador trade without banks, but it’s also how scammers lure victims into fake deals. Then there’s crypto exchange scam, a platform that looks real but has no license, no audit, and no way to withdraw your funds. Also known as sham exchange, it’s the most common trap in unregulated spaces—like HUA Exchange, which turned out to be a ghost site with no real team or infrastructure. These aren’t edge cases. They’re the norm in unregulated markets.

Why does this matter? Because unregulated crypto doesn’t just hurt individuals—it creates a ripple effect. When people lose money on fake airdrops like ROSX or phantom tokens tied to non-existent projects, trust in the whole space erodes. Even legitimate tools like restaking or CBDCs get dragged into the mess because outsiders can’t tell the difference between a real protocol and a scam. The truth? You don’t need to avoid crypto to stay safe—you just need to avoid the unregulated parts. Stick to platforms with clear licenses, transparent teams, and real customer support. If it feels too good to be true, or if no one can tell you who’s behind it, it probably is.

Below, you’ll find real stories from the wild side of crypto—how Ecuadorians trade cash for Bitcoin, why fake exchanges like HUA keep popping up, how airdrops turn into traps, and what to do when you spot red flags before it’s too late. These aren’t theory pieces. They’re field reports from people who’ve been there. Read them before you click ‘Confirm’ on that next unregulated deal.

India's Unregulated Crypto Status: Risks and Opportunities for Traders in 2025

Caius Merrow Oct, 31 2025 0India's crypto market thrives in a legal grey zone: taxed but not regulated. Traders face high 30% taxes and no legal protections, but opportunities remain for those who understand the risks and keep meticulous records.

More Detail