What is JUSD Stable Token (JUSD) Crypto Coin? A Real-World Look at Price, Use Cases, and Risks

Jun, 3 2025

JUSD Slippage Calculator

Trade Impact Calculator

JUSD has very low liquidity (only $130k daily volume). Large trades experience significant slippage. Calculate how much you'd lose when trading this unstable stablecoin.

Slippage Calculation

Based on $130k daily volumeJUSD has extremely low liquidity with only $130,000 daily trading volume. This means:

- Trading over 10,000 JUSD causes 2% slippage (over $200 loss on $10k trade)

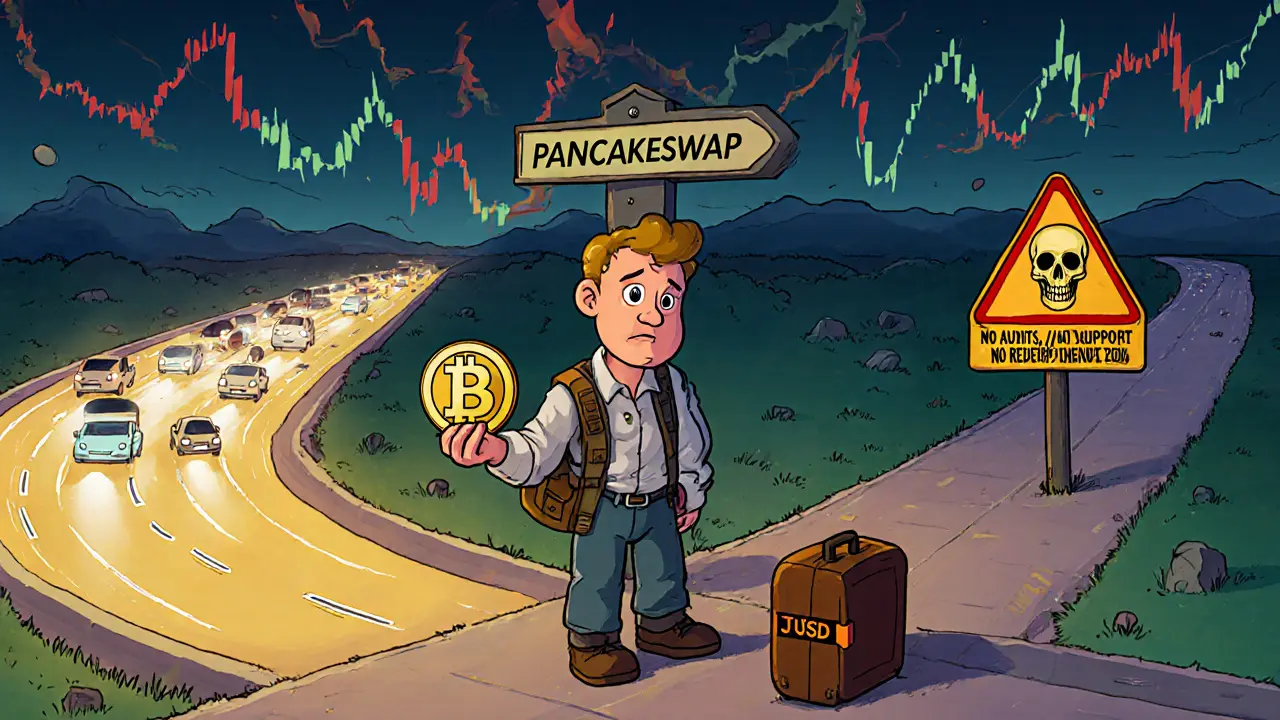

- No redemption mechanism if it loses its peg

- No reserve audits - you can't verify backing

JUSD is a stablecoin designed to hold a value of $1.00 USD, built on the Binance Smart Chain. Unlike Bitcoin or Ethereum, which swing wildly in price, JUSD aims to stay steady - making it useful for sending money across borders, trading on decentralized exchanges, or holding value without the usual crypto rollercoaster. But here’s the catch: while it claims to be stable, it’s far from mainstream. You won’t find it on Coinbase, Kraken, or even most DeFi apps. It’s mostly traded on PancakeSwap, and even there, liquidity is thin. If you’re considering using JUSD, you need to know what’s real and what’s just hype.

How JUSD Keeps Its $1 Value

JUSD says it stays pegged to the US dollar using a mix of algorithmic controls and asset backing. That means it’s supposed to be backed by real dollars or other assets held in reserve, and smart contracts automatically adjust supply to keep the price at $1. The official whitepaper mentions a decentralized oracle network that feeds real-time price data to prevent drift. That sounds solid - until you realize no one knows what’s actually in those reserves.

Compare that to USDC or USDT. Circle and Tether publish monthly audits from big accounting firms like Grant Thornton. You can see exactly how many dollars back each token. JUSD? Nothing. No public attestations. No transparency. That’s not just a gap - it’s a red flag. After the TerraUSD collapse in 2022, where an algorithmic stablecoin lost its peg and crashed to pennies, investors learned: if you can’t verify the backing, don’t trust it.

Technical Details You Can’t Ignore

JUSD runs as a BEP-20 token on Binance Smart Chain. That means it’s fast and cheap. A typical JUSD transfer costs less than 10 cents in gas fees, compared to $2-$5 on Ethereum. Its contract address is 0xbf3950DB0522A7F5CAa107D4Cbbbd84dE9E047e2. You’ll need this if you’re buying or swapping it. Mistake the address by one character, and you could lose your money forever.

Here’s where things get weird. The total supply is listed as 50 billion tokens across CoinGecko and LiveCoinWatch. But Tokpie.io, a site that lists JUSD, says the total supply is just under 100 million. That’s a 500x difference. Which one’s right? No one knows. CoinGecko also shows a fully diluted valuation of over $50 billion - but that’s based on the full 50 billion tokens being in circulation. In reality, less than 0.1% of that is actually being traded. That’s not a market cap. It’s a math error dressed up as a number.

Where You Can Buy JUSD (And Where You Can’t)

JUSD is available on Binance, but only through their Web3 Wallet and decentralized exchange (DEX) features. You can’t buy it directly with a credit card on Binance.com. You need to first buy BNB, send it to a Web3 wallet like Trust Wallet or MetaMask, then swap it for JUSD on PancakeSwap. That’s a multi-step process that’s confusing for beginners.

Outside of Binance’s ecosystem, JUSD is nearly invisible. It’s not listed on Coinbase, Kraken, KuCoin, or OKX. Even among decentralized exchanges, over 97% of its trading volume happens on PancakeSwap. That’s a huge problem. Low liquidity means when you try to sell even a small amount - say 50,000 JUSD - you’ll get hit with 2% slippage. That’s $100 lost on a $5,000 trade. For comparison, USDT trades billions daily across dozens of platforms. JUSD trades around $130,000 a day. That’s not a stablecoin. That’s a side project.

Why JUSD Exists - And Why It Might Not Last

The whitepaper claims JUSD was built to fix slow, expensive global payments. It cites SWIFT’s 3-5 day settlement times and the 1.4 billion unbanked people worldwide. That’s a noble goal. But JUSD doesn’t solve those problems. No banks, remittance services, or businesses accept it. No one uses it for payroll, cross-border invoices, or supply chain financing. It’s just sitting on Binance’s DEX, quietly trading between a few dozen users.

Industry analysts like Maria Chen from Blockdata point out that new stablecoins without audits and real-world adoption are unlikely to survive. The U.S. Stablecoin Transparency Act of 2023 requires monthly reserve disclosures. JUSD doesn’t comply. It’s not even on CoinRanking’s approved list - they explicitly warn users it’s unverified, has low volume, and lacks exchange listings.

Delphi Digital’s 2025 report predicts 70% of stablecoins under $100 million in market cap will disappear by 2027. JUSD sits at around $50 million fully diluted - but its actual circulating value is under $50,000. It’s not just small. It’s on life support.

Real User Experiences

People who use JUSD aren’t investing in it. They’re using it as a temporary bridge. On Reddit, users say things like, “I use JUSD to swap between BSC tokens because it’s cheap and stable enough for 15 minutes.” One trader said they held JUSD for a week to avoid Bitcoin’s volatility - and it worked. No drops. No spikes. But they wouldn’t hold it longer.

There are no reviews on Trustpilot. No official support team. No developer documentation beyond the whitepaper. Binance’s help center has over 100 tickets from people pasting the wrong contract address and losing funds. That’s not a sign of a mature project. That’s a sign of poor education and weak safeguards.

Is JUSD Worth Using?

Here’s the bottom line:

- Use JUSD if: You’re already on Binance Smart Chain, need a cheap stable token for short-term swaps, and understand the risks. It’s fine for small, quick trades.

- Avoid JUSD if: You’re storing value, sending large amounts, or want to use it outside Binance. You’re taking a gamble with no safety net.

It’s not a scam. The token works technically. Transfers go through. The price hasn’t crashed. But it’s also not a reliable financial tool. It’s a quiet experiment with no real traction, no transparency, and no future unless it changes.

If you’re looking for a stablecoin that’s safe, widely accepted, and audited - stick with USDC or USDT. If you’re curious and want to try JUSD for a $5 swap? Fine. But don’t put your savings in it. Don’t use it to pay anyone. And never, ever trust it with more than you’re willing to lose.

What’s Next for JUSD?

There’s been no major update since September 2025, when Binance added JUSD to their Web3 Wallet swap feature. The roadmap promised integration with real-world asset tokenization - but nothing has happened. No partnerships. No announcements. No audits.

Its future depends on one thing: transparency. If the team behind JUSD publishes reserve proofs, lists on 5+ major exchanges, and hires a third-party auditor, it might survive. Until then, it’s just another crypto experiment floating in the noise.

Is JUSD a scam?

No, JUSD isn’t a scam in the traditional sense. The token exists, transactions work, and it hasn’t collapsed like TerraUSD. But it lacks transparency, audits, and real adoption - which makes it extremely risky. Calling it a scam implies fraud. Calling it a failed experiment is more accurate.

Can I earn interest on JUSD?

Some DeFi platforms on Binance Smart Chain may offer lending or staking for JUSD, but it’s rare and risky. With low liquidity and no audits, you’re exposing yourself to smart contract bugs and sudden price slippage. Stick to well-known stablecoins like USDC if you want to earn yield safely.

How do I buy JUSD?

You can only buy JUSD on Binance’s Web3 Wallet via PancakeSwap. First, buy BNB on Binance.com. Transfer it to Trust Wallet or MetaMask. Connect your wallet to PancakeSwap, search for JUSD using its contract address (0xbf3950DB0522A7F5CAa107D4Cbbbd84dE9E047e2), and swap BNB for JUSD. Never buy from random sites or Telegram links.

Why is JUSD’s market cap so high if it’s not popular?

CoinGecko calculates market cap by multiplying total supply (50 billion) by the current price ($1.0006). But 99.9% of those tokens aren’t circulating. That’s like saying a company is worth $10 billion because it printed 10 billion shares - even though only 100 are traded. It’s misleading. Focus on circulating supply instead - which is under $50,000.

Is JUSD better than USDT or USDC?

No. JUSD is cheaper to transfer on BSC, but that’s its only advantage. USDT and USDC are accepted everywhere, have billions in liquidity, are audited monthly, and are backed by real reserves. JUSD has none of that. Unless you’re doing tiny, short-term swaps on BSC, there’s no reason to use JUSD over the big players.

What happens if JUSD loses its peg?

If JUSD drops below $1, there’s no safety net. No reserve audits mean no one knows if it’s backed at all. Unlike USDC, which can redeem 1:1 for USD, JUSD has no redemption mechanism. You’d be stuck holding a token that’s worth less than $1 - and no one will want to buy it. That’s why transparency isn’t optional. It’s essential.