What Is Margin Trading in Cryptocurrency? A Clear Guide to Leverage, Risks, and How It Works

Jan, 8 2026

Margin trading in cryptocurrency lets you borrow money to trade bigger positions than your own cash allows. It’s not magic-it’s leverage. And like any tool, it can build wealth or destroy it. If you’ve ever seen someone turn $1,000 into $10,000 in a single trade, that’s margin. But you rarely hear about the people who lost everything trying to do the same thing.

How Margin Trading Actually Works

Here’s the simple version: you put up your own money as collateral, called margin, and the exchange lends you more on top. If you deposit $1,000 and use 5x leverage, you can control a $5,000 position. That’s it. No complicated formulas. No secret algorithms. Just borrowing.

When you open a trade, you’re either going long (betting the price will go up) or short (betting it will go down). If Bitcoin rises 10% and you’re long with 5x leverage, your $1,000 becomes $1,500. That’s a 50% gain on your own money. Sounds great, right?

But if Bitcoin drops 10%? Your $1,000 is gone. Poof. Because you’re not just losing your own money-you’re losing the exchange’s money too. And they’ll come after you.

What Happens When You Lose Too Much? Liquidation

Every exchange sets a maintenance margin-the minimum amount of equity you must keep in your account. For a 5x leveraged position, that’s usually around 5-10%. If your balance dips below that, the system automatically closes your trade to protect the lender. That’s called liquidation.

Let’s say you open a $5,000 long position with $1,000. Your liquidation price might be $4,500. If Bitcoin drops just 10% from your entry, you’re wiped out. No warning. No second chance. Just a red screen and a zero balance.

During the May 2021 Bitcoin crash, over $1 billion in margin positions were liquidated in under 24 hours. That’s not a glitch. That’s how the system is designed. High volatility = mass liquidations. And retail traders are the ones who get crushed.

Spot Margin vs. Futures: What’s the Difference?

Not all leverage is the same. There are two main types:

- Spot margin trading: You borrow to buy or sell actual crypto. You own the asset. Leverage is usually capped at 3x-10x. Platforms like Binance, Kraken, and Coinbase Pro (before it was removed) offered this.

- Futures trading: You don’t own the asset. You’re betting on its price movement. Leverage can go as high as 125x. Platforms like BitMEX and Bybit specialize in this.

Spot margin is slightly less risky because you hold the underlying coin. If it rebounds after a crash, you still own it. Futures are pure speculation-you’re betting on a price, not owning anything. And with higher leverage, liquidation happens faster.

Fees, Funding Rates, and Hidden Costs

Margin isn’t free. Exchanges charge funding rates-interest paid every 4 to 8 hours. These can add up fast, especially if you hold a position overnight or longer.

On some platforms, funding rates swing wildly. If you’re long on Bitcoin and the market is crowded with longs, you might pay 0.1% every 8 hours. That’s 0.3% per day. Over a week, that’s 2.1% gone just for holding. And if you’re short? You might get paid-but only until the market flips.

Many new traders don’t realize how much these fees eat into profits. One Altrady survey found that 28% of beginners lost money not because of bad trades, but because they didn’t account for funding costs.

Who Should Even Try This?

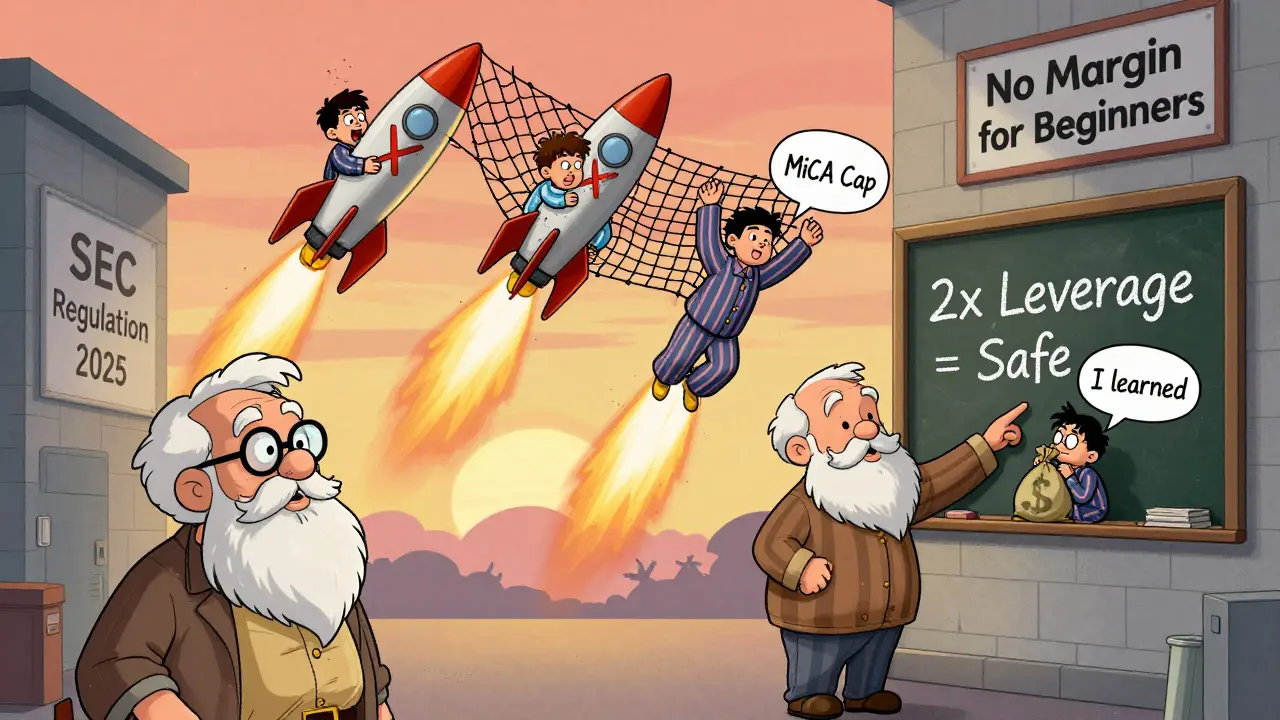

Margin trading is not for beginners. Not even close.

Exchanges like Bitpanda and Gemini explicitly warn: “Only experienced traders should use margin.” What does that mean? You need:

- At least 6-12 months of spot trading experience

- A solid understanding of technical analysis

- Discipline to set stop-losses and stick to them

- The emotional control to walk away when things go wrong

Reddit users who’ve survived margin trading say the same thing: “I lost three times before I got smart.” One trader, u/CryptoTrader87, made 300% in two weeks with 5x leverage on ETH-then lost it all in one trade during the Bitcoin ETF volatility spike.

Another, u/SafeHodler, said: “Margin nearly destroyed me. I didn’t lose money-I lost my confidence.”

Regulations Are Changing-Fast

As of 2025, margin trading is still available on major exchanges like Binance and Kraken-but not everywhere.

Coinsbase shut down its margin feature in 2025 because of “strict regulatory requirements.” The U.S. SEC has cracked down hard on exchanges offering spot margin to American users. The CFTC allows futures, but spot margin? Not so much.

In Europe, MiCA rules cap retail leverage at 2x-5x. That’s a big deal. Before 2022, you could get 25x leverage on some platforms. Now? You’re lucky to get 5x.

These changes aren’t about protecting investors-they’re about protecting the financial system. The IMF warned in April 2025 that unregulated crypto margin trading poses “systemic risks” during market crashes. That’s why regulators are stepping in.

Real-World Risks You Can’t Ignore

Here are the three most dangerous myths:

- “I’ll just set a stop-loss.” In fast-moving markets, stop-losses often don’t execute at the price you set. Slippage can wipe you out before the order fills.

- “I only risk 5% of my portfolio.” That sounds smart-until your 5% becomes 100% in 30 seconds during a flash crash.

- “I’ll get out before liquidation.” Markets can gap 10-20% in minutes. You won’t see it coming.

Trustpilot reviews for margin platforms show a pattern: 42% of negative reviews in Q4 2024 cited “aggressive liquidation thresholds.” Users say the system feels rigged. And sometimes, it is.

What Do Experts Recommend?

Even the most experienced traders agree on one thing: never trade with money you can’t afford to lose.

Top tips from active traders:

- Use no more than 3x-5x leverage. Anything higher is gambling.

- Set stop-losses 10-15% below your entry. Don’t rely on the exchange’s liquidation price.

- Never put more than 5% of your total portfolio into a single margin trade.

- Check funding rates before opening a position. If it’s above 0.1% every 8 hours, reconsider.

- Trade only during low-volatility periods. Avoid news events, ETF approvals, or Fed announcements.

Platforms like Binance now offer “dynamic liquidation thresholds” that adjust based on market stress. Kraken launched “margin insurance pools” in early 2025 to reduce auto-deleveraging. These are good signs-but they’re still just band-aids.

Is Margin Trading Worth It?

Yes-if you’re disciplined, experienced, and treat it like a business, not a lottery ticket.

No-if you’re chasing quick riches, don’t understand how liquidation works, or think “it can’t happen to me.”

Margin trading accounts for 30-40% of total crypto trading volume on major exchanges. That’s not because it’s safe. It’s because it’s addictive. The high of a 10x win feels like winning the lottery. The low of a liquidation feels like bankruptcy.

And here’s the truth: most people who try it lose. Not a little. Not even half. Almost all of them. The ones who win? They’re the ones who treat it like a job-not a game.

What Comes Next?

By 2026, experts predict stricter global regulations. Only 3-4 major exchanges will survive the compliance costs, according to Fidelity Digital Assets. Margin trading won’t disappear-but it’ll become harder to access, especially for retail traders.

For now, if you’re thinking about trying it:

- Start with 2x leverage.

- Trade with $100, not $1,000.

- Learn spot trading first.

- Read the fine print on funding rates and liquidation rules.

- And most importantly-ask yourself: Can I afford to lose this?

If the answer isn’t a clear yes, don’t do it. There’s no shame in staying on the sidelines. The market will still be here tomorrow. And so will your money.