What Is ProStarter (PROT) Crypto Coin? Definition, Specs, Risks & Outlook

Apr, 4 2025

PROT Risk Assessment Tool

PROT Risk Assessment

This tool evaluates ProStarter (PROT) based on the risk indicators discussed in the article. Answer the questions to get an overall risk assessment for this cryptocurrency.

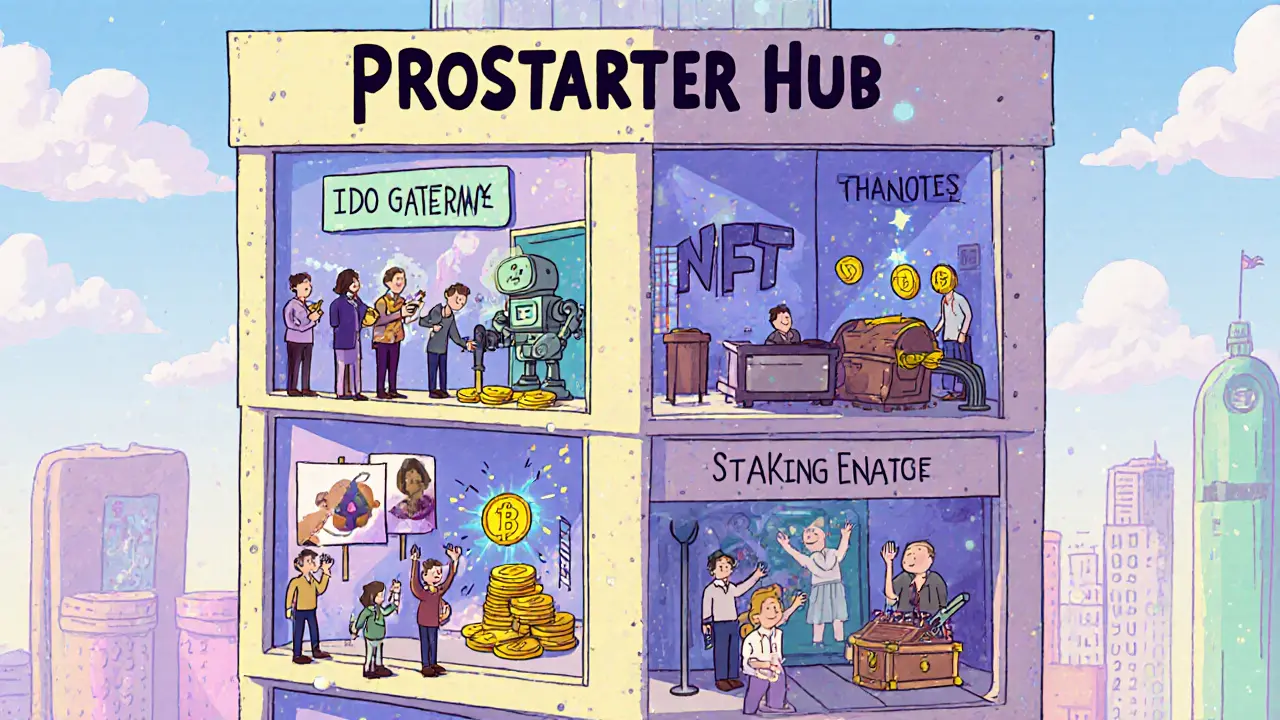

You've probably seen the ticker PROT pop up on a price chart and wondered what it actually is. In short, ProStarter (PROT) is a utility token that lives inside the ProStarter ecosystem - a DeFi platform that promises to help blockchain startups raise money, launch token sales, and run an NFT marketplace. Below we break down the token’s purpose, technology, market reality, and why most investors treat it as a red‑flag.

What Is ProStarter (PROT)?

ProStarter (PROT) is a utility token designed for fundraising and incubation services on the ProStarter platform. The token does not operate on its own blockchain; instead it is a smart‑contract token minted on existing networks such as Ethereum and EOS. Holders can use PROT to participate in token sales, access premium features, and earn rewards within the ecosystem.

How Does PROT Work Within the Platform?

- Fundraising gateway: Projects submit proposals, and investors lock PROT to gain allocation rights in upcoming IDOs (Initial DEX Offerings).

- NFT Marketplace: The token acts as payment for minting, buying, and selling NFTs listed on ProStarter’s marketplace.

- Reward engine: Staking PROT can generate yield in the form of additional tokens or platform‑specific perks.

- Governance: Token‑holders may vote on platform upgrades or new project listings, though concrete voting mechanisms are rarely documented.

The idea is to create a one‑stop shop for early‑stage blockchain projects, offering marketing, technical assistance, and community building-all powered by PROT.

Technical Specifications

| Attribute | Value |

|---|---|

| Token Standard | ERC‑20 (Ethereum) / EOS Smart‑Contract |

| Total Supply | 75,000,000 PROT |

| Circulating Supply | 0 (reported by major exchanges) |

| Launch Date | 2022 (GitHub activity first seen April 2022) |

| Primary Use Cases | IDO participation, NFT purchases, staking rewards, governance |

Notice the odd mismatch between total supply and reported circulating supply. Most exchanges list a price for PROT even though they claim no tokens are actually circulating - a red flag we’ll revisit.

Market Data - Prices, Volume, and Listings

PROT’s market data is a patchwork of conflicting numbers. Below is a snapshot from three major sources as of October 2023:

| Source | Price (USD) | 24‑hr Volume (USD) | Market Cap |

|---|---|---|---|

| CoinPaprika | $0.005668 | $≈50 | $≈425,000 |

| Binance | $0.004892 | $30.33 | $0 |

| Phemex | $0.004092 | $29.71 | $0 |

All three sites agree on minuscule daily volume (≈$30) but differ dramatically on market cap and price. The most baffling detail is the $0 market cap reported by Binance and Phemex, which usually signals that no tokens are actually trading despite a quoted price.

Why the Numbers Don’t Add Up - Core Risks

- Zero circulating supply: A token cannot have a market‑driven price without any tradable units. This suggests that listed prices are theoretical or based on stale data.

- Negligible liquidity: $30 of daily volume means you would struggle to buy or sell even a few thousand PROT without moving the price dramatically.

- Exchange ambiguity: Some platforms (Holder.io) claim PROT isn’t listed anywhere; others show a price but no actual order book.

- Historical price crash: An all‑time high of $14.29 versus today’s sub‑$0.01 level reflects a >99.9 % loss, typical of pump‑and‑dump schemes.

- Lack of community evidence: No verifiable Reddit threads, user reviews, or active Discord channels are linked in the public data.

These factors collectively make PROT an extremely high‑risk asset, more akin to a speculative meme token than a functional fundraising tool.

How Does PROT Compare to Established Fundraising Platforms?

| Feature | ProStarter (PROT) | Polkastarter | Binance Launchpad | DAO Maker |

|---|---|---|---|---|

| Native Token | PROT | PKT | BNB | DAO |

| Total Value Locked (TVL) | ≈$0 | $1.2 B | $3.5 B | $400 M |

| Exchange Listings | None / ambiguous | Multiple (KuCoin, OKX) | Binance only | Multiple |

| Liquidity (24‑hr Volume) | ~$30 | $150 M+ | $2 B+ | $20 M+ |

| Community Size (Telegram) | ≈0 active members | ≈150k | ≈500k | ≈80k |

Even the smallest of the listed rivals dwarfs PROT’s market presence. If you need a platform with real funding power, the alternatives are far more reliable.

Can You Actually Acquire PROT?

Given the contradictory listings, the practical steps are:

- Check if a reputable exchange (e.g., KuCoin or OKX) has opened a market for PROT. As of late 2023, none do.

- Search for peer‑to‑peer offers on crypto‑trading forums - but be wary of scams.

- Consider the token’s status as “awaiting listing” - many projects abandon the token before ever reaching a public market.

If you do find a seller, expect to pay a premium for a token that essentially cannot be liquidated.

Checklist: Should You Stay Away or Keep an Eye on PROT?

- Is there a clear, verifiable road‑map with milestones? - No

- Are there active, transparent community channels? - No

- Do reputable exchanges list the token with an order book? - No

- Does the token have a circulating supply that matches its price data? - No

- Is the project’s codebase actively maintained? - Last commit April 2022, suggesting inactivity.

If you answered “yes” to most of the above, the token might warrant deeper research. In PROT’s case, the answers are overwhelmingly negative, signaling that most investors should steer clear.

Future Outlook - What Might Change?

There are three scenarios that could alter PROT’s fate:

- Successful exchange listing: If a mid‑size exchange finally adds PROT, liquidity could improve, but the token would still need a real circulating supply.

- Platform revival: The ProStarter team could relaunch the ecosystem with new partnerships, tokens, or a re‑branded token. This would require fresh development activity and community engagement.

- Abandonment: Most likely, the token will fade into obscurity, with the remaining smart‑contract code lingering on-chain but never used.

Given the current data, Scenario 3 is the most probable.

Bottom Line

ProStarter (PROT) is a utility token that promises fundraising services but suffers from nonexistent liquidity, contradictory market data, and an almost non‑existent community. For anyone looking for a reliable crypto investment, the token fails basic sanity checks and should be treated as a high‑risk, possibly dead project.

What blockchain does PROT run on?

PROT is an ERC‑20 token on Ethereum and also issued as a smart‑contract token on the EOS network.

Why does PROT show a price if there’s no circulating supply?

Some data aggregators pull price quotes from exchange listings that exist only in a technical sense (a market pair is created, but no actual orders are placed). Without tradable tokens, the price is essentially a placeholder.

Can I use PROT to launch my own token sale?

In theory, yes - the platform advertises PROT as the currency for IDOs. In practice, the lack of liquidity and exchange support makes it impractical for most projects.

Is PROT a good investment?

Given the zero circulating supply, daily volume around $30, and no active community, PROT is classified as extremely high risk and is generally not recommended for investors seeking liquidity.

Where can I find official information about ProStarter?

The official site is prostarter.io, and the project’s code is hosted at github.com/prostarter-Dev/prostarter_token. Social channels include Twitter @ProtOfficial.