How to Secure a Kazakhstan Crypto Mining License in 2025

Oct, 9 2025

Kazakhstan Mining License Timeline Calculator

Preparation Status

Enter which requirements you've completed to estimate your timeline

Estimated Timeline

Total Estimated Time

Key Requirements Status

Timeline Breakdown

Preparation Phase

Incorporation Phase

Application Phase

Important Notes

Remember: The 6-9 month timeline assumes all documentation is complete. Missing any critical requirement can add significant delays. Key items to complete before applying:

- Registered legal entity in Kazakhstan

- Office space in AIFC campus

- Two local staff members (AML officer + compliance officer)

- Full AML/KYC policies

- Functional mining platform demo

Imagine trying to set up a massive Bitcoin farm, only to discover you need a special permission ribbon from a hidden authority in the heart of Central Asia. That’s the reality for anyone eyeing the lucrative mining scene in Kazakhstan today. The country has turned crypto mining into a tightly‑controlled business, and the gatekeeper is the Kazakhstan crypto mining license - a permit issued exclusively by the Astana International Financial Center (AIFC).

What the Regulatory Landscape Looks Like

In 2023 the Kazakh government formalized its approach with Order No. 384. The order shifted crypto mining from a permit‑heavy regime to a “notification‑based” activity, but it also introduced a new licensing tier that - and only - the AIFC can grant. This hybrid model lets the state reap economic benefits while keeping a tight lid on money‑laundering risks.

Who Can Apply for the License?

The law draws a clear line: only a Kazakhstan legal entity or an individual entrepreneur registered in the country can qualify. Applicants must also prove either ownership or a legal right to use a digital mining data processing center (DMDC). If you plan to host hardware in a third‑party facility, you need documented rights to place both software and hardware complexes there.

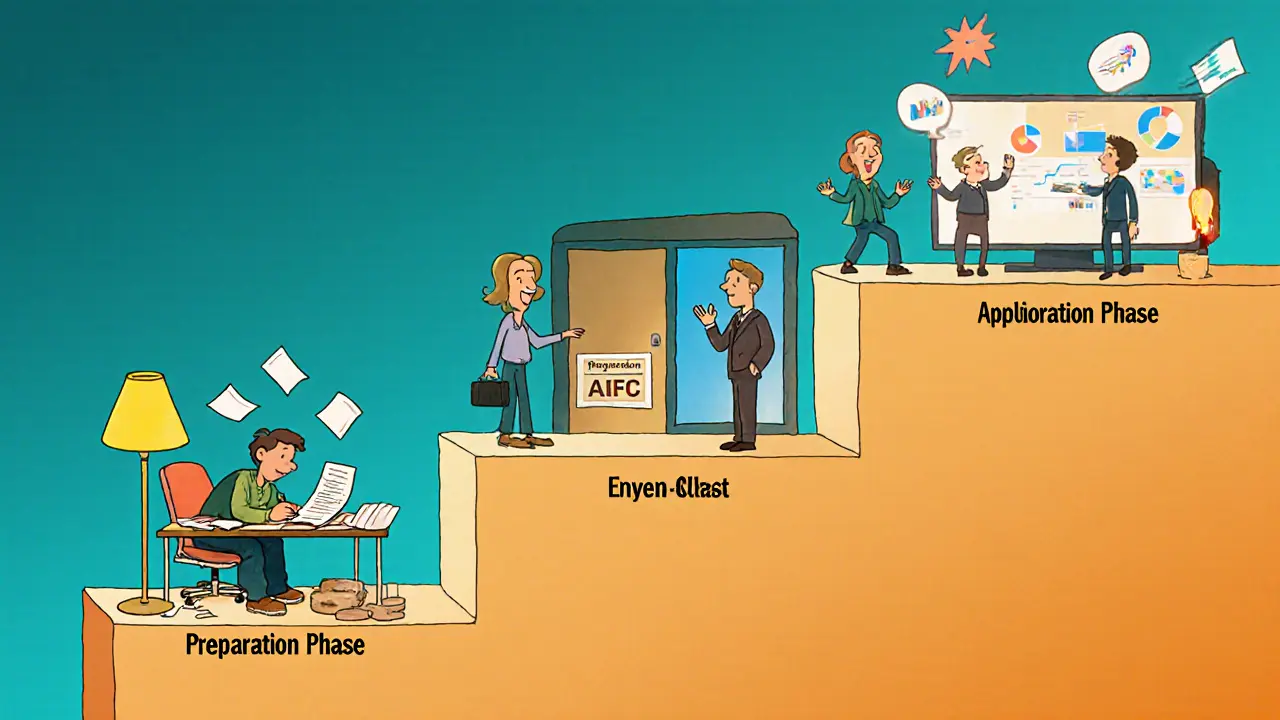

The Three‑Phase Licensing Journey

Getting the green light isn’t a weekend project. The AIFC runs a structured 6‑to‑9‑month process that breaks down into three distinct phases.

- Preparation Phase (2‑3 months)

- Draft a detailed business plan with realistic financial projections.

- Gather corporate documents from any parent companies.

- Design Anti‑Money Laundering (AML) and Know Your Customer (KYC) policies, install compliant software, and outline client onboarding procedures.

- Identify senior management and board members - the AIFC expects at least four distinct roles.

- Incorporation Phase (1‑2 months)

- Register a new company inside the AIFC jurisdiction.

- Rent office space within the AIFC campus - a physical address is mandatory.

- Hire at least two local staff members: an AML officer and a compliance officer.

- Deposit the required share capital into a Kazakh corporate bank account.

- Application Phase (3‑4 months)

- Submit proof of functional AML/CFT systems and risk‑assessment capabilities.

- Provide a demo of your mining platform or a working prototype.

- Show that the management board possesses the experience demanded by the regulator.

- Attach all previously prepared documents and pay the application fee.

If you can keep the timeline tight, you’ll receive the license and can start mining legally.

Financial and Operational Obligations

Once licensed, miners face a set of ongoing duties that shape profitability.

- Tax Rate: A flat 15% corporate tax on mining income. This is competitive compared to many European jurisdictions.

- Asset Sale Requirement: 75% of mined crypto must be sold on AIFC platforms. The threshold rose from 50% in 2024, reflecting the government’s desire to capture foreign currency.

- Capital Requirements: No fixed minimum, but the regulator expects sufficient cash to cover operational costs for at least six months.

- Reporting: Quarterly AML/CFT reports must be filed with the Information Committee for the Regulation and Improvement of Activities in the Sphere of Preventing Money Laundering (ICRIAP).

According to the latest figures, the mining sector contributed roughly $34.6 million over the past three years, while AIFC‑run exchanges handled over $1.4 billion in 2024.

Why Digital Mining Pools Are Mandatory

The Kazakh model forces every miner to join a licensed Digital Mining Pool (DMP). The state has accredited only five pools so far, and each pool operates under its own license. This centralisation serves two purposes:

- It lets regulators monitor hash‑rate distribution and enforce the 75% asset‑sale rule efficiently.

- It creates a revenue stream for the pools, which in turn pay licensing fees back to the AIFC.

For operators used to independent mining, the pool requirement is a major shift. You’ll need to sign a service agreement, share a portion of your hash power, and align your payout schedule with the pool’s rules.

Kazakhstan vs. Other Jurisdictions: A Quick Comparison

| Aspect | Kazakhstan (AIFC) | United States (state‑by‑state) | Middle East (e.g., UAE) |

|---|---|---|---|

| Licensing Authority | AIFC exclusive | Varies by state; often none | None or minimal |

| Tax Rate | 15% corporate | Varies (0‑21%) | 0‑5% in free zones |

| Asset‑sale requirement | 75% on AIFC exchanges | None | None |

| Mandatory mining pool | Yes, licensed DMPs only | No | No |

| AML/KYC obligations | Strict AML‑CFT reporting to ICRIAP | FinCEN reporting (if applicable) | Varies, often light |

The table shows why many miners eye Kazakhstan: a decent tax rate but strict controls. If you value predictability over freedom, the AIFC route might be worth the paperwork.

Practical Tips to Smooth the Process

Below are real‑world adjustments that helped the first batch of licensed operators.

- Local staff matters. Hiring a qualified AML officer who understands Kazakh law speeds up the compliance review. Many firms bring in a consultant for the first six months and then transition to an in‑house team.

- Office space isn’t optional. Even a modest coworking desk inside the AIFC counts as a “rental”. Remote‑only setups are rejected during the incorporation phase.

- Prepare a demo early. The AIFC asks for a working prototype of your mining dashboard. A short video walkthrough can satisfy the requirement without a full‑scale launch.

- Plan for the 75% rule. Align your sales strategy with AIFC exchanges. Some operators pre‑negotiate liquidity contracts to avoid price slippage when dumping large volumes.

- Watch the timeline. The 6‑9‑month window is realistic only if you submit clean documents. Missing a single AML policy template can add weeks.

Future Outlook: Regulations May Tighten Further

Regulators have already nudged the asset‑sale ratio up once this year. Analysts expect two more moves before 2027:

- A higher minimum share‑capital requirement to weed out under‑capitalized operators.

- Potential introduction of a “state‑run crypto reserve” that would obligate licensed miners to sell a portion of their output at a fixed price to support a sovereign digital currency.

If you’re planning a long‑term mining venture, build flexibility into your business plan now-especially around cash flow and compliance staffing.

Quick Checklist Before You Apply

- Confirm you are a registered Kazakhstan legal entity or individual entrepreneur.

- Secure rights to a DMDC or a third‑party facility with documented usage agreements.

- Draft AML‑CFT and KYC policies that meet ICRIAP standards.

- Hire an AML officer and a compliance officer residing in Kazakhstan.

- Reserve office space inside the AIFC campus.

- Prepare a functional mining platform demo.

- Plan to sell 75% of mined assets on AIFC exchanges.

- Allocate budget for a 15% corporate tax and quarterly reporting fees.

Tick all the boxes, and you’ll be on a clear path to the coveted Kazakhstan crypto mining license.

Frequently Asked Questions

Do I need to be a Kazakh resident to get the license?

You must register a legal entity or individual entrepreneur in Kazakhstan. Residency isn’t required for foreign owners, but the entity itself must be locally incorporated.

Can I mine independently without joining a Digital Mining Pool?

No. The current law mandates that all licensed miners operate through an AIFC‑approved digital mining pool. Independent mining is considered a violation and can lead to license revocation.

What happens if I fail to sell 75% of my mined coins on AIFC platforms?

The regulator can impose fines up to 10% of the undisclosed amount, and repeated breaches may result in suspension or cancellation of the license.

How long does the entire licensing process usually take?

From the initial notification to final approval, expect 6‑9 months, assuming all documentation is complete and the AML/KYC framework meets standards.

Is there a minimum capital amount I must deposit?

There is no fixed statutory minimum, but the AIFC reviews each case to ensure the applicant has enough cash to sustain operations for at least six months.