SEC vs CFTC: How Crypto Regulation Battles Are Shaping the Future of Digital Assets

Feb, 11 2026

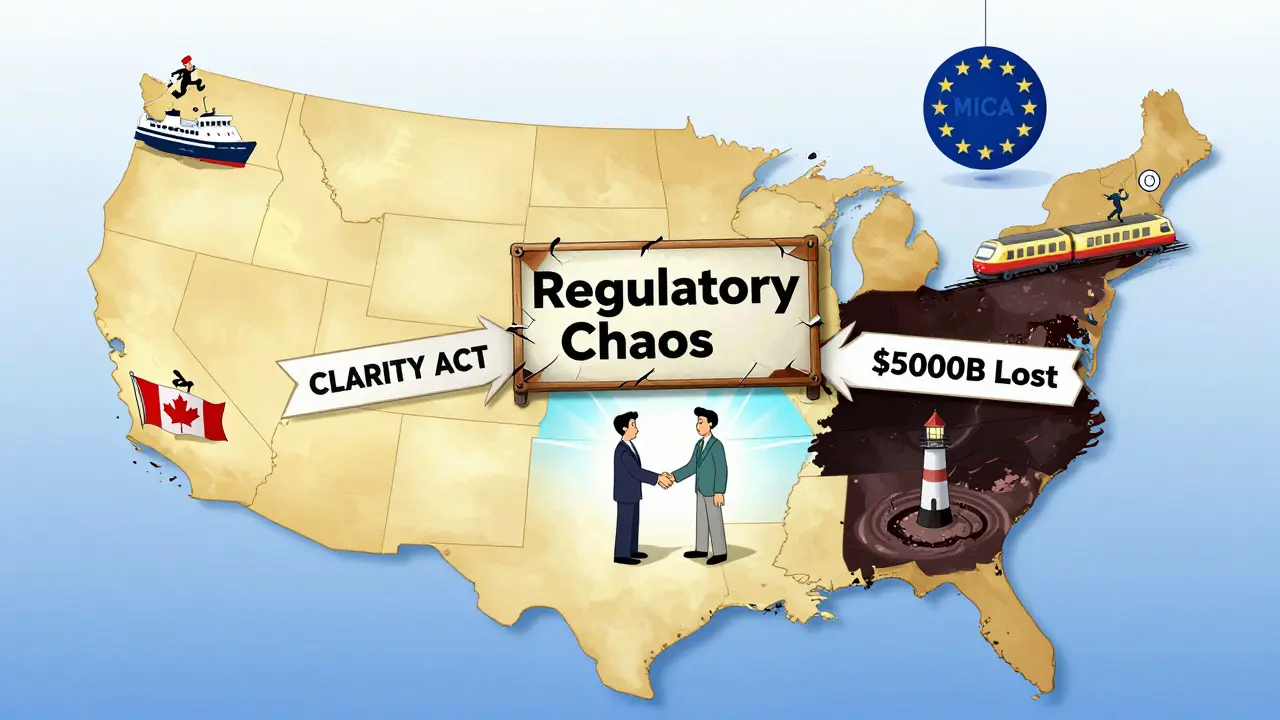

When you buy Bitcoin or trade Ethereum, who’s actually in charge? It’s not as simple as you might think. In the U.S., two federal agencies are locked in a years-long tug-of-war over who gets to regulate crypto - the SEC or the CFTC. And this fight isn’t just bureaucratic noise. It’s shaping whether your favorite crypto projects get shut down, delayed, or forced to move overseas.

Who Says What? The SEC and CFTC’s Conflicting Rules

The SEC says: if a digital asset acts like a stock, it’s a security. The CFTC says: if it’s a digital good traded like gold or oil, it’s a commodity. Both are technically right - but they’re using different laws to say it. The SEC’s power comes from the Securities Act of 1933 and the Securities Exchange Act of 1934. Their main tool? The Howey Test. This 75-year-old legal standard asks three things: Did people invest money? Was there a common enterprise? And did they expect profits mainly from someone else’s effort? If yes - it’s a security. That’s why the SEC sued Coinbase, Binance, and Kraken. They argued tokens like SOL, ADA, and ETH were sold like investment contracts. The CFTC, on the other hand, answers to the Commodity Exchange Act. Back in 2015, they ruled Bitcoin was a commodity. In 2018, a federal court agreed. By 2023, they explicitly said Ether, Litecoin, and even Tether were commodities too. Their jurisdiction is strongest when it comes to futures, options, and derivatives - like Bitcoin futures traded on CME since 2017. But they also go after fraud and market manipulation in spot markets. The problem? A token can be both. Or neither. Or something in between. And that’s where the chaos begins.The Gray Zone: When a Token Doesn’t Fit

Not all crypto is black and white. Take Ethereum. The SEC has called it a security in enforcement actions. The CFTC called it a commodity. Courts have backed both sides - sometimes in the same case. That’s because Ethereum started as a security (during its 2014 ICO) but evolved into something else. Today, it’s decentralized. Miners and validators don’t profit from a single company’s effort - they’re spread across thousands of nodes. That’s why the CFTC says it’s a commodity. But the SEC argues: many people bought ETH expecting profits because Vitalik Buterin and the Ethereum Foundation promoted it. This ambiguity isn’t just theoretical. It’s costing companies millions. A 2024 Deloitte survey found U.S. crypto firms spend an average of $2.7 million per year just trying to figure out which rules apply. For smaller projects, that’s not a cost - it’s a death sentence.

Enforcement Wars: Who’s Winning?

Since 2017, the SEC has filed 32 enforcement actions against crypto firms. The CFTC? Just 15. The SEC is more aggressive. They’ve gone after exchanges, lenders, and even influencers. Their most common charge? Operating as an unregistered securities exchange. The CFTC tends to focus on market manipulation. Their biggest case? A 2021 lawsuit against a Bitcoin derivatives trader who spoofed prices on futures markets. They also approved Bitcoin futures in 2017 and Ether futures in 2023 - moves that gave legitimacy to crypto trading. But here’s the twist: in early 2025, the SEC quietly dropped its case against Coinbase. After a year of court battles, they filed a joint motion to dismiss. Analysts called it a strategic retreat. Why? Because the judge had already ruled the SEC’s case was plausible - meaning they had a strong legal argument. Yet they walked away. Was it new leadership? A shift in strategy? Or a sign they’re losing the public relations war? Meanwhile, the CFTC made a bold move in April 2025: they approved spot Ethereum ETFs. That’s huge. Spot ETFs let investors buy actual Ethereum - not futures contracts. The SEC had delayed Bitcoin ETFs until August 2025. The message? The CFTC is stepping into territory the SEC once claimed as its own.What’s at Stake? $500 Billion and Global Competitiveness

This isn’t just about rules. It’s about money - and power. The U.S. crypto market was worth $175 billion in annual transactions in 2024. But U.S.-based companies only captured 14% of the global market. In 2020, it was 32%. Why the drop? Regulatory uncertainty. Investors don’t want to put money into a market where the rules change every six months. Compare that to the European Union. On June 30, 2024, MiCA went into effect - a single, clear rulebook for all 27 member states. Crypto firms know exactly what’s allowed. No more guessing. The Center for Strategic and International Studies estimates that if the U.S. fixes its regulatory mess by 2027, it could unlock $500 billion in new investment. That’s not speculation. That’s a projection based on real capital flow data. Meanwhile, crypto firms are leaving. Coinbase moved its derivatives trading to Canada. Kraken opened a new office in Switzerland. Circle, the issuer of USDC, now does most of its compliance through the EU.

The Path Forward? The CLARITY Act and What’s Coming

In April 2024, the U.S. House passed the CLARITY Act - a bipartisan bill that tries to end the war. Here’s how it works:- If a digital asset is decentralized, on a mature blockchain, and doesn’t give ownership rights - it’s a digital commodity → regulated by the CFTC.

- If it’s sold as an investment with promises of profit → it’s a security → regulated by the SEC.

What This Means for You

If you’re a trader: you might see more spot ETFs for Ethereum and Bitcoin soon - but only if they’re approved under CFTC rules. If you’re a developer: launching a new token? You’ll need to ask: Is it decentralized? Are users buying it to use it - or to profit from someone else’s work? The answer determines your legal risk. If you’re an investor: don’t assume a token is safe just because it’s on Coinbase or Kraken. They’re still following dual compliance rules. That means some tokens are still under SEC scrutiny. The bottom line? The SEC and CFTC aren’t fighting over who’s right. They’re fighting over who gets to control the future of money. And right now, the winner isn’t the agency - it’s the market that moves fastest.Is Bitcoin a security or a commodity?

Bitcoin is widely considered a commodity under CFTC jurisdiction. Courts have affirmed this since 2018. The SEC has never formally classified Bitcoin as a security, and it doesn’t meet the Howey Test because there’s no central entity managing its development or profits.

Why does the SEC care about Ethereum?

The SEC argues that Ethereum was initially sold as an investment contract during its 2014 ICO, and that early promoters (like the Ethereum Foundation) still influence its value. Even though the network is now decentralized, the SEC claims the initial sale creates lasting security status. The CFTC and courts have disagreed, calling Ethereum a commodity due to its current decentralized structure.

Can a crypto asset be regulated by both agencies?

Yes. Some tokens start as securities (during fundraising) and later become commodities (once decentralized). Until clear rules are passed, firms like Coinbase and Kraken treat all tokens as potentially both - doubling their compliance costs to avoid penalties from either agency.

What’s the difference between a spot ETF and a futures ETF?

A spot ETF holds the actual cryptocurrency - like real Bitcoin or Ether. A futures ETF holds contracts that bet on future prices. The CFTC regulates futures ETFs. The SEC regulates spot ETFs - but only if they’re classified as securities. The CFTC’s approval of spot Ethereum ETFs in 2025 challenges the SEC’s traditional control over this space.

Why are U.S. crypto firms moving overseas?

Because regulatory uncertainty makes it too risky to operate in the U.S. The EU’s MiCA law gives clear, unified rules. In the U.S., firms must guess whether they’re violating SEC or CFTC rules - or both. Many have relocated compliance, trading, or development teams to Switzerland, Singapore, and Canada to avoid fines and lawsuits.