Crypto Sanctions Evasion: How Blockchain Bypasses Financial Controls

When people talk about crypto sanctions evasion, the use of cryptocurrency to circumvent government financial restrictions. Also known as crypto obfuscation, it’s not about hiding money from taxes—it’s about moving funds past state-imposed blocks, like those on Russian banks or Iranian entities. This isn’t science fiction. It’s happening right now, using tools built into open-source blockchains that no single company controls.

The biggest wake-up call came with Tornado Cash, a decentralized Ethereum mixer that pooled and shuffled crypto to break transaction trails. The U.S. Treasury’s OFAC slapped sanctions on it in 2022—not because it was a company, but because it was software. And that changed everything. Suddenly, developers, wallet providers, and even users faced legal risk just for interacting with a public smart contract. This wasn’t about criminals. It was about the line between privacy and evasion. If you can’t trace a transaction, regulators can’t enforce sanctions. That’s the core tension.

What’s often missed is that crypto mixers, tools designed to obscure the origin of digital assets. aren’t all the same. Some are centralized services with KYC—easy to shut down. Others, like Tornado Cash, are fully decentralized, running on code that anyone can run. That’s why banning one doesn’t kill the idea. It just pushes it into newer, less visible forms: private chains, peer-to-peer swaps, or even layer-2 networks that don’t report to Ethereum’s main chain. And while governments try to track wallet addresses, users adapt—using multiple hops, bridge protocols, or even non-crypto methods like cash-based P2P trades in places like Ecuador or India, where regulation is thin.

So what’s left for regular users? Not everyone using privacy tools is breaking the law. But if you’re trying to move crypto to or from a sanctioned entity, you’re walking a legal tightrope. The posts below dig into real cases: how Tornado Cash worked, why it got banned, what happened to its developers, and how similar tools are still out there—sometimes hiding in plain sight as "privacy wallets" or "anonymizing bridges." You’ll also find stories of exchanges that got caught, airdrops that vanished overnight, and how regulators are now scanning blockchain data like detectives with heat maps. This isn’t about theory. It’s about what’s real, what’s risky, and what’s still possible in today’s crypto world.

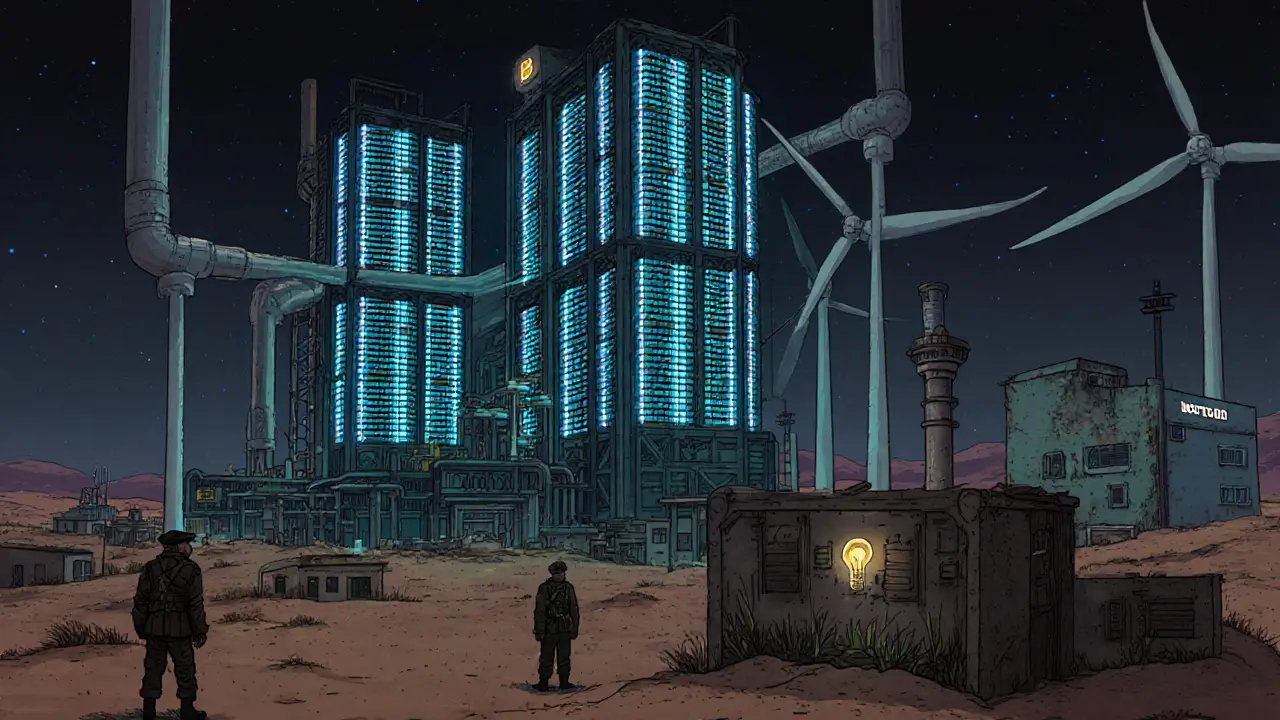

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Caius Merrow Nov, 20 2025 0Iran has turned Bitcoin mining into a state-led sanctions evasion strategy, using cheap electricity and state-backed mining farms to generate billions in crypto revenue. It's bypassing Western banks, funding imports, and reshaping how sanctions work in the digital age.

More Detail