BOA Exchange Crypto Exchange Review: What Bank of America Actually Offers in Crypto

Jan, 24 2026

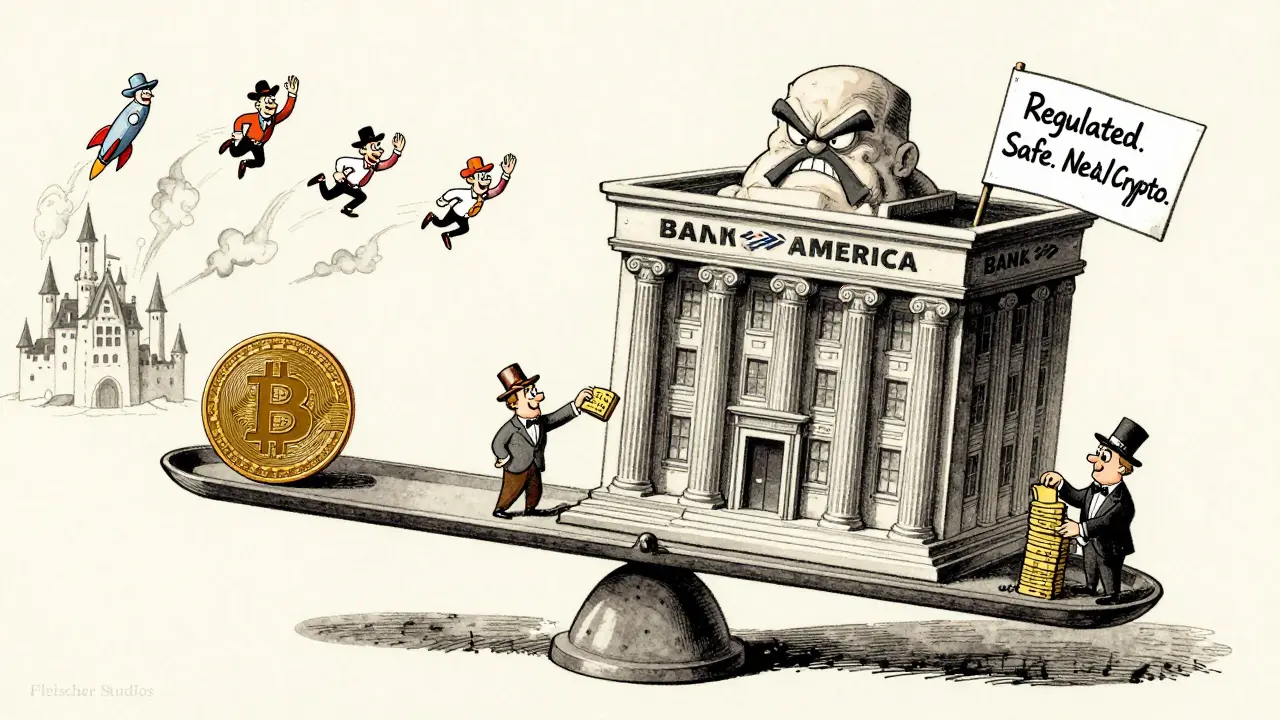

There’s no such thing as a BOA Exchange. If you’re searching for a Bank of America crypto trading platform, you’re looking in the wrong place. Bank of America doesn’t run a crypto exchange like Coinbase or Binance. You can’t buy Bitcoin directly through their app. You can’t send Ethereum to a BOA wallet. And you definitely won’t find a crypto dashboard with live charts and spot trading. That’s not what they do.

But here’s what they do do-and it’s a big deal. As of January 5, 2026, Bank of America quietly changed its rules for wealth management clients. Now, advisors at Merrill Edge, Bank of America Private Bank, and Merrill Lynch can recommend Bitcoin and Ethereum ETFs to their clients. Not direct crypto. Not wallets. Not exchanges. Just regulated exchange-traded funds that track the price of digital assets.

This isn’t a minor tweak. It’s a full U-turn. Just a few years ago, Bank of America’s CEO Brian Moynihan called Bitcoin a scam on CNBC. Now, they’re letting advisors put crypto ETFs into client portfolios. That shift tells you everything you need to know about how mainstream finance is changing.

What You Can Actually Buy Through Bank of America

You can’t trade Bitcoin on BOA. But you can buy shares in four specific Bitcoin ETFs through your existing brokerage account:

- iShares Bitcoin Trust (IBIT) - BlackRock’s ETF, the largest by volume

- Wise Origin Bitcoin Fund (FBTC) - Fidelity’s offering, known for low fees

- Bitwise Bitcoin ETF (BITB) - Focused on transparency and liquidity

- Grayscale Bitcoin Mini Trust (GBTC) - The original, now restructured under new SEC rules

These aren’t crypto. They’re stocks. You buy them like Apple or Tesla. No wallet. No private keys. No blockchain. Just a ticker symbol on your brokerage statement.

For Ethereum, the same rules apply-but only starting later in Q1 2026. And even then, the max allocation is capped at 2%, compared to 4% for Bitcoin. That’s because Ethereum’s seen more price swings. BOA’s risk team still treats it like a volatile wild card.

How Much Crypto Can You Have?

Bank of America doesn’t let you go all-in. Their official guidance says advisors can recommend 1% to 4% of your portfolio in Bitcoin ETFs. For Ethereum, it’s 0.5% to 2%. That’s it.

Why so low? Because BOA’s not trying to make you rich. They’re trying to keep you from losing everything. Their internal documents say crypto allocations should only go to clients with:

- A 10-year minimum investment horizon

- A risk tolerance score of 7 or higher on their 10-point scale

- No immediate need for that money (like retirement in 3 years)

That’s not for traders. That’s for long-term investors who want a tiny slice of crypto exposure without touching a crypto exchange. If you’re looking to day trade Bitcoin or stack sats, BOA isn’t your platform. But if you’re a conservative investor who wants to hedge against inflation or diversify with digital assets, this might make sense.

Why ETFs? Why Not Direct Crypto?

Why go through ETFs instead of letting you buy Bitcoin directly? Three reasons:

- Regulation - The SEC hasn’t approved direct crypto custody for banks. ETFs are securities, which BOA already knows how to handle.

- Control - BOA doesn’t want to deal with hacks, lost keys, or wallet scams. ETFs are custodied by regulated firms like BlackRock and Fidelity.

- Liability - If you lose money on a direct crypto trade, it’s on you. If you lose money on an ETF, BOA’s advisor could be held responsible. That’s why they’ve built strict rules.

But here’s the catch: ETFs have fees. IBIT charges 0.12% annually. FBTC is even lower at 0.05%. That’s cheaper than most crypto exchanges. But compared to buying Bitcoin directly on Coinbase (which charges 0.5%-1.5% per trade), you’re still paying more over time. And because ETFs trade on the stock market, their price can drift from the actual Bitcoin price. Sometimes IBIT trades at a 2% premium. Other times, it’s at a 1.5% discount. That’s not something you’d see on a real crypto exchange.

Who Is This For? Who Should Avoid It?

This service is designed for one type of person: the traditional investor who’s curious about crypto but scared of the wild west.

Good fit:

- You’re over 40 and have a 401(k) or IRA

- You’ve never traded crypto before

- You trust your financial advisor

- You want exposure without learning how to use MetaMask

Avoid it if:

- You want to hodl Bitcoin long-term and believe in decentralization

- You’re under 30 and want to stack sats daily

- You’re trying to beat the market with crypto

- You think ETFs are the same as owning the real thing

If you’re the type who reads crypto forums, tracks mining difficulty, or uses a hardware wallet-you’re better off on Coinbase or Kraken. BOA’s offering is for people who want crypto as a line item on their portfolio report, not as a lifestyle.

How Does It Compare to Other Banks?

Bank of America isn’t alone. Morgan Stanley started allowing crypto ETFs in 2025 with a 1-5% range. Vanguard followed in January 2026, letting all 50 million of its clients trade Bitcoin ETFs through their brokerage accounts. But BOA’s move stands out because of scale.

They manage $4.6 trillion in client assets. Even if just 2% of that shifts into Bitcoin ETFs-that’s $92 billion in potential inflows. That’s more than all the crypto ETFs got in their first year combined.

Compare that to JPMorgan Chase, which still only lets ultra-rich private bank clients access crypto ETFs. Or Wells Fargo, which hasn’t budged at all. BOA’s decision signals that crypto is no longer fringe-it’s part of the new normal for wealth management.

What Advisors Are Saying

Advisors had to complete a 3-hour training module before they could recommend these ETFs. According to an internal Merrill Lynch survey of 1,200 advisors, 92% said the learning curve was “moderate.” The biggest challenge? Explaining ETF premiums and discounts to clients who think they’re buying Bitcoin.

One advisor in Florida told me: “I had a client who asked why his IBIT shares were up 3% when Bitcoin only went up 1%. I had to explain that ETFs trade like stocks-supply and demand on the stock market affects the price separately.”

Another advisor in Texas said: “I’ve never had so many questions about tax lot accounting. With ETFs, you’re not just buying Bitcoin-you’re buying shares in a fund that creates and redeems Bitcoin in-kind. It’s complicated.”

Despite the complexity, Trustpilot reviews for Merrill Edge jumped from 3.8 to 4.1 stars in January 2026. Over a third of new reviews mentioned crypto access as a reason for the higher rating.

Is This a Good Move for You?

Let’s say you have $100,000 in your Merrill Edge account. You’re 52. You’ve saved for retirement. You’re not a tech guy. But you’ve heard Bitcoin might be digital gold. You’re not sure what to do.

BOA’s option lets you allocate $2,000 (2%) to FBTC. You don’t need to change anything else. No new apps. No passwords. No seed phrases. You just click “Buy” in your existing account. The ETF will show up alongside your S&P 500 fund and bond holdings.

That’s convenient. That’s safe. But it’s not the same as owning Bitcoin.

If you want full control, you’ll still need a real crypto exchange. But if you want to dip your toe in without leaving your bank’s ecosystem? BOA’s ETF access is the easiest, most regulated path right now.

It’s not perfect. The fees add up. The exposure is limited. And you’re not holding the actual asset. But for mainstream investors? It’s a milestone. And it’s here to stay.

What’s Next?

Bank of America plans to add Ethereum ETFs in Q1 2026. They’re also watching Bitcoin’s volatility. If it spikes above 85% over 30 days, they’ll automatically review their 4% cap. That’s not a reaction-it’s a safeguard.

They’re not building a crypto empire. They’re not trying to be the next Coinbase. They’re just letting their clients have a small, safe, regulated way to get exposure.

And that’s the real story here. Crypto isn’t about exchanges anymore. It’s about integration. BOA didn’t launch a crypto platform. They made crypto fit into the world they already live in.

That’s how it becomes mainstream.

Is there a BOA crypto exchange?

No, Bank of America does not operate a crypto exchange. You cannot buy, sell, or store Bitcoin or Ethereum directly through BOA. Instead, they allow wealth management advisors to recommend regulated Bitcoin and Ethereum ETFs through existing brokerage accounts like Merrill Edge.

Can I buy Bitcoin through Bank of America?

You can’t buy Bitcoin directly. But you can buy shares in Bitcoin ETFs like IBIT or FBTC through your BOA brokerage account. These ETFs track Bitcoin’s price but are traded like stocks, not as actual cryptocurrency.

What’s the maximum crypto allocation allowed by BOA?

Bank of America allows up to 4% of a client’s portfolio to be allocated to Bitcoin ETFs and up to 2% for Ethereum ETFs. These limits are based on client risk tolerance and investment horizon, with a minimum 10-year horizon required.

Are BOA’s crypto ETFs better than Coinbase?

It depends on your goals. BOA’s ETFs are safer and easier for traditional investors-they’re regulated, custodied, and integrated into your existing portfolio. But Coinbase gives you direct ownership of Bitcoin, lower fees on trades, and access to staking, DeFi, and NFTs. BOA is for exposure; Coinbase is for control.

Why does BOA only allow ETFs and not direct crypto?

BOA avoids direct crypto because of regulatory, custody, and liability risks. The SEC hasn’t approved banks to hold cryptocurrency directly. ETFs are securities, which BOA already knows how to manage under existing financial regulations. This lets them offer crypto exposure without taking on the risks of wallet security, hacks, or private key loss.

Do BOA’s crypto ETFs have high fees?

The expense ratios are low-between 0.05% and 0.12% annually for Bitcoin ETFs. That’s cheaper than most crypto exchanges’ trading fees. But because ETFs trade on the stock market, they can trade at premiums or discounts to Bitcoin’s actual price, which adds hidden costs over time.

Is BOA’s crypto policy a sign that crypto is mainstream now?

Yes. Bank of America managing $4.6 trillion in assets and now allowing crypto ETFs is a major signal that institutional finance has accepted digital assets as a legitimate, if limited, part of diversified portfolios. It’s not about speculation anymore-it’s about integration.