Digitex Crypto Exchange Review: Zero Fees, High Risks in 2025

Nov, 23 2025

DGTX Token Risk Calculator

Token Viability Calculator

See how DGTX token price fluctuations affect Digitex exchange sustainability based on the article's data points.

Exchange Viability Assessment

Digitex claims to be the only crypto exchange with zero trading fees. That sounds like a dream for scalpers and high-frequency traders. But if it’s too good to be true, it usually is. By November 2025, Digitex still operates with no commissions on spot or futures trades. But behind that headline feature is a shaky foundation - low liquidity, unreliable withdrawals, and a business model that depends entirely on the price of its own token, DGTX, staying afloat.

How Digitex Makes Money Without Charging Fees

Most exchanges make money by taking a cut of every trade - 0.1% here, 0.04% there. Digitex doesn’t. Instead, it relies on its native token, DGTX. Every trade you make on Digitex is paid for in DGTX. The platform doesn’t charge you directly, but it burns DGTX tokens from its treasury to cover the cost of execution. That means the whole system only works if DGTX keeps rising in value. If the token price drops, the exchange has less fuel to keep running. This isn’t just theory. Digitex’s revenue comes from staking rewards, yield farming, and its Blockfunder launchpad for new tokens. But these are secondary. The real engine is the token economy. And that’s risky. If traders stop buying DGTX, or if the price crashes, the exchange could run out of funds to cover trades. No one else in the top 100 exchanges runs this way. Binance, Bybit, OKX - they all charge fees. And they’re profitable. Digitex is betting its survival on a token price that’s been stuck under $0.00003 for over a year.The DGTX Token: A Fragile Backbone

As of March 2025, there are nearly 5 billion DGTX tokens in circulation. The price hovers around $0.00003. That’s a market cap of about $150,000. Compare that to Binance’s BNB, which trades above $600 with a $90 billion market cap. DGTX isn’t just small - it’s microscopic. And that’s a problem. The token uses an ERC-223 standard on Ethereum, which is supposed to prevent lost transfers. But that’s a technical detail. What matters is that DGTX has no real utility outside Digitex. You can’t use it to pay for anything else. You can’t stake it on other platforms. It doesn’t give you voting rights or discounts on services. Its only job is to keep Digitex alive. And right now, it’s failing at that. Price predictions are all over the map. Some say DGTX could hit $0.00007 by 2030. Others predict it’ll drop to $0.00001. The truth? No one knows. With such low liquidity, even a single large buy or sell can swing the price 20% in minutes. That’s not a market. That’s a casino.Trading on Digitex: Fast, But Empty

The platform offers spot trading and both perpetual and traditional futures contracts. The interface is clean. Order execution is fast. For experienced traders, the lack of fees means you can scalp without worrying about fees eating into tiny profits. But here’s the catch: there’s almost nothing to trade. As of early 2025, Digitex listed only seven trading pairs. Bitcoin, Ethereum, Solana, Dogecoin - that’s about it. No Cardano, no Polkadot, no Chainlink. No stablecoin pairs like USDT/USD or USDC/BTC. You can’t even trade Bitcoin against Ethereum directly. That’s not a full exchange. That’s a niche playground. Compare that to Bybit, which offers over 400 trading pairs. Or Binance, with more than 1,000. Digitex doesn’t just lag behind - it’s irrelevant for anyone building a diversified portfolio.

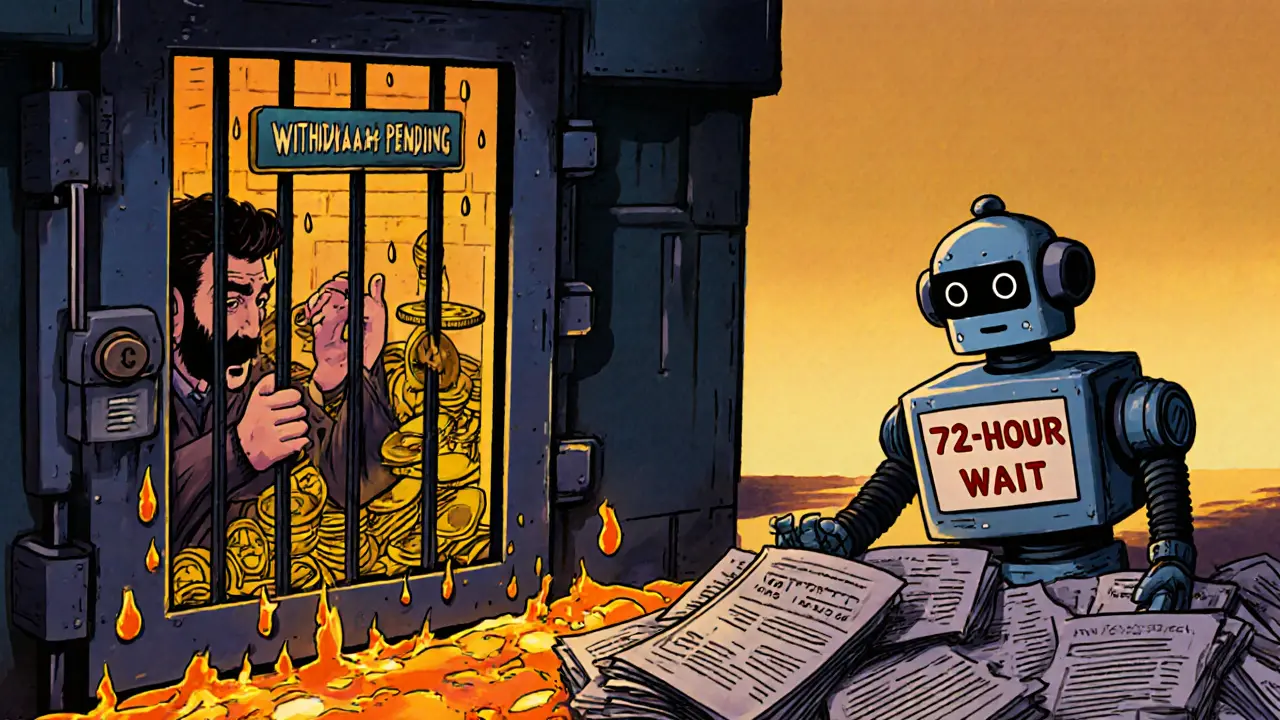

Withdrawal Problems and Silent Support

User reports from Reddit and Trustpilot paint a troubling picture. In March 2024, one user tried to withdraw 5,000 DGTX. Two weeks later, it was still pending. Another user said they waited 17 days for a withdrawal and got no response from support. Customer service response times average 72 hours. That’s three times longer than the industry standard. Top exchanges reply in under 24 hours. Digitex doesn’t even try. Their Telegram group has 12,500 members. Binance’s has over 5 million. The silence isn’t just annoying - it’s dangerous. If your funds are stuck, and no one answers, what do you do? There are also reports of API instability. Developers on GitHub say connection drops happen 37% of the time during peak hours. If you’re using automated bots, that’s a dealbreaker. Your strategy fails. Your money vanishes. And no one helps you fix it.Is Digitex Legit? The Red Flags

The platform is registered in the U.S., but it’s not regulated by the SEC or any major financial authority. That’s not unusual for crypto exchanges - but it’s a risk. More concerning: the domainh5.dxcoin.com appears on the UK Financial Conduct Authority’s list of scam websites. Digitex’s official site is digitexfutures.com. Is this a phishing site impersonating Digitex? Or is it linked to them? No one has clarified. The ambiguity erodes trust.

CoinMarketCap lists Digitex as an “Untracked Listing.” That means they don’t verify its trading volume. Why? Because the numbers are too low, inconsistent, or possibly fake. If the exchange doesn’t meet basic transparency standards, why should you trust it with your money?

Martini.ai gives Digitex a “B4” credit rating - the lowest possible for any exchange still operating. That’s a warning sign from a firm that tracks crypto financial health. They say Digitex’s credit risk has improved since 2021, but it’s still dangerously high.

Who Should Use Digitex? Who Should Avoid It?

If you’re a retail trader with a small account, and you’re only interested in trading Bitcoin or Ethereum futures with zero fees - and you’re okay with slow withdrawals and no customer support - then Digitex might be worth a small test. But if you’re serious about crypto trading, you should avoid it. Here’s why:- You need more than 7 trading pairs - Digitex doesn’t offer them.

- You need fast, reliable withdrawals - Digitex fails here.

- You need liquidity - Digitex’s order books are thin.

- You need support - Digitex doesn’t respond.

- You need confidence - Digitex’s business model is a gamble.

Alternatives That Actually Work

If you want zero fees, you’re better off with other options:- Bybit: Charges 0.025% on futures, but offers 400+ pairs, deep liquidity, and 24/7 support.

- Binance: Fees are low (0.02% maker, 0.04% taker), but they offer everything - spot, futures, staking, DeFi, and more.

- KuCoin: No fees on spot trades for users holding KCS. Decent futures market, good support.

The Bottom Line

Digitex is a bold experiment that’s failing. The zero-fee model sounds revolutionary. But in reality, it’s unsustainable. The token is worthless outside the platform. The liquidity is non-existent. The support is silent. The regulatory risk is growing. If you’re looking to trade crypto in 2025, don’t risk your capital on a platform that’s barely holding on. There are better, safer, and more reliable exchanges out there. Digitex isn’t the future of crypto trading. It’s a cautionary tale.Is Digitex exchange safe to use in 2025?

Digitex is not considered safe for most users. While the platform isn’t officially shut down, it has low liquidity, unreliable withdrawals, poor customer support, and a business model that depends on its token price staying stable - which it hasn’t for years. The UK Financial Conduct Authority has flagged a related domain as a potential scam, adding to trust concerns. Only experienced traders with small amounts to risk should consider using it.

Can I make money trading on Digitex?

Technically, yes - if you’re a scalper and you trade Bitcoin or Ethereum with tiny positions, the zero fees can help you avoid fee erosion. But in practice, it’s unlikely. The lack of liquidity means slippage is high, order fills are inconsistent, and you can’t exit positions quickly. Plus, if DGTX crashes, your profits vanish. Most users report losses due to withdrawal delays and poor execution.

What’s the current price of DGTX?

As of March 2025, DGTX trades at approximately $0.0000301. That’s down from $0.00005 in early 2024. With nearly 5 billion tokens in circulation, the total market cap is under $150,000. This makes it extremely vulnerable to manipulation and price swings.

Does Digitex support fiat deposits?

No. Digitex only accepts cryptocurrency deposits. You can’t buy Bitcoin with USD, EUR, or NZD directly. You need to buy crypto on another exchange first, then send it to Digitex. This adds steps, fees, and risk - especially if you’re new to crypto.

Why is Digitex not tracked by CoinMarketCap?

CoinMarketCap classifies Digitex as an “Untracked Listing” because it fails to meet minimum standards for liquidity, transparency, and volume verification. The exchange doesn’t provide enough reliable data to confirm its trading activity. This is a red flag - it means no independent source can verify if the platform is even active at scale.

What are the best alternatives to Digitex?

For zero-fee spot trading, try KuCoin with KCS staking. For low-fee futures, Bybit and Binance are far superior - they offer hundreds of trading pairs, deep liquidity, and reliable support. If you want a regulated platform, use Coinbase or Kraken. Digitex doesn’t compete on features, reliability, or safety - only on a gimmick.