Iran Bitcoin mining: What's really happening with crypto mining in Iran

When you hear about Iran Bitcoin mining, the large-scale use of computational power to validate Bitcoin transactions and earn rewards, often driven by low energy costs and weak regulatory oversight. It’s not just a niche activity—it’s one of the most significant mining operations on the planet, fueled by state-subsidized electricity and a population eager to bypass economic restrictions. Unlike countries that ban crypto, Iran quietly lets miners run rigs in homes, warehouses, and even government buildings. The result? Iran has regularly ranked in the top 5 global Bitcoin mining nations, sometimes hitting over 10% of the network’s total hash rate.

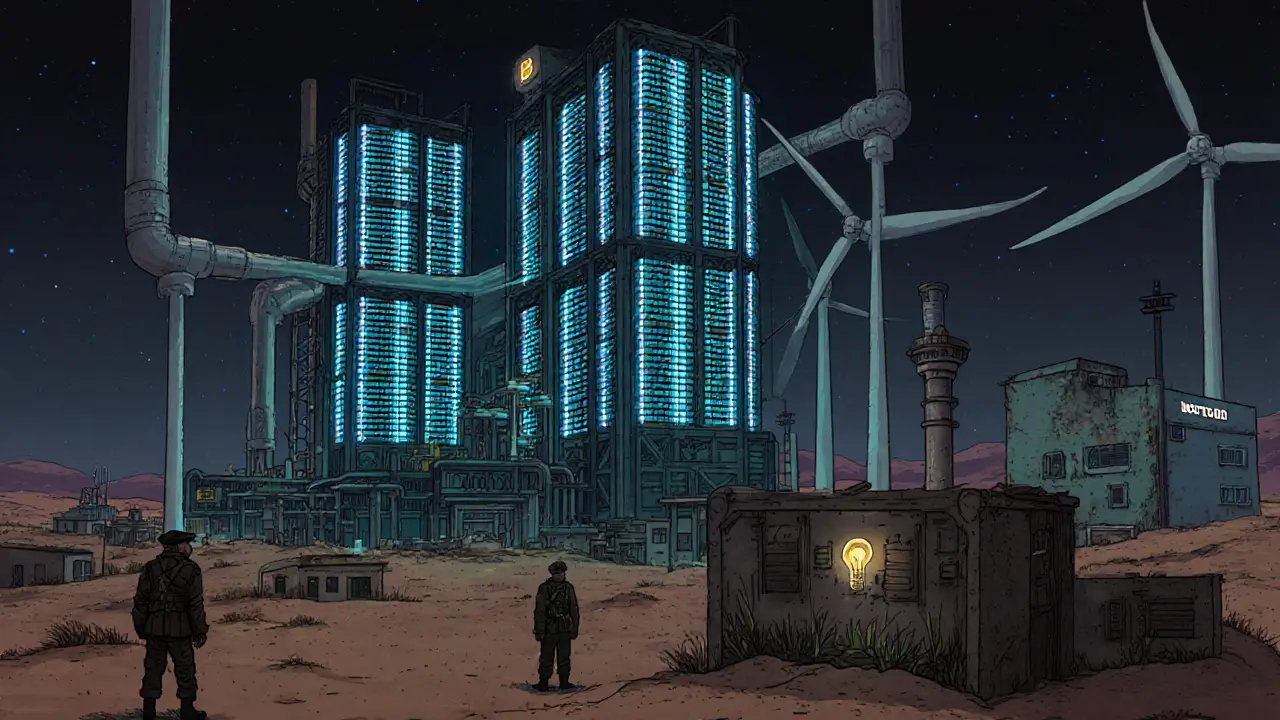

What makes this possible? cryptocurrency mining, the process of using specialized hardware to solve complex math problems that secure the Bitcoin blockchain. It’s not magic—it’s electricity and machines. In Iran, electricity costs as little as $0.02 per kWh in some regions, compared to $0.15 or more in the U.S. or Europe. That’s the difference between running a profitable operation and losing money. Miners use ASICs—specialized chips designed only for Bitcoin mining—and they’re everywhere. You’ll find them in basements in Tehran, in rural provinces, and even in converted military facilities. The government doesn’t always approve, but it also doesn’t stop it—because mining brings in hard currency and keeps the grid busy during off-peak hours. And while Western media paints Iran as a rogue state, the reality is more complex: miners are often ordinary people using crypto to protect savings from inflation, not criminals. Some even use mining income to buy food, medicine, or send money abroad.

But there’s a flip side. Bitcoin hash rate, the total computational power securing the Bitcoin network. When Iran’s miners go offline—because of sanctions, blackouts, or crackdowns—the global network feels it. In 2021 and again in 2023, Iran’s mining activity dropped sharply after U.S. sanctions targeted energy exports and crypto transactions. The hash rate dipped, and Bitcoin’s security temporarily weakened. That’s not just an Iran problem—it’s a global one. When one country dominates mining, the network becomes vulnerable to its political and economic swings. Then there’s crypto regulation Iran, the inconsistent and shifting legal stance the Iranian government takes toward cryptocurrency mining and trading. Sometimes it’s banned. Sometimes it’s taxed. Sometimes it’s encouraged. One day, the government announces a national mining farm. The next, it shuts down hundreds of homes for power theft. No one knows what rules apply, and that uncertainty drives miners underground—or out of the country.

And don’t forget the hardware. mining hardware Iran, the specialized equipment—mainly ASIC miners like Antminer S19 or WhatsMiner M30s—used to mine Bitcoin at scale. These machines aren’t cheap. But in Iran, people buy them secondhand from China, smuggle them through Turkey, or rebuild old rigs from scrap. Some even use stolen power to run them. The result? A messy, decentralized, high-risk mining ecosystem that’s surprisingly resilient.

What you’ll find in the posts below isn’t hype. It’s facts. Real data on how Iran’s mining scene affects Bitcoin’s security, what happens when sanctions hit, and how ordinary people use crypto to survive. You’ll see how mining isn’t just about technology—it’s about economics, politics, and survival. And if you think crypto mining is just a tech trend, think again. In Iran, it’s a lifeline.

How Iran Uses Bitcoin Mining to Bypass International Sanctions

Caius Merrow Nov, 20 2025 0Iran has turned Bitcoin mining into a state-led sanctions evasion strategy, using cheap electricity and state-backed mining farms to generate billions in crypto revenue. It's bypassing Western banks, funding imports, and reshaping how sanctions work in the digital age.

More Detail